With some calm restored to Wall Street overnight, attention today tuned to the release of Q2 NZ GDP and the Australian labour force report for August.

NZ avoids recession as GDP bounces back in Q2

Following a 0.2% contraction in Q1 as Omicron ripped through the country, the New Zealand economy bounced back in Q2, expanding by 1.7%, exceeding the market consensus for a 1% rise. The re-opening of international borders prompted a return of international tourists and strong gains across accommodation, dining, sports, and other recreational activities.

While the positive GDP print in Q2 means the NZ economy has avoided the technical definition of a recession (two consecutive negative quarters of GDP growth), it is a double-edged sword. The economy remains strong, and inflation is too high and will keep the RBNZ on track to deliver its fifth successive 50bp rate hike when it meets in October.

AU Unemployment Rate lifts to 3.5% - but still the lowest since 1974

The Australian unemployment rate climbed by 0.1% to 3.5% in August. The lift in the unemployment rate came about as a 33,500 rise in employment was not enough to offset a 0.2% rise in the participation rate to 66.6%.

The participation rate is 0.2% below the record high in June and 0.7% higher than before the pandemic. The underemployment rate decreased by 0.1 percentage points to 5.9 per cent. The underutilisation rate, which combines the unemployment and underemployment rates, remained at 9.4 per cent.

As noted yesterday, the strong jobs market was likely behind a lift in consumer confidence supported by lower petrol prices and the shock value of aggressive RBA rate hikes wearing off.

In this case, there is no reason for the RBA not to continue tightening further into the restrictive territory into yearend to tame spiralling inflation and to cool a tight labour market. The market sees the cash rate ending the year near 3.35%.

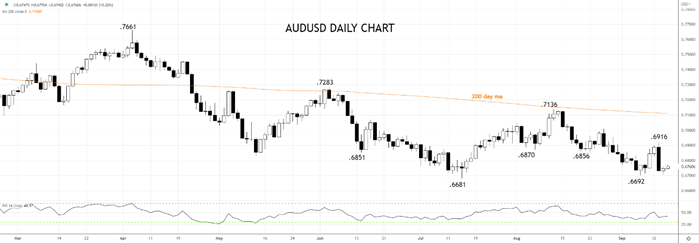

The AUDUSD has found some support as risk aversion eased overnight and, following the solid labour force report, to be trading at .6763.

Providing the AUDUSD holds above the band of support at .6700/.80, there is scope for the AUDUSD to recover back to .6850. However, should the AUDUSD see a sustained break and close below .6680, watch out below!!

Source Tradingview. The figures stated are as of September 15th, 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade