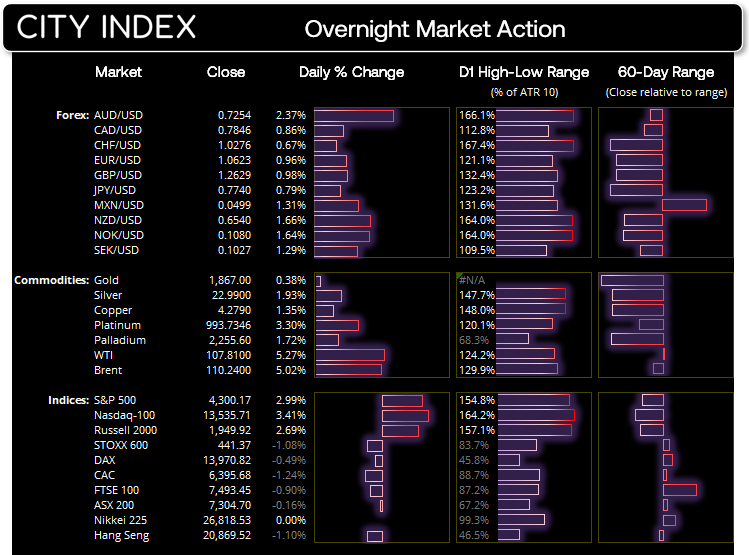

Wednesday US cash market close:

- The Dow Jones Industrial rose 932.27 points (2.81%) to close at 34,061.06

- The S&P 500 index rose 124.69 points (2.51%) to close at 34,058.75

- The Nasdaq 100 index rose 445.81 points (3.41%) to close at 13,535.71

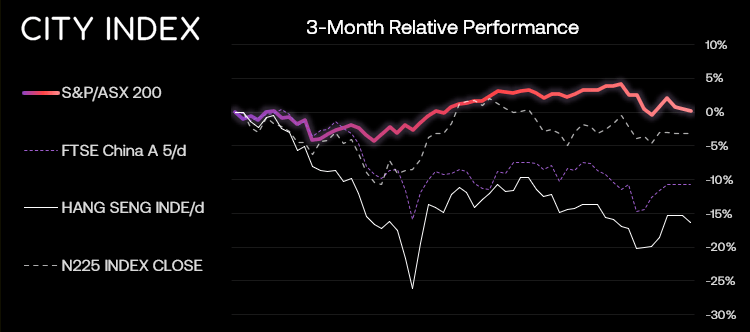

Asian futures:

- Australia's ASX 200 futures are down 0 points (-0.65%), the cash market is currently estimated to open at 7,304.70

- Japan's Nikkei 225 futures are up 70 points (0.26%), the cash market is currently estimated to open at 26,888.53

- Hong Kong's Hang Seng futures are up 215 points (1.04%), the cash market is currently estimated to open at 21,084.52

- China's A50 Index futures are up 107 points (0.8%), the cash market is currently estimated to open at 13,623.30

We’re still going to get a lot of Fed hikes. Just not as many as markets had priced in. Money markets were pricing in a more aggressive trajectory than the Fed hinted at today which led to an inevitable repricing. The anticipated 50-bps hike in September has been trimmed to 25-bps, and expectations of 25-bps hikes in November through to March are now all well below 50%. Moreover, traders now see rates finishing the year at 225-250 bps (down from 300-325 bps this time yesterday) and peaking at 275-300, well below the 350-375 seen yesterday.

This was seen as good news for stock markets which saw US markets rebound led by the Nasdaq 100. The Nasdaq rose 3.5% with above-average volume and is on track for a bullish engulfing week, along with DJI and the S&P 500. 94% of the S&P’s stocks advanced on the day and all of its 11 sectors rose, led by energy.

USD broadly weaker

Clearly, that was too much for dollar bulls to ‘bear’ which prompted traders to cast aside their long bets like they never happened. The US dollar index fell around -1% during its second worst session this year, and the dollar was weaker against all major peers with commodity FX taking the lead. USD/JPY fell to a 5-day low and looks set to test 128.

Best day for the Aussie since the pandemic

The Australian dollar enjoyed its best day since the pandemic. The RBA may no longer be behind the Fed’s curve, and that is being reflected in the AU-US 2-year yield differential which is now positive for the first time since November at +7 bps. Given these developments we suspect that traders will now place a greater emphasis on any positive data from Australia over the US, and provide further support for AUD. And with large speculators net-short AUD by -27,651 contracts, there’s a lot of bears who will be looking to cover their losing positions.

Commodities broadly higher

The Thomson Reuters Commodity index closed back above the 2014 high as the weaker US dollar provided commodities with a tailwind. Gold closed above 1880 – a level we flagged a pivotal for traders, so we have reverted to a bullish bias over the near-term.

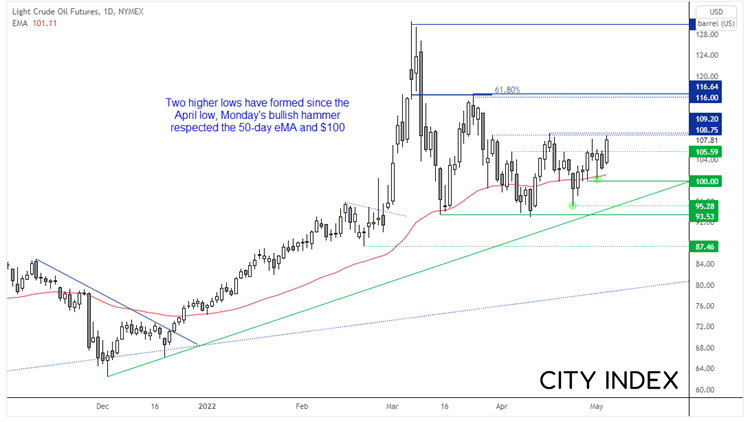

WTI looks like it is considering a breakout of 109.Whilst prices have traded in a corrective pattern since topping around 130 in March, clues of demand can be seen with its two higher lows since finding support at 93.50. Monday’s bullish hammer respected 100 and the 50-day eMA as support and prices are now close to testing 108.75 resistance, a break above which brings the 116 high into focus. Today we would like to see 105 / 105.60 hold as support ahead of any anticipated breakout, and a move below 105 could be an early warning that the breakout is not yet near.

ASX 200:

ASX 200: 7304.7 (-0.16%), 04 May 2022

- Energy (0.83%) was the strongest sector and Real Estate (-1.49%) was the weakest

- 5 out of the 11 sectors closed higher

- 6 out of the 11 sectors closed lower

- 5 out of the 11 sectors outperformed the index

- 83 (41.50%) stocks advanced, 110 (55.00%) stocks declined

Outperformers:

- +3.89% - Hub24 Ltd (HUB.AX)

- +3.37% - Orora Ltd (ORA.AX)

- +3.01% - Virgin Money UK PLC (VUK.AX)

Underperformers:

- -19.19% - AVZ Minerals Ltd (AVZ.AX)

- -11.18% - ARB Corp Ltd (ARB.AX)

- -6.97% - Novonix Ltd (NVX.AX)

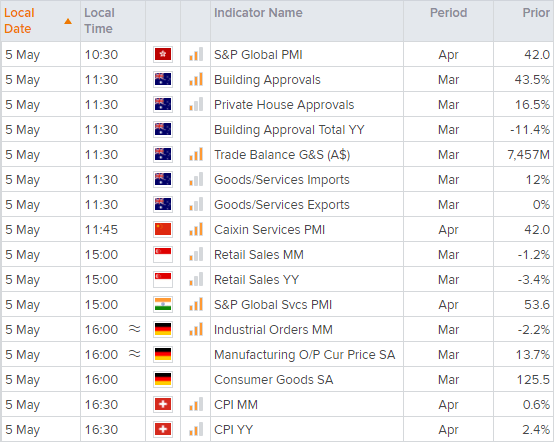

Up Next (Times in AEST)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

- Open an account, or log in if you’re already a customer

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade