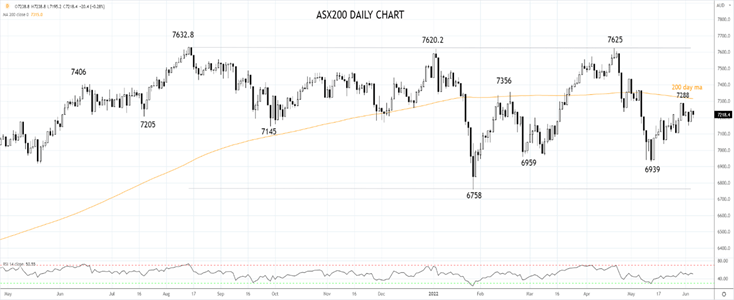

After notching up three straight weeks of gains, the ASX200 is trading 23 points lower at 7216 at 2.55 pm Sydney time.

Today's stumble comes after a tentative rally on Wall Street hit the skids last week as resilient U.S economic data heightens expectations for a 50bp hike at the September FOMC meeting.

Also undermining confidence, continued turmoil in energy markets as crude oil pushed above $120 p/b on expectations of increased demand from the re-opening in China and the start of the driving season in the U.S.

Higher energy prices feed into inflationary expectations and higher interest rates, a sure recipe for another wave of selling in the beaten-up IT Sector.

Tyro Payments (TYR) fell 5.4% to $0.96c after being removed from the ASX200. Afterpay owner Block (SQ2) fell 3.8% to $115.21, and Appen (APX) fell 3.75% to $6.16 as it joined Tyro exiting the ASX200. Novonix fell 3.56% to $3.52, and cloud computing firm Megaport (MP1) fell 3.37% to $6.31.

Falls also for the Industrial Sector led by Qantas (QAN), falling by 2.37% to $5.36, plumbing company Reece (REH) dropped 1.96% to $15.00. Boral (BLD) fell 1.7% to $2.88, and Seven Group Holdings (SVW) fell 1.5% to $18.98.

A hit also for the Materials sector despite the price of iron ore and other commodities extending gains following the China re-opening. OZ Minerals (OZL) fell 1.74% $24.29, BHP Group (BHP) fell 0.73% to $46.44. Fortescue Metals (FMG) fell 0.33% to $22.40, South 32 (S32) fell 0.2% to $5.07.

Enjoying the tailwinds of higher energy prices, the coal miners have made gains led by New Hope Coal (NHC), an inclusion in the ASX200, which added 1.54% to $3.96. Whitehaven Coal (WHC) added 1.39% to $5.49, and Coronado Coal (CRN) added 0.45% to $2.15.

Woodside (WDS) has extended its gains lifting by 2.4% to $32.57 following a bullish note by a U.S investment bank. Beach Energy (BPT) lifted by 1.65% to $1.85, Santos (STO) added 1.43% to $8.52.

The big banks have fallen in line with a strong seasonal tendency to underperform until July. National Australia Bank (NAB) fell 0.86% to $31.01, ANZ fell 0.52% to $24.89, Commonwealth Bank (CBA) fell 0.36% to $104.82, Macquarie (MQG) fell 0.15% to $183.77, and Westpac (WBC) fell 0.17% to $23.96.

The roller coast ride in the Lithium space continues. Vulcan Energy (VUL) fell 3.1% to $7.45, Galan Lithium (GLN) fell 2.9% to $1.33, Iluka Resources (ILU) fell 2.46% to $10.72, and Liontown Resources (LTR) fell 2.76% to $1.23. New ASX200 inclusions, Core Lithium (CXO) and Lake Resources (LKE) fell 0.4% and 1%, respectively.

Over the past nine months, the ASX200 has traded within a broad 6750/7630 type range. The middle of the range is 7200ish, and 100 points on either side of here is "no man's" land. A break above the 200-day moving average at 7320/30 would indicate that a rally towards the top of the range is underway. While a move below 7100ish would indicate a test of range lows is underway.

Source Tradingview. The figures stated are as of June 6th, 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade