Asian Futures:

- Australia’s ASX 200 futures are down 0 points (0%), the cash market is currently estimated to open at 7342.6

- Japan's Nikkei 225 futures are down -110 points (-0.36%), the cash market is currently estimated to open at 30138.81

- Hong Kong's Hang Seng futures are down -187 points (-0.77%), the cash market is currently estimated to open at 24005.16

European Friday close:

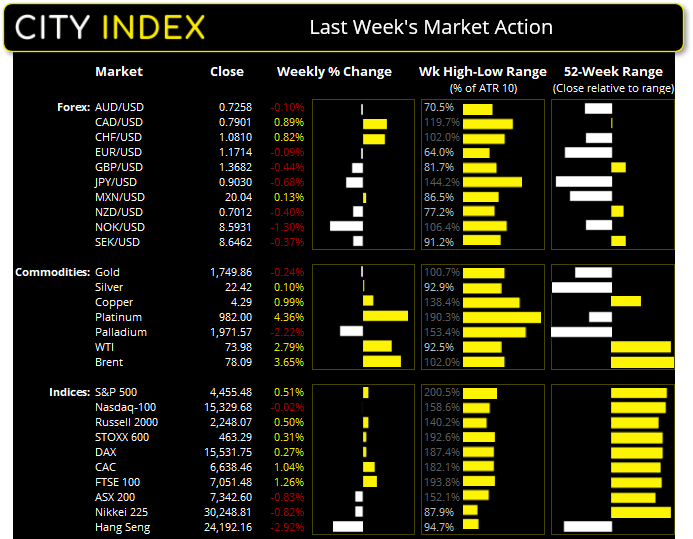

- UK's FTSE 100 index fell -26.87 points (-0.38%) to close at 7051.48

- Europe's Euro STOXX 50 index fell -36.41 points (-0.87%) to close at 4158.51

- Germany's DAX index fell -112.22 points (-0.72%) to close at 15531.75

- France's CAC 40 index fell -63.52 points (-0.95%) to close at 6638.46

US Friday close:

- The Dow Jones rose -166.42 points (0.1%) to close at 34,798.00

- The S&P 500 rose 6.5 points (0.15%) to close at 4,455.48

- The Nasdaq 100 rose 13.097 points (0.09%) to close at 15,329.68

Indices:

After gapping lower, US indices recouped earlier losses to post marginal gains on Friday as concerns over Evergrande resurfaced. With all eyes on how (or if) they manage their debts over the coming days and weeks it will remain in the back of investor’s minds, with the potential to weigh on sentiment.

The Nasdaq 100 found support at its 20-week eMA and closed just -0.25% lower after recouping early losses and closing back above 15k. The S&P 500 rose 0.5% after also finding support at its 20-week eMA.

The Nikkei 225 has fond support at the 29,415 high so our bias remains bullish above that level. Its next target is the 30,710 high.

ASX 200 Market Internals

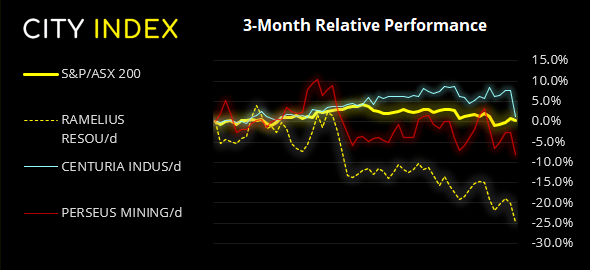

ASX 200: 7342.6 (-0.37%), 26 September 2021

- Energy (1.41%) was the strongest sector and Real Estate (-2.12%) was the weakest

- 3 out of the 11 sectors closed higher

- 9 out of the 11 sectors closed lower

- 5 out of the 11 sectors outperformed the index

- 56 (28.00%) stocks advanced, 134 (67.00%) stocks declined

- 68.5% of stocks closed above their 200-day average

- 50% of stocks closed above their 50-day average

- 38% of stocks closed above their 20-day average

Outperformers:

- + 5.7% - Computershare Ltd (CPU.AX)

- + 5.5% - Premier Investments Ltd (PMV.AX)

- + 3.7% - Washington H Soul Pattinson and Company Ltd (SOL.AX)

Underperformers:

- -6.1% - Ramelius Resources Ltd (RMS.AX)

- -5.9% - Centuria Industrial Reit (CIP.AX)

- -5.7% - Perseus Mining Ltd (PRU.AX)

Forex: DXY finds support

A risk-off tone on Friday saw NZD and AUD as the day’s weakest currencies as concerns over Evergrande resurfaced. Higher oil prices supported CAD which was the strongest major with USD a close second. Month to date, the USD and Canadian dollars are the strongest majors whilst CHF and AUD are the weakest.

There is little data out today in Asia, although the German elections could provide some volatility for EUR pairs.

USD/JPY rallied for a third consecutive day as it tracked yields higher. 110.80 is the next resistance levels for bulls to conquer and, looking at momentum leading into that key level of Friday, it looks like a matter if time before they succeed.

Learn how to trade forex

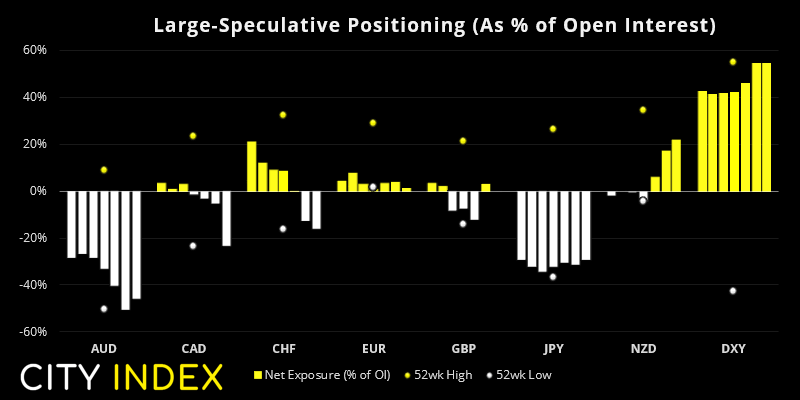

From the Weekly COT Report (Commitment of Traders)

From Tuesday 21st September 2021

- According to calculation from IMM traders are net-long USD by US $13.4 billion, although slightly net-short against emerging currencies. This is the most bullish traders have been on the dollar since March 2020.

- Traders flipped to net-short exposure to GBP futures.

- Large speculators flipped to net-long exposure of platinum futures.

- Traders increased net-short exposure to AUD futures 2.2k contracts, making it a new record of bearish exposure.

- Traders increased net-short exposure to CAD futures by 18.6k contracts, which is its most aggressive weekly change by bears since March 2020.

- Traders were net-short CHF futures for a second week, and at their most bearish level since December 2019.

- Net-long exposure to EUR futures fell by -15.4k contracts, which is near its least bullish level since March 2020.

Commodities: Metals diverge

WTI hit our 74.23 target in Friday during its third consecutive bullish session. We think it may be able to break higher, although the monthly R1 pivot sits just above that high so we may find a pause in trend initially.

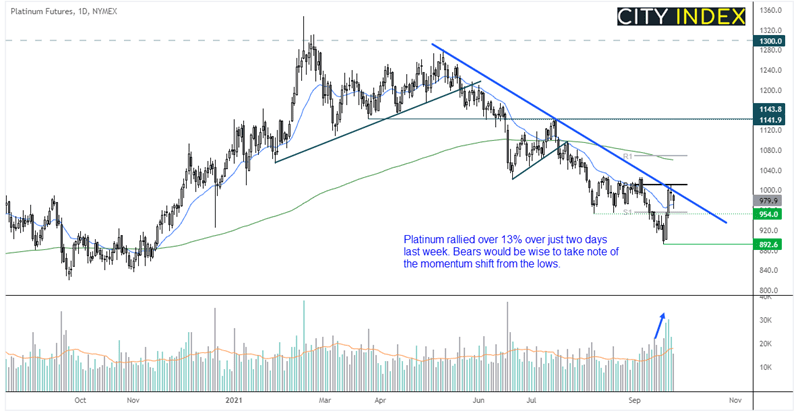

Platinum futures rallied an impressive 13.1% over just two days last week, after falling to its lowest level since November. Bears would be wise to take note of that momentum shift. It found resistance at the May trendline, before printing an indecision candle at the monthly pivot point and trendline and then pulling back to the 20-day eMA. We suspect a bullish breakout is now on the cards.

A break above last week’s high will invalidate the bearish trendline and see prices back above the monthly pivot point, bringing the 200-day eMA and monthly R1 pivot into focus around 1070.

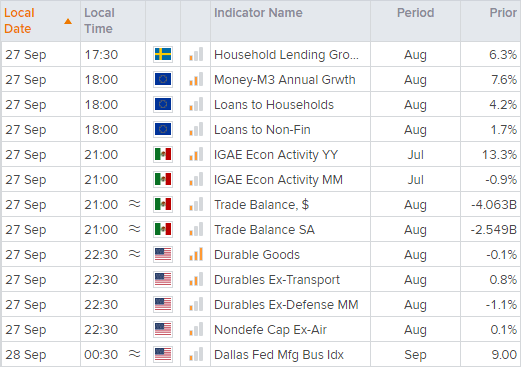

Up Next (Times in AEST)

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.