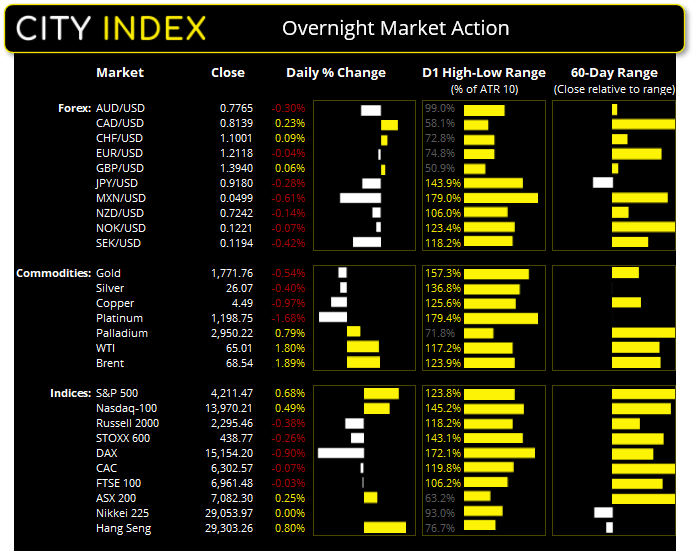

Asian Futures:

- Australia's ASX 200 futures are down -16 points (-0.23%), the cash market is currently estimated to open at 7,066.30

- Japan's Nikkei 225 futures are down -130 points (-0.45%), the cash market is currently estimated to open at 28,923.97

- Hong Kong's Hang Seng futures are down -73 points (-0.25%), the cash market is currently estimated to open at 29,230.26

UK and Europe:

- UK's FTSE 100 index fell -2.19 points (-0.03%) to close at 6,961.48

- Europe's Euro STOXX 50 index fell -18.13 points (-0.45%) to close at 3,996.90

- Germany's DAX index fell -137.98 points (-0.9%) to close at 15,154.20

- France's CAC 40 index fell -4.41 points (-0.07%) to close at 6,302.57

Thursday US Close:

- The Dow Jones Industrial rose 239.98 points (0.71%) to close at 34,060.36

- The S&P 500 index rose 28.29 points (0.68%) to close at 4,211.47

- The Nasdaq 100 index rose 68.589 points (0.49%) to close at 13,970.21

US indices outperform European bourses

After a shaky start, the S&P 500 recovered earlier losses to close marginally higher by 0.6%. And the recovery was all thanks to a strong earnings report by FaceBook (FB) which saw the stock rise 7.6% as the second-best performer of the day. Amazon Inc (AMZ) also beat earnings estimates, but the report was released just after the closing bell. Communications services and financial sectors were the strongest performers, and seven out of the 11 sectors were higher by the close.

Large cap tech stocks also rose, with the Nasdaq 100 rising by 0.5% and outperforming the Nasdaq composite (0.2%). The Dow Jones was up 0.6% whilst small caps were flat with the Russell 2,000 closing -0.01% lower.

It was a different case in Europe which saw bourses close in the red in the face of rising yields across the region. The Euro STOXX 50 printed a bearish outside day and finished the session -0.26% lower, although DAX was the laggard closing down -0.9%.

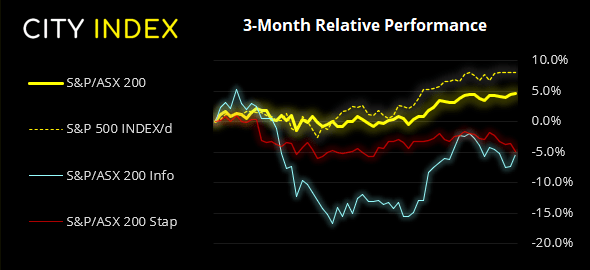

ASX 200 Market Internals:

We’re expecting a soft open looking at futures markets. Although the ASX 200 found resistance at the April high anyway, so the bias is bearish early on in the session. However, PMI data is released for Japan, China and Australia over the next few hours, so we could be in for some volatility around current levels to be on for a break either way, which makes 7094 – 7100 a pivotal zone today (and potentially next week).

ASX 200: 7082.3 (0.25%), 28 April 2021

- Information Technology (2.25%) was the strongest sector and Consumer Staples (-1.27%) was the weakest

- 6 out of the 11 sectors outperformed the index

- 5 hit a new 52-week high, 1 hit a new 52-week low

- 74.5% of stocks closed above their 200-day average

- 60% of stocks closed above their 20-day average

Outperformers

- + 7.91% - Nickel Mines Ltd (NIC.AX)

- + 6.77% - Ramelius Resources Ltd (RMS.AX)

- + 5.38% - Resolute Mining Ltd (RSG.AX)

Underperformers:

- -5.62% - Nuix Ltd (NXL.AX)

- -4.52% - Unibail-Rodamco-Westfield SE (URW.AX)

- -3.86% - Woolworths Group Ltd (WOW.AX)

Learn how to trade indices

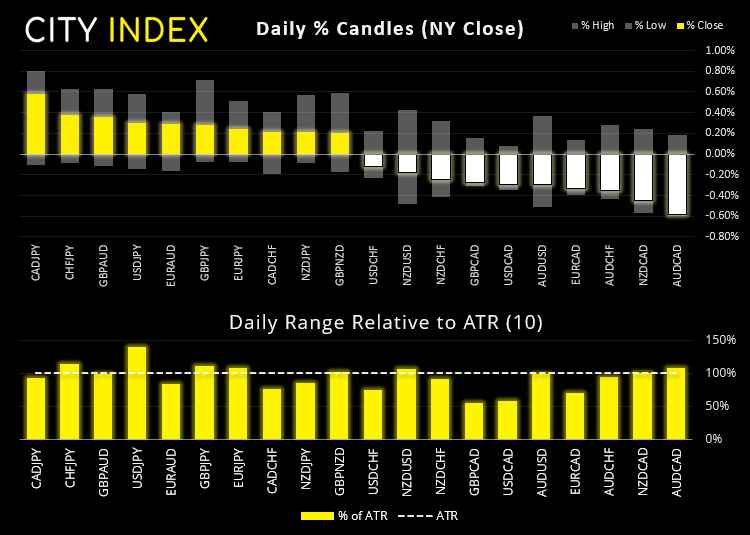

Forex: CAD takes the lead with higher oil prices

The US dollar index (DXY) has closed back on 90.60 support and printed a small indecision candle, suggesting bears are lacking the required fuel to drive it lower, over the near-term. However, one candle does not change a trend, and structurally the daily trend remains bearish below Wednesday’s FOMC high of 91.13.

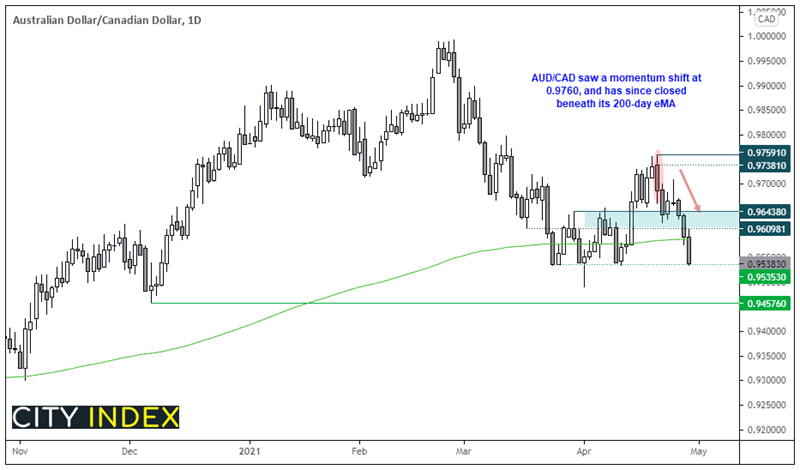

Oil prices were supportive of an already-strong Canadian dollar. CAD/JPY rallied for a fifth consecutive session and trades above our initial 88.30 target, and bulls are eyeing up next resistance at 89.20. USD/CAD is now pips away from the February 2018 low, although there’s no clear signs of a trough forming yet. And the Canadian dollar is also overpowering its commodity FX peers, AUD and NZD.

After a countertrend bounce in the first few weeks of April, a momentum shift occurred at 0.9760 following the BOC’s mawkish meeting and bearish momentum has now accelerated as oil prices have risen. It closed firmly beneath its 200-day eMA, but is now probing key support at 0.9535. Given the fundamental backdrop aligns with the bearishness of the chart, we fancy its odds of breaking below support in due course. Therefore, our bias remains bearish below yesterday’s high and a break below 0.9535 brings the 0.9457 into focus.

Learn how to trade forex

Commodities: Oil extends its lead, gold falls from 200-day eMA

Oil extended its lead to a six-week high on higher oil demand forecasts and positive economic data. WTI currently trades around 64.80 and its next resistance levels are 66.40 and 67.98, whilst next major resistance for brent is 70.0.

It was a volatile session for gold, initially rising to test its 200-day eMA but falling over 1% due to rising yields and stronger economic data. Whilst our core view remains bullish, yesterday’s bearish outside candle pierced 1760 support, so we’d prefer to step aside until volatility subsides.

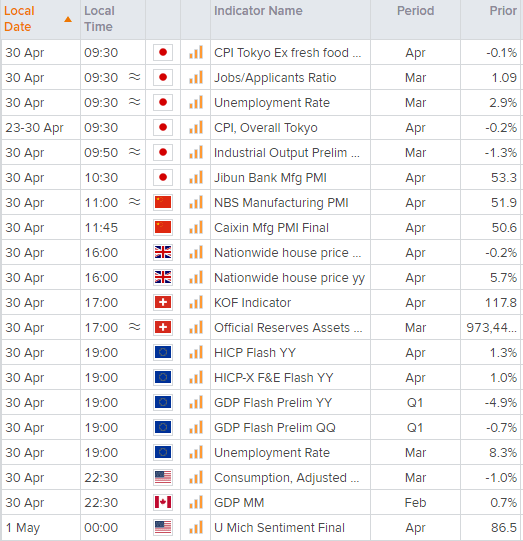

Up Next (Times in AEST)

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here.