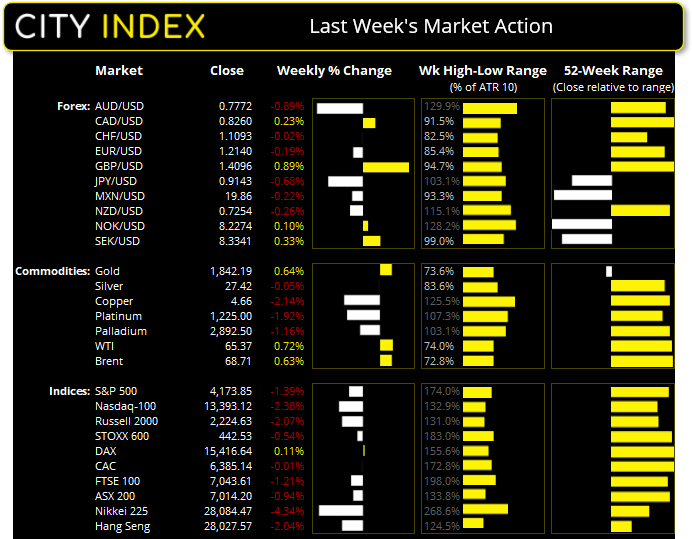

Asian Futures:

- Australia's ASX 200 futures are up 48 points (0.69%), the cash market is currently estimated to open at 7,062.20

- Japan's Nikkei 225 futures are up 240 points (0.86%), the cash market is currently estimated to open at 28,324.47

- Hong Kong's Hang Seng futures are up 186 points (0.67%), the cash market is currently estimated to open at 28,213.57

UK and Europe:

- UK's FTSE 100 index rose 80.28 points (1.15%) to close at 7,043.61

- Europe's Euro STOXX 50 index rose 64.99 points (1.64%) to close at 4,017.44

- Germany's DAX index rose 216.96 points (1.43%) to close at 15,416.64

- France's CAC 40 index rose 96.81 points (1.54%) to close at 6,385.14

Friday US Close:

- The Dow Jones Industrial rose 433.79 points (1.29%) to close at 34,021.45

- The S&P 500 index rose 61.35 points (1.5%) to close at 4,173.85

- The Nasdaq 100 index rose 283.968 points (2.17%) to close at 13,393.12

Learn how to trade indices

Indices rallied into Friday’s close:

The Euro STOXX 50, DAX and CAC rallied to a four-day high on Friday, after printing bullish reversal candles at their 50-day eMA’s on Thursday. The CAC is just shy of its record high and the DAX is not too far behind. But we suspect they’ll challenge and perhaps break to new highs this week.

Bullish hammers appeared on the weekly charts of the S&P 500, Nasdaq and Russell 2000, whilst the Dow Jones printed a bearish outside week at its record highs. All of the sectors of the S&P 500 closed higher, led by energy and tech stocks, US yields fell for a second consecutive session and the US dollar fell on Friday to close flat for the week.

It wasn’t so rosy for the Nikkei 25, which printed a bearish engulfing (and worst week in in 14-months) and closed at its lowest level since February. Whilst it recovered slightly on Friday we suspect bears may be tempted to fade into minor rallies beneath 28,308 resistance.

The ASX 200 closed the week with a bearish outside candle. Given we’re in May, a month which has closed lower 70% of the time over the past thirsty years, this outside week should be taken note of as we may have seen the high for the month. That said, there was strong buying activity at the open on Friday, and futures markets are pointing towards a strong open for the ASX. So, if prices hold above 7012 support today we may see an attempt to break above 7075 and bring 7100 into focus. Key support levels for bears to conquer include 6993, 6966, 6938 and 6905.

ASX 200 Market Internals:

ASX 200: 7014.2 (0.45%), 16 May 2021

- Energy (1.7%) was the strongest sector and Materials (-1.18%) was the weakest

- 6 out of the 11 sectors outperformed the index

- 10 out of the 11 sectors closed higher

- 134 (67.00%) stocks advanced, 58 (29.00%) stocks declined

- 62% of stocks closed above their 200-day average

- 53.5% of stocks closed above their 50-day average

- 37.5% of stocks closed above their 20-day average

Outperformers:

- + 9.16% - Whitehaven Coal Ltd (WHC.AX)

- + 6.07% - Treasury Wine Estates Ltd (TWE.AX)

- + 4.83% - Clinuvel Pharmaceuticals Ltd (CUV.AX)

Underperformers:

- -5.19% - Pilbara Minerals Ltd (PLS.AX)

- -4.29% - Nickel Mines Ltd (NIC.AX)

- -4.17% - Xero Ltd (XRO.AX)

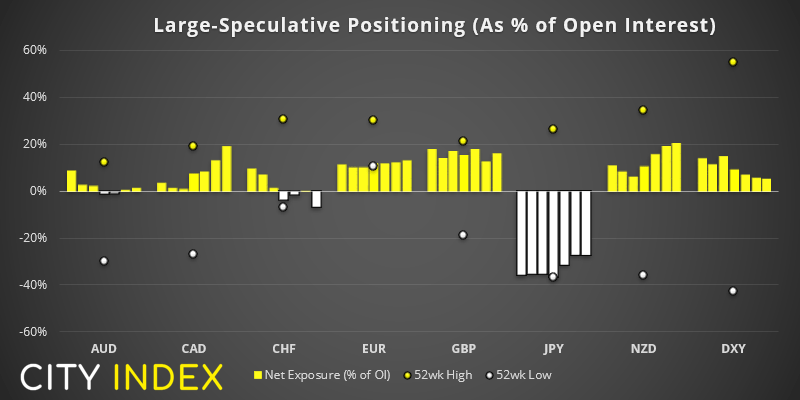

From the Weekly COT Report (Commitment of Traders)

- Traders flipped to net-long exposure on US 10-year bonds (bearish for yields).

- Large speculators flipped to net-long exposure on the Brazilian Real for the first time since August 2019.

- Traders remained net-long the US dollar index (DXY) for a ninth consecutive week, yet at their least bullish level since flipping to net-long in March.

- Traders were their most bullish on the Canadian dollar since November 2019.

- Large speculators were their most bullish on the New Zealand dollar in nine weeks.

- Traders were their most bullish on silver futures since January.

- Net-long exposure to euro futures rose to a 10-week high.

- Net-short exposure to the Swiss Franc rose to its most bearish level since March 2020.

The US dollar index (DXY) closed the week flat and printed a Rikshaw Man doji above 0.90 support. However, Friday saw prices roll over and wipe out earlier gains for the week, so we could see bears try to drive DXY back to the 89.86 lows this week.

USD/CHF broke beneath its retracement line on Friday and stopped just shy of our initial target above 0.9000. Given the bearish structure of the daily charts we prefer to fade into resistance levels and the bias remain bearish beneath 0.9093. A break above this level however confirms an inverted hammer on the weekly charts.

USD/JPY retraced on Friday and is holding above the 50% Marabuzo line we mentioned in Friday’s Asian Open report. We are looking for bullish momentum to return and prices challenge 110 whilst it holds above 108.60 support.

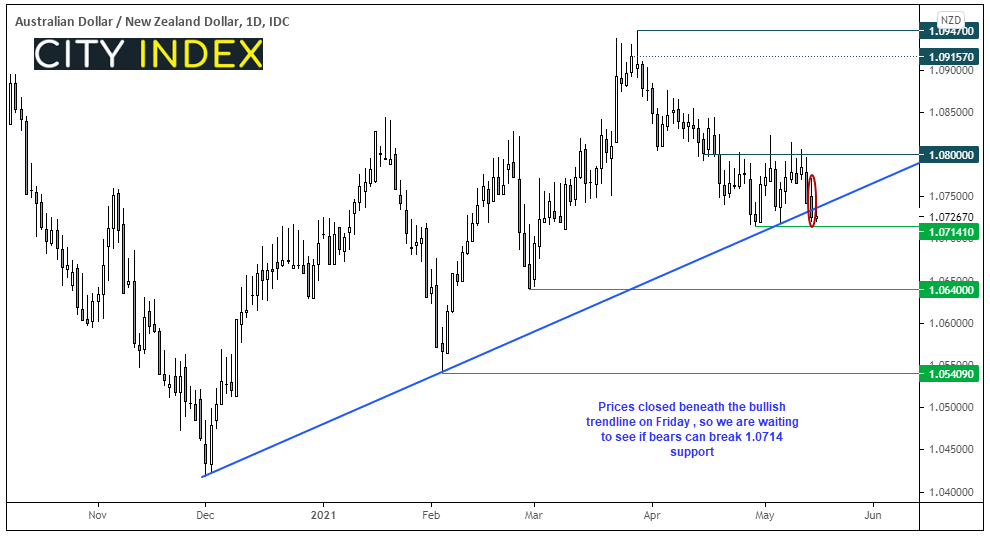

AUD/NZD breaks trendline support

Last Monday we highlighted the technical juncture that AUD/NZD found itself in. A daily close above 1.0800 would have earned our bullish interest, yet repeated failed attempts to hold above this level warned of a break of the bullish trendline on the daily chart. Bearish momentum has now taken prices beneath the trendline and considering a break of key support at 107.14, which would bring the 1.0640 low into focus for bears.

Learn how to trade forex

Commodities:

Silver rallied to a two-day high on Friday, closing the week at 27.41 and forming a three-day bullish reversal pattern above 26.63 support (Morning Star Reversal). Its bullish channel remains intact and our bias remains bullish above Thursday’s low. Gold closed just off its three-month high, and bulls may try to challenge the upper trendline of its bearish channel this week.

Oil prices were higher on the back of a weaker dollar and printed bullish inside days. WTI futures settled the week at 654.37 and brent futures closed at 68.41.

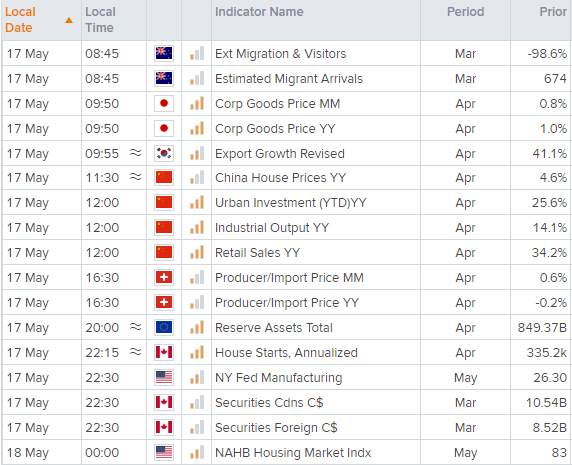

Up Next (Times in AEST)

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here.