AstraZeneca earnings preview: what to expect from Q4 results

When will AstraZeneca release its Q4 results?

AstraZeneca will release results for the fourth-quarter (Q4) and the full year at 0700 GMT on Thursday December 11.

In addition, the company will hold a virtual roadshow during which it will discuss the annual results in further detail on Friday December 12.

AstraZeneca earnings consensus: what to expect

AstraZeneca is currently making headlines almost daily because of its coronavirus vaccine, but this should not overshadow its results on the day – which will be the main driver of any share price movement. The vaccine may be one of AstraZeneca’s most important developments but, for now, it is not driving the company’s growth or results.

AstraZeneca has said it is expecting revenue to rise by ‘high single-digit to a low double-digit percentage’ in 2020. The current consensus suggests it will be toward the lower end of that range and rise by 7.9% to $26.32 billion.

As for earnings, AstraZeneca is targeting growth in its core earnings per share in ‘mid-to-high-teens’, in-line with the consensus that forecasts a 15.1% increase to $4.03.

|

AstraZeneca Earnings Consensus |

Q4 2019 |

Q4 2020e |

FY 2019 |

FY 2020e |

|

Revenue |

$6.66 billion |

$7.10 billion |

$24.38 billion |

$26.32 billion |

|

Core EPS |

$0.89 |

$1.20 |

$3.50 |

$4.03 |

|

Reported EPS |

$0.24 |

$0.64 |

$1.03 |

$2.42 |

(Source: Reuters)

AstraZeneca’s coronavirus vaccine

AstraZeneca’s vaccine, developed with Oxford university, was one of the first vaccines to be widely approved in a number of countries. For example, it was given the green light by the UK on December 30 and in the EU on February 1.

However, this has placed pressure on its supply chain and sparked fears that supplies will struggle to keep up with demand this year. AstraZeneca is being asked to supply doses by countries all around the world and the company found itself in the centre of a dispute of vaccine protectionism when it admitted it wouldn’t be able to supply the EU with the amount it originally promised.

A greater concern will be the recent doubt cast over the efficacy of the vaccine after a small study of 2,000 mostly young people in South Africa found it had little effectiveness in protecting against the mutated variant found in the country.

AstraZeneca’s vaccine has received widespread backing from around the world since then, including from the World Health Organisation, which reiterated its view that it offers protection against severe disease and death. The UK has stood by the vaccine, while the US has said it still intends to roll it out.

Regardless, the world is realising that vaccines will need to adjusted to stay effective against the virus as it mutates – as is necessary with the likes of flu jabs every year. AstraZeneca has said it is already working on new vaccines targeting new variants and that it hopes to have them ready before the end of the third quarter.

Can new medicines continue to drive growth?

AstraZeneca reported growth across the board during the first three quarters of 2020, but one particular area to watch is the performance of new medicines.

Sales of new medicines jumped 34% in the first nine months of 2020, considerably faster than its more established drugs with overall sales up by 9%. Notably, new medicines are making up a larger proportion of topline income and currently accounts for 52% of total revenue compared to 42% at the end of September 2019. Investors will want to see this trend continue.

Notably, AstraZeneca has won a string of new approvals for a number of its drugs since its last quarterly update, which should support further growth. Forxiga secured approval to be used for heart failure in China, Japan and the EU (where it was also approved to treat ovarian and prostate cancer). Lynparza was given the green light to treat three different cancers in Japan. Calquence can now be used to treat leukaemia in the EU and Japan. And Enhertu was approved to treat gastric cancer in the US and breast cancer in the EU.

All of these approvals, combined with others for the likes of Symbicort and Brilinta, should allow AstraZeneca to maximise the income it can produce from its newer medicines.

AstraZeneca’s acquisition of Alexion Pharmaceuticals

Investors should also look for any news on the acquisition of Alexion Pharmaceuticals that was agreed in December. AstraZeneca is paying $175 per share in cash and shares, valuing the deal at £39 billion. Alexion shareholders will own 15% of AstraZeneca once the deal is done.

Don’t expect too much news, as the deal is not expected to be completed until the third quarter of 2021. Once completed, Alexion will become an important cog in the AstraZeneca machine and a major driver of improved revenue, earnings and cashflow that will allow AstraZeneca to pay down debt and increase its dividend.

How to trade AstraZeneca’s results

AstraZeneca has beaten expectations for three consecutive quarters and as a result its share price has risen the last three times it has reported results. Notably, shares suffered a heavy fall when it last missed expectations with its Q4 2019 results a year ago.

Brokers are bullish on AstraZeneca shares in the long-term, with an average Buy rating currently on the stock. There is currently 9 brokers rating AstraZeneca at Strong Buy, 12 at Buy, 4 at Hold, 1 at Sell and 1 at Strong Sell. The average target price of 8864.42p sits 22.5% above the current share price, suggesting AstraZeneca is undervalued and offers plenty of upside.

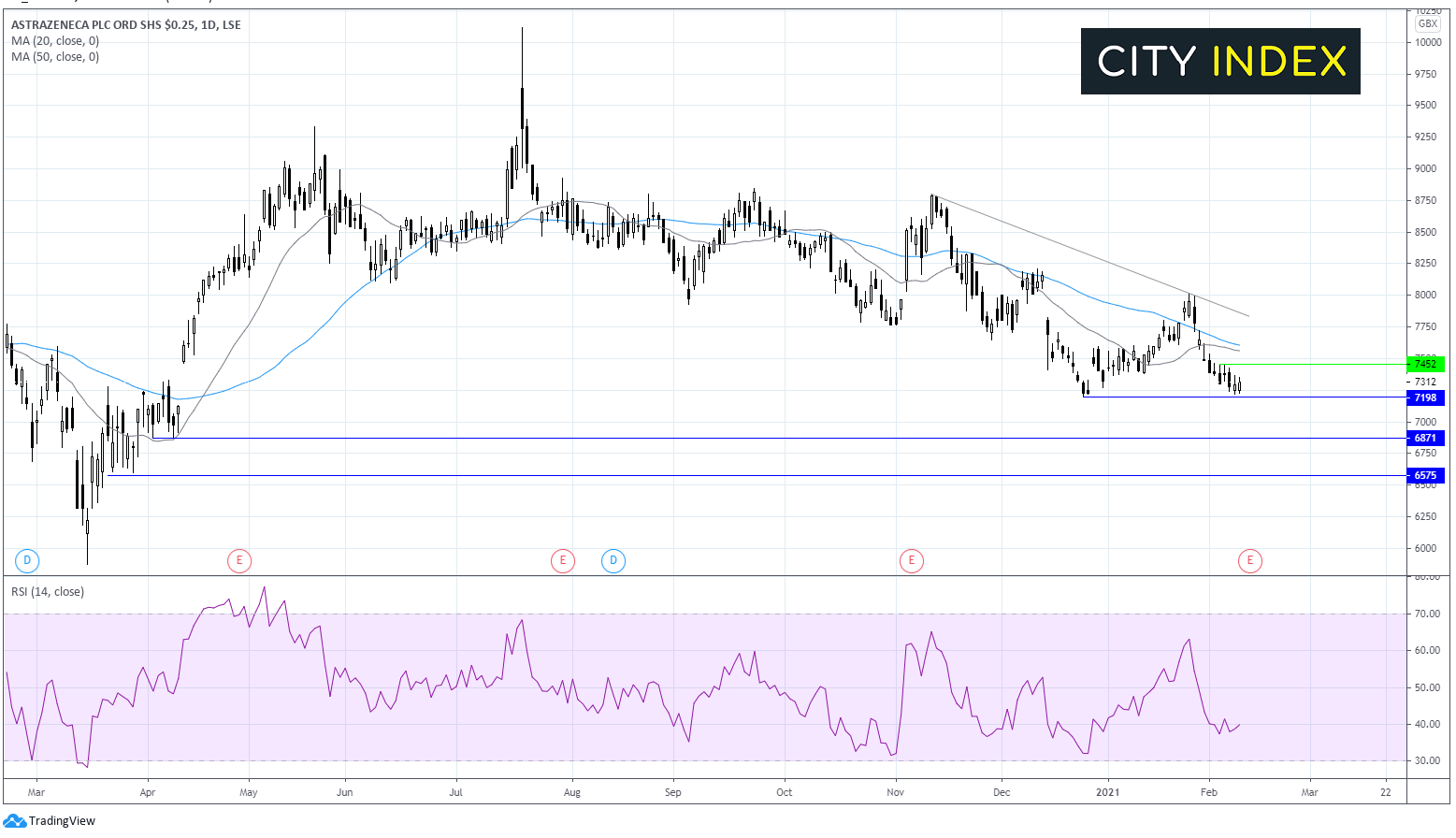

AstraZeneca technical analysis

After rebounding firmly from mid-March lows AstraZeneca traded relatively flat across most of the year and has been trending lower since early November. It trades below its 100, 50 & 20 sma on the daily chart confirming a bearish trend.

The RSI is in bearish territory, supportive of further weakness in the price.

Support can be seen at 7200 a level tested in late December. A breakthrough this level could see the selloff gain momentum as it targets 6870 a level last seen in April, with subsequent weakness bringing 6575 into play.

Any attempted recovery could see resistance at 7450 today’s high ahead of 7560 the 20 sma and 7600 50 sma. Beyond there more bulls could push the price to 7860 the descending trend line, a breach at this level could negate the current bear trend.

How to trade AstraZeneca shares

You can trade AstraZeneca shares with City Index using spread-bets or CFDs, with spreads from 0.1%.

Follow these easy steps to start trading AstraZeneca shares today.

- Open a City Index account, or log-in if you’re already a customer.

- Search for ‘AstraZeneca’ or its ticker ‘AZN’ in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade