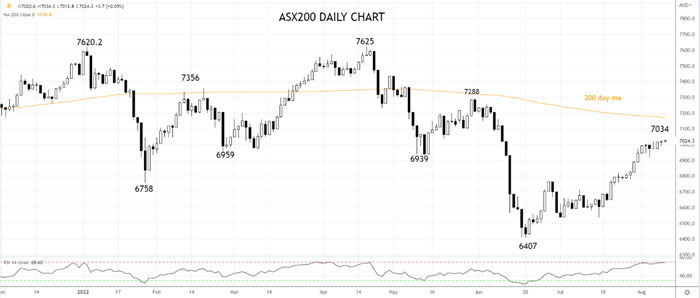

The ASX200 trades 2 points higher at 7022 at 3.20 pm Sydney time.

The ASX200 has made marginal gains for a third straight session, following a disappointing session on Wall Street overnight as key indices gave back early gains to close lower on the day.

On the surface, today’s session on the local bourse lacked momentum. However, under the hood, there was plenty of action as earning reports dropped from companies including REA Group, Megaport and Coronado Global Resources, and a Q3 trading update from NAB.

Despite reporting a $1.8bn third-quarter profit, the share price of NAB fell 3% as it reported its Net Interest Margins (NIM) were lower than expected - comments that weighed on fellow big banks. CBA fell 1.2% to $101.30, Westpac fell 0.95% to $21.86, ANZ fell 0.65% to $22.77. Macquarie added 1.2% to $178.70.

The Westpac Consumer sentiment index fell for a ninth consecutive month (to 81.2 in August from 83.8 in July) as rising interest rates, and high inflation weighed on consumers. In this type of environment, consumers usually cut back on discretionary purchases. However, today the Consumer Discretionary Sector has been the best on the ground.

Star Entertainment added 1.74% to $2.93, Wesfarmers added 1.6% to $47.50, JB Hi-Fi added 1.4% to $44.42, and Aristocrat Leisure added 1% to $34.40.

Shrugging off weak guidance from chip maker Nvidia overnight, the Tech sector has added 1.25% as cloud company Megaport reported a surge in revenues, which sent its shares soaring 9.40% higher to $8.95. Seek added 2.75% to $23.66, Altium added 2.80% to $31.95, and Xero added 2.6% to $967.42.

The Real estate sector has gained led by a 5% rise in the REA share price to $130.26 after its core revenues grew by 26% to $1.17bn. Shopping Centres Australia added 2.4% to $2.95, and Charter Hall Group added 1.9% to $12.46.

A mixed day for the Materials Sector. Surging coal prices helped Coronado Global report a $US561.9mn profit for the June half year, sending its share price 6.6% higher to $1.62. Yancoal added 2.84% to $4.89, New Hope Coal added 2.15% to $4.04. Elsewhere, the Big Australian, BHP fell 0.65% to $38.87, and FMG fell 0.3% to $18.90.

Another session of fireworks for Lithium stocks as sentiment rebounds. Lake Resources added 27.5% to $1.37. Core Lithium added 9% to $1.49, and Liontown Resources added 6.6% to $1.72.

Technically, we are on the sidelines here in the local bourse. While the ASX200 continues to grind higher on falling momentum, U.S equity markets appear to be looking for a top.

Source Tradingview. The figures stated are as of August 9th, 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade