The ASX200 is trading 17 points higher at 7228 at 3.15 pm Sydney time.

A positive start to the new month, despite a soft lead from Wall Street overnight on renewed inflationary concerns as Euro Zone inflation made fresh record highs.

Today's rebound supported by a rise in U.S equity futures and the release of a robust Q1 2022 Australian GDP print, despite the headwinds of Omicron and severe floods in NSW and QLD.

The Industrial sector has made gains led by Transurban Group (TCL) as it added 2.16% to $14.68. Seven Group Holdings (SVW) added 1.4% to $19.05, Brambles (BXB) added 1% to $10.99, and Reece (REH) added 0.7% to $16.14.

Gains also for the big banks despite a seasonal tendency for the big banks to underperform from now until July. Commonwealth Bank (CBA) fell 2% to $106.53. Macquarie (MQG) added 1.4% to $188.60, ANZ added 1.1% to $25.33, National Australia Bank (NAB) added 0.88% to $31.53, Westpac (WBC) added 0.84% to $24.06.

The IT Sector is back under pressure on rising inflation and interest rate expectations. Novonix (NVX) fell 11.5% to $3.62, Zip (ZIP) fell 8.2% to $0.84c, Sezzle (SZL) fell 8.1% to $0.51c, Life 360 (360) fell 7.26% to $3.45, Tyro Payments (TYR) fell 4.25% to $1.01, and Megaport (MP1) fell 4% to $7.02.

A mixed day for the heavyweight Materials Sector. Mineral Resources (MIN) has fallen 6.33% to $59.80, Lynas Rare Earths (LYC) fell 6.1% to $9.25, Oz Minerals (OZL) fell 2.45% to $23.51, South 32 (S32) fell 1.6% to $4.92. Going the other way Fortescue Metals (FMG) added 2.83% to $20.68, BHP Group (BHP) added 1.4% to $45.21, and Rio Tinto (Rio) added 0.1% to $114.56.

Carnage in the Lithium sector as Goldman Sachs slashed its benchmark Lithium chemical price. Pilbara Minerals (PLS) fell 20% to $2.36, Liontown Resources (LTR) fell 18.4% to $1.16, Core Lithium (CX0) fell 18% to $1.15, Galan Lithium (GLN) fell 14.3% to $1.32 and Allkem (AKE) fell 12.25% to $12.03.

Origin Energy (ORG) is trading 13.9% lower at $5.89 after withdrawing guidance due to volatile energy markets.

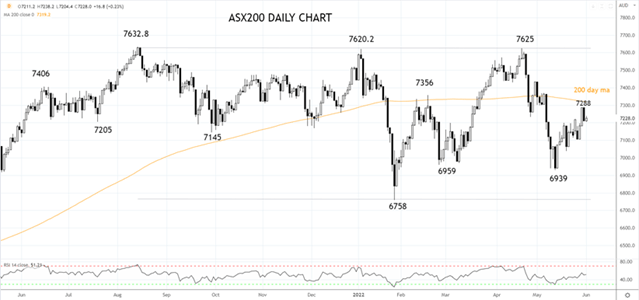

Yesterday's retreat below 7200 marks the end of another volatile May, with the index closing out the month 3% lower and below the 200-day moving average at 7320ish, a level that the index needs to reclaim to gain a firmer footing. Until then, further choppy range trading is expected.

Source Tradingview. The figures stated are as of June 1st, 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade