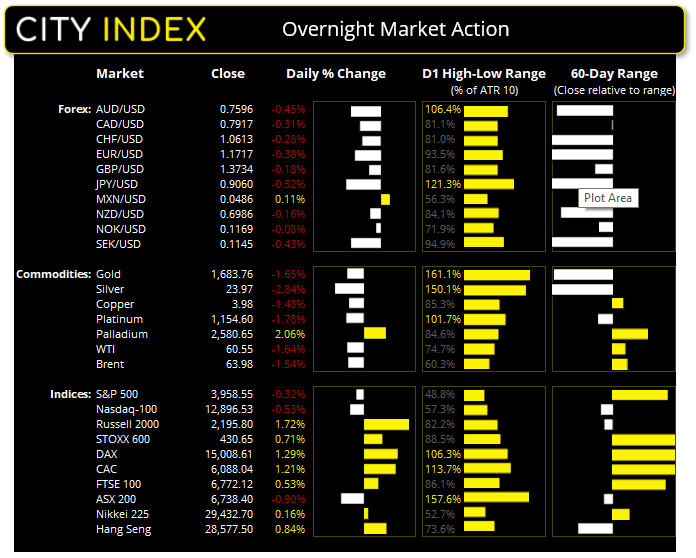

Asian Futures:

- Australia's ASX 200 futures are up 41 points (0.61%), the cash market is currently estimated to open at 6,779.40

- Japan's Nikkei 225 futures are down -170 points (-0.58%), the cash market is currently estimated to open at 29,262.70

- Hong Kong's Hang Seng futures are up 122 points (0.43%), the cash market is currently estimated to open at 28,699.50

UK and Europe:

- The UK's FTSE 100 futures are up 36 points (0.54%)

- Euro STOXX 50 futures are up 38 points (0.99%)

- Germany's DAX futures are up 159 points (1.07%)

Tuesday US Close:

- The Dow Jones Industrial fell -104.41 points (-0.31%) to close at 33,066.96

- The S&P 500 index fell -12.54 points (-0.32%) to close at 3,958.55

- The Nasdaq 100 index fell -69.209 points (-0.53%) to close at 12,896.53

The rise of yields hit a technical speedbump

US 10-year treasury yield hit its highest level since January 2020, yet later reversed to produce a bearish pinbar and settle at 1.7%. Two technical factors they may be part of the reversal are that yields are now trading around their 200-week eMA and the 10-year treasury note (which moves inversely to yields) is trading around a historical support level around 94’14.

Interestingly the 30-year yield (long end of the curve) failed to retest its March high and closed with a bearish outside day at 2.36%. So given these early signs, this is certainly something to watch for a potential trend reversal even if it is not the consensus at present.

Consumer confidence hits a post-pandemic high

US consumer confidence hit a one-year high according to a report from the Consumer Board. Rising 19.3 points to 109.7 from 90.4 it shows a strong rebound from consumers and was its fastest monthly rise in nearly 10 years. The survey also showed an improved outlook for employment. Separately, house prices have also risen another 11.1% from this time a year ago, up from a 10.1% rise previously according to the Case-Shiller index.

Indices: Wall Street divided, Europe leads the way

It was a mixed picture on Wall Street with the technology stocks leading the way lower whilst the Russell 2000 posted a minor gain. The S&P 500 was slightly lower yet remains above its 10-day eMA. It is the second indecision candle in a row which shows prices are coiling ahead of the long weekend and Friday’s Nonfarm payroll report. Consumer staples and information technology were the weakest sectors, and 259 (51.3%) stocks declined whilst 246 (48.7%) advanced.

It was a different vibe in Europe with the Euro STOXX and DAX hitting fresh record highs with conviction and the CAC probing the March high. The FTSE 100 accelerated away from its 10-day eMA to seven day high.

Australia’s ASX 200 rolled over from its highs yesterday after another failed attempt to break above 6850 the previous session. Queensland entering another lockdown for three days with the prospects of it being extended over the Easter break weighed on sentiment, and this played out nicely with our short bias in yesterday’s Asian open report. Still, SPI 200 futures are +41 points higher so ASX 200 is set to open around 6780.

Forex: The dollar continues to dominate

The US dollar index (DXY) rose 0.4% to its highest level since early November, closing the session above the 11th of November high in another show of bullish defiance. In turn this saw USD/CHF tap an 8-month high after finding support above the June 2020 lows and USD/JPY hit a fresh 1-year high.

- AUD/JPY closed the day with a bearish pinbar to warn of weakness at its six-day high. A break beneath yesterday’s low brings a bearish bias for the session although potential support at 83.30 remains due to the Marabuzo line previously mentioned.

- AUD/NZD fell to a 5-day low after printing a series of upper wicks (selling tails) around 1.0936 resistance. A potential target for counter-trend traders is the 1.0850 handle, just above the February high.

- AUD/CAD appears tempting to bearish swing traders with its bearish outside day / hammer, during its daily downtrend. A break below the 200-day eMA (0.9579) assumes bearish continuation.

- NZD/JPY produced a bearish hammer and closed on the 77.00 resistance. As mentioned in yesterday’s video, this is one to watch for a potential short should risk-appetite sour and strengthen the Japanese yen, given its strong bearish move lower mid-March and the break of its bullish trendline.

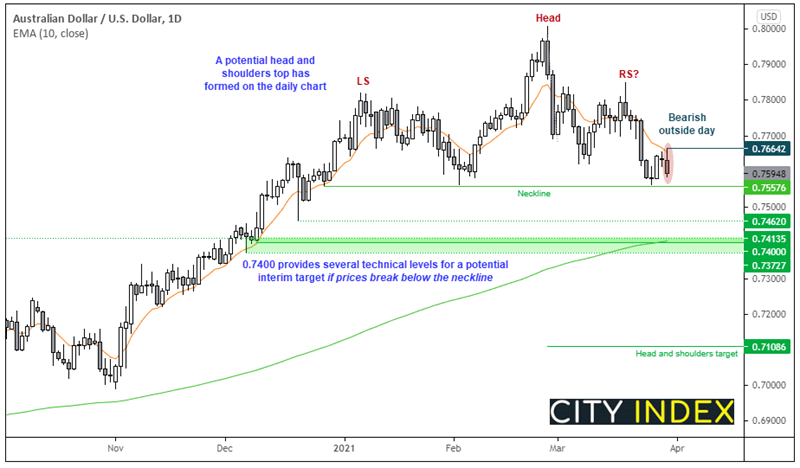

AUD/USD closes in on key support

Prices have held above 0.7557 support since December. Since then, prices have rallied to 80c (for all of five minutes) and created a lower high and a lower low. Whilst not ‘textbook perfect’ the daily chart is grinding out a bearish reversal pattern similar to a head and shoulders top pattern and its measured move from the 80c top to the neckline around 0.7557 projects a target just above 71c.

Whilst this target may be on the ambitious side for some, a clear break of 0.7557 would bring the 0.7462 low into focus, and/or technical levels around 0.7400 where the 200-day eMA resides.

As yesterday closed with a bearish outside day which was capped by the 10-day eMA, we suspect a retest of neckline support is on the cards.

- A break below 0.7557 could confirm a longer-term head and shoulders reversal pattern, with a target around 0.7100.

- Over the near-term, bears could target the lows around 0.7400 and 0.7462.

- The bias remains bearish beneath yesterday’s bearish outside day high at 0.7664.

Commodities: Oil prices continue to coil, gold bulls fold

Oil prices produced inside days yesterday’s and their second consecutive session of indecision, where prices move higher and lower yet settle the day near their opening prices. Given the volatility of last week then it's good to see the market pause for breath. But the coiling nature of price action this week means we may be approaching another burst of volatility.

Gold prices sliced through 1700 support with apparent ease as the strong dollar and higher real yields weighed on the precious metal. A break beneath 1670 would be a significant level for bears to conquer and could invoke a stronger sell-off, assuming large stops which likely reside beneath that support level get triggered.

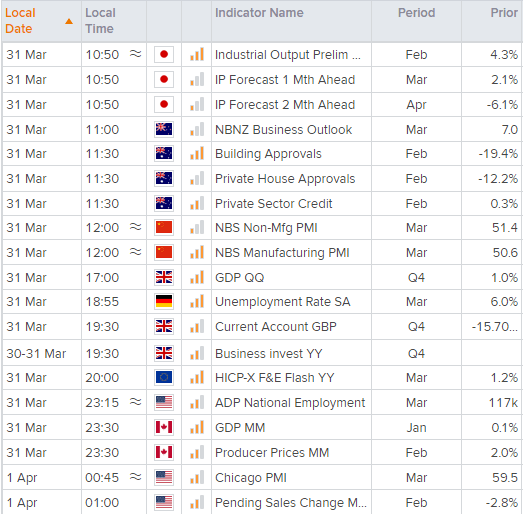

Up Next (Times in AEDT)

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here.

- It’s quite a busy calendar today across all regions. Whilst NBNZ business outlook is marked down as low priority on the calendar traders should note that RBNZ pay close attention to this report. So, any shift in sentiment are likely to be taken on board by the central bank.

- China PMI data puts AUD, NZD FX pairs into focus (strong data is usually bullish for the currencies).

- UK GDP is forecast to remain at 1%. A sudden contraction could therefore be GBP bearish.