The ASX200 is trading 65 points higher at 6670 at 3.00 pm Sydney time.

The strong start to the new week came as U.S stock markets snapped a 5-session losing streak on Friday, as better than expected corporate earnings and economic data eased concerns over slowdown risks.

A surprise fall in U.S consumer long-term inflation expectations also supportive of risk sentiment as it eased fears over a heavy-handed 100bp rate hike when the Fed meets at the end of July.

Tech stocks have been the day’s best-performing sector, making the most of improved risk sentiment. Tyro Payments climbed by 8.46% to $0.70c, Wisetech Global added 6.4% to $46.93, Life360 added 5.68% to $3.72, EMLP Payments added 6.4% to 1.08 and Afterpay owner Block added 5.1% to $98.16.

Energy stocks have gained as the market holds its breath to see if gas flows from Russia to Europe resume this week after the conclusion of maintenance work on the Nord Stream 1 pipeline. Beach Energy climbed by 2.7% to $1.71, Woodside added 2% to $31.26, Origin Energy added 2% to $5.63, Santos added 1.8% to $7.11 and AGL added 1.25% to $8.17.

A rebound for the Materials Sector as metals and coal prices climbed on the Chinese futures exchange. Whitehaven Coals shares added 4.90% to $5.89 after earlier touching an 11-year high at $6.14 as the company forecast its full-year earnings to rise to $3B. New Hope Coal added 2.75% to $4.30. Yancoal added 2.75% to $5.90, Coronado Coal gained 0.75% to $1.68.

Elsewhere gains for FMG as it added 2.08% to $16.67, Rio Tinto added 1.8% to $94.97 and BHP added 1.75% to $36.71. Mineral Resources added 2.5% to $44.45, and South 32 added 2.64% to $3.50.

Suncorp has soared by 5.14% after it became the target of a proposed takeover by ANZ. ANZ shares were put in a trading halt as it looks to raise $3.5 billion to help fund the purchase. Elsewhere NAB added 1% to $28.74, Westpac added 0.85% to $20.06. CBA added 0.46% to $93.30. While Macquarie added 2.46% to $172.12.

Lithium miners have made good gains, led by Liontown Resources, which added 6.3% to $1.01, Core Lithium added 5.6% to $5.59, Iluka Resources added 3.9% to $8.55, Allkem added 3.59% to $10.10, and Lake Resources climbed by 3.3% to $0.63c.

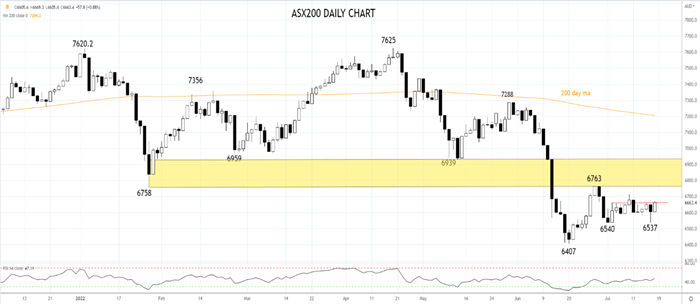

Turning to the charts, the ASX200 looks set to close above the band of resistance at 6650/60, which has capped for 7 of the past 9 trading sessions. Attention now turns to medium-term resistance at 6750/6950 that the ASX200 needs to reclaim to negate the technical damage caused by the breakdown in June.

Source Tradingview. The figures stated are as of July 18th, 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade