The ASX200 is on track to lock in a fourth straight day of gains, trading 36 points higher at 6742 at 3.00 pm Sydney time.

The ASX200 buoyed by rebalancing flows and from energy stocks after an open mic at the G7 summit caught President Macron telling President Biden that the UAE and Saudi Arabia were almost at their oil output limits.

Beach Energy (BPT) added 6.06% to $1.75. Woodside (WDS) added 4.28% to $32.66, Origin Energy (ORG) added 3.22% to $5.93, and Santos (STO) added 3.2% to $7.62.

Today's rebound in metal prices on the Chinese futures exchange has supported the recovery in Materials stocks. Fortescue Metals (FMG) added 3.86% to $18.57, BHP Group (BHP) added 3.69% to $42.71, Rio Tinto (RIO) added 2.51% to $106.42 and Mineral Resources (MIN) added 2.38% to $49.87.

Another rise in already elevated coal prices has re-energized coal stocks. New Hope Coal added 6.61% to $3.55, Yancoal (YAL) added 5.38% to $5.48, Coronado Coal (CRN) added 3.32% to $1.79, and Whitehaven Coal (WHC) added 3.24% to $4.94.

The rebound in tech stocks came unstuck as U.S yields rose overnight, again pressuring valuations in the growth sector. Tyro Payments (TYR), fell 9.8% to $0.78c, Life 360 (360) fell 7.1% to $2.87, Appen Limited (APX) fell 7.1% to $5.92, Megaport (MP1) fell 6.2% to $5.92, EML Payments fell 6.1% to $1.37, and ZIP fell 6.3% to $0.48c.

Higher yields have also weighed on the big banks as ANZ fell 1.52% to $22.62, Westpac (WBC) fell 1.15% to $19.69, National Australia Bank (NAB) fell 0.88% to $27.69, Commonwealth Bank (CBA) fell 0.2% to $93.55, and Macquarie (MQG) fell 0.19% to $165.93.

Concerns over cost-of-living pressures and higher interest rates have also weighed on consumer-facing stocks. JB Hi-Fi (JBH) fell 3.8% to $39.05, Flight Centre (FLT) fell 3.25% to $17.80, Wesfarmers (WES) fell 2.7% to $42.96, Webjet (WEB) fell 1.8% to $5.46, and Aristocrat Leisure (ALL) fell 1.5% to $34.28.

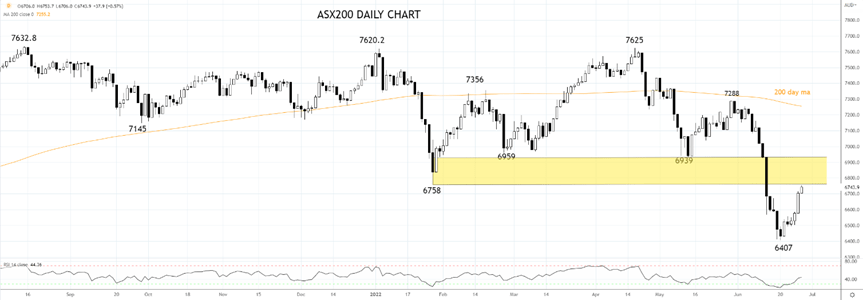

Technically, the ASX200 needs to continue its recovery above a band of resistance (formerly support) at 6750/6950ish, to negate the technical damage caused by the rout in mid-June. A test of this resistance level seems reasonable likely due to a continuation of rebalancing flows this week and as new money enters the market in early July.

Source Tradingview. The figures stated are as of June 28th, 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade