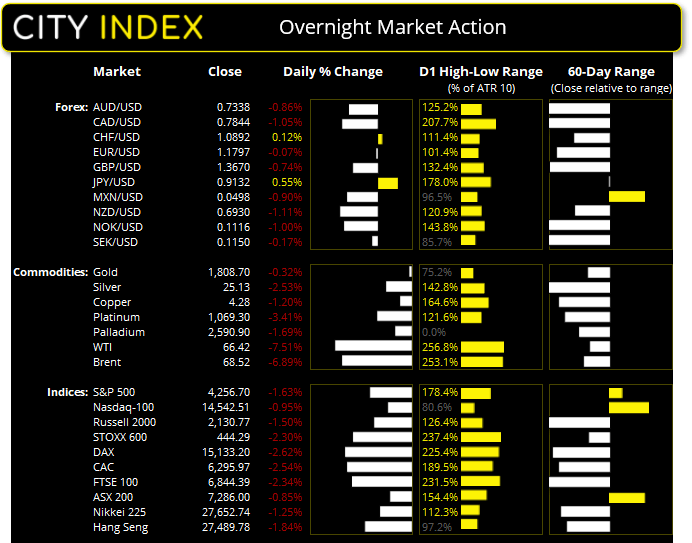

Asian Futures:

- Australia's ASX 200 futures are down -33 points (-0.45%), the cash market is currently estimated to open at 7,253.00

- Japan's Nikkei 225 futures are down -330 points (-1.2%), the cash market is currently estimated to open at 27,322.74

- Hong Kong's Hang Seng futures are down -254 points (-0.92%), the cash market is currently estimated to open at 27,235.78

UK and Europe:

- UK's FTSE 100 index fell -163.7 points (-2.34%) to close at 6,844.39

- Europe's Euro STOXX 50 index fell -107.24 points (-2.66%) to close at 3,928.53

- Germany's DAX index fell -407.11 points (-2.62%) to close at 15,133.20

- France's CAC 40 index fell -164.11 points (-2.54%) to close at 6,295.97

Monday US Close:

- The Dow Jones Industrial fell -725.81 points (-2.09%) to close at 33,962.04

- The S&P 500 index fell -68.67 points (-1.59%) to close at 4,258.49

- The Nasdaq 100 index fell -132.284 points (-0.9%) to close at 14,549.09

Learn how to trade indices

Indices: US advise against travel to UK

Bond yields were broadly lower as investors remained concerned that the rise of the Delta Variant will weigh on growth. Global stock market indices were broadly lower as investors rushed for the exit, which saw the S&P 500 shed -1.5% with all sectors in the red, led by energy and financial sectors. The Dow Jones fell -2% and cut through its 50-day eMA to a 4-week low whilst the Nasdaq 100 held up relatively well at -0.9% after gapping lower.

The Russell 2000 (RUT) is on track to break a 9-month bullish streak, unless it can recoup the -7.8% lost this month with the 8 trading sessions remaining in July. At the current rate of volatility, it is about 1-2 trading days away from testing the January low, but the 200-day eMA is also in the vicinity so there is potential for technical support, even if only briefly so.

The UK removed restrictions as part of ‘freedom day’, prompting the US to advise against travelling to the UK. Both the US State Department and US Centres for Disease Control issued level 4 warnings against visiting. With daily cases now rising over 50k per day it has also been reported that 40% of new hospital admissions are from fully vaccinated people. The FTSE 100 fell -2.34% during its worst session in two months.

ASX 200 Market Internals:

ASX 200: 7286 (-0.85%), 19 July 2021

- Healthcare (1.62%) was the strongest sector and Materials (-2.44%) was the weakest

- 4 out of the 11 sectors closed higher

- 8 out of the 11 sectors closed lower

- 6 out of the 11 sectors outperformed the index

- 32 (16.00%) stocks advanced, 152 (76.00%) stocks declined

- 3 hit a new 52-week high, 1 hit a new 52-week low

- 66% of stocks closed above their 200-day average

- 53% of stocks closed above their 50-day average

- 42.5% of stocks closed above their 20-day average

Outperformers:

- + 3.41% - Deterra Royalties Ltd (DRR.AX)

- + 3.40% - Polynovo Ltd (PNV.AX)

- + 2.72% - Elders Ltd (ELD.AX)

Underperformers:

- -9.65% - Chalice Mining Ltd (CHN.AX)

- -8.74% - Evolution Mining Ltd (EVN.AX)

- -5.72% - Eagers Automotive Ltd (APE.AX)

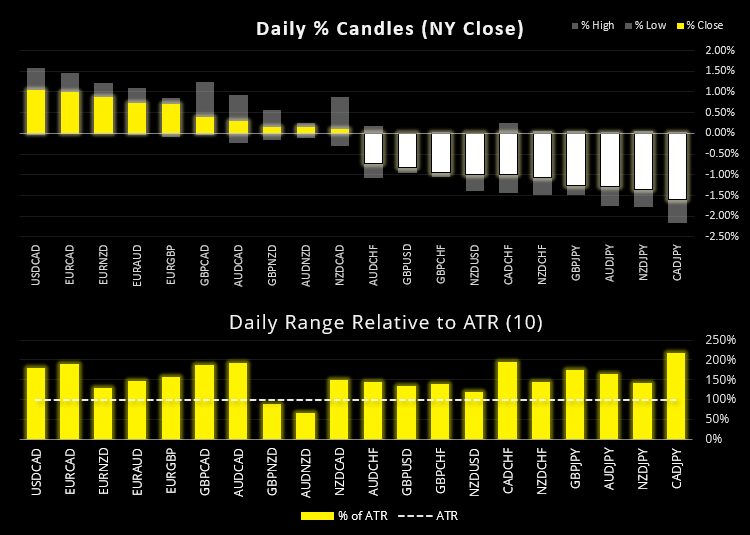

Forex: JPY, CHF and USD lead the pack

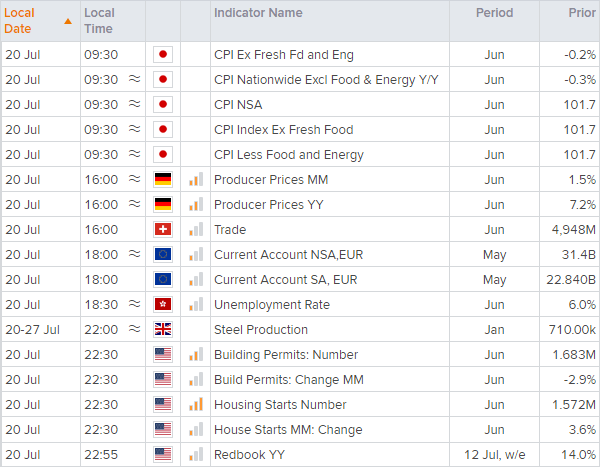

The economic calendar is showing more signs of life today, although none of it is particularly top-tier stuff so the covid theme is likely to be the main driver. What remains to be seen is whether Asia will provide a pause (or even technical retracements) before Europe opens.

The US dollar index (DXY) pierced its way above gap resistance at 93.83 yet gave back some earlier gains to close on that key level. Whilst the dollar caught safe have bids against risker currencies, the Japanese yen and Swiss franc were again the strongest majors during a classic risk-off session.

USD/CAD rose over 1% to a 5month high, EUR/USD dipped below 1.1772 support but managed to close back above 1.1800 and AUD/USD closed below 0.7400 for the first time this year. The dollar was also broadly higher against emerging market.

Commodity currencies once again bore the brunt, seeing NZD, CAD and AYD as the weakest major currencies overnight. CAD/JPY fell -1.6% to its lowest level since early February, AUD/JPY shed -1.3% and EUR/JPY broke beneath the July low in line with yesterday’s bias.

Learn how to trade forex

Commodities broadly lower, led by oil

Oil prices tumbled over -6% yesterday as prices were hit with a double whammy of OPEC+ agreeing to increase output and lower demand expectations in fears of new global lockdowns. WTI futures down -7.5% and brent futures falling -6.8% by the close.

Gold broke below its 200-day eMA and trend support, although the subsequent volatility seen around these key levels show that volatility is yet to guide direction. Silver did not suffer from this issue with its clean break beneath its 200-day eMA, falling a further -2% to a 3-month low.

Copper futures finally rolled over below trend resistance after several failed attempts to break above the 50-day eMA. That prices didn’t even test 4.435 resistance showed a lack of appetite from bulls, so it simply required a bout of risk-off to send it toppling. Now momentum has realigned with the bearish move from its triangle breakout we suspect bears will try to drive this closer to $4.00 support. Our bias remains bearish below 4.3445, although trend resistance can also be used to fine tune the bias as price action develops.

Up Next (Times in AEST)

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.