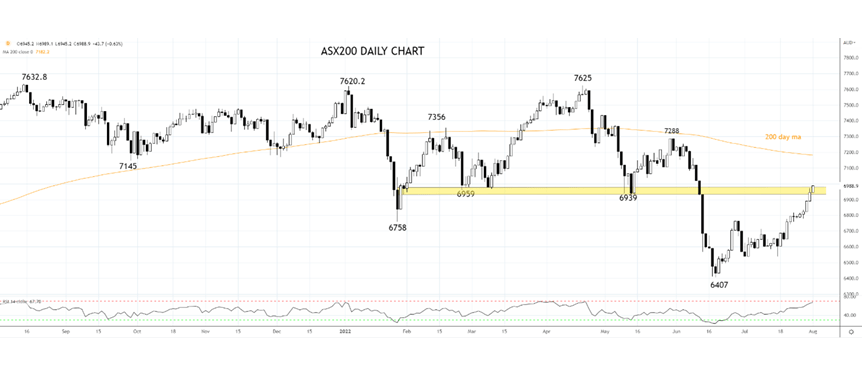

The ASX200 trades 39 points higher at 6984 at 2.45 pm Sydney time.

The ASX200 has started a new week and month on a positive footing, building on its 5.74% gain in July as it clung to the coattails of a wicked rebound on Wall Street.

Today's gains come despite China's growth and geopolitical concerns weighing on U.S equity futures and ahead of tomorrow's RBA Board meeting, which is expected to see the RBA raise its official cash rate for a third consecutive time by 50bp from 1.35% to 1.85%.

The energy sector has been the day best performing sector as the market braces for the outcome of another disappointing OPEC+ meeting as key producers are already struggling to meet existing production targets. Woodside Energy added 2.2% to $32.67, Origin Energy added 1.35% to $6.02, Santos added 1.2% to $7.39, and Beach Energy added 0.85% to $1.83

The Materials sector has gained led by shares of Lynas Rare Earths which added 4.31% to $9.09. BHP added 1.45% to $39.25, South 32 added 1.45% to $3.87, Mineral Resources added 1.43% to $54.51, and Rio Tinto added 1% to $98.83 still trying to reclaim a toe hold above $100.00.

Gains for Healthcare stocks led by Sonic Health Care added 3% to $35.39. Fisher &Paykel added 1.77% to $19.51, Ansell added 1.2% to $26.45, Cochlear added 1.26% to $216.93, and Biotech giant CSL added 1% to $292.73.

A mixed session for tech stocks. The sizzle in BNPL stock Sezzle continued as it added 13.41% to $0.93c and Seek added 1% to $23.18. Elsewhere, Megaport dived 10% to $8.72, Novonix fell 4.6% to $2.70, and Tyro Payments fell 1.8% to $0.81c.

After a 15% rebound from its June lows, the Financial Sector has paused for a breath today as data showed that house prices in July fell at their fastest pace since 1983. Macquarie Bank fell 1.2% to $178.95, ANZ fell -0.87% to $22.70, NAB fell -0.52% to $30.44 and CBA fell 0.2% to $100.58. Westpac bucked the trend as it added 0.3% to $21.56.

Lithium stocks have continued their rebound, led by Lake Resources, which added 7.41% to $0.87c, Allkem added 5.14% to $11.86, Core Lithium added 3.25% to $1.20, and Pilbara Minerals added 2.17% to $2.83.

The ASX200 appears set to post its first daily close above the critical 6940/60 resistance band. A second consecutive daily close above 6960 would negate the technical damage caused by the selloff in June and put the 200-day moving average at 7200 on the radar.

Source Tradingview. The figures stated are as of August 1st, 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade