US Futures turn higher, watch LOW, TGT, MRNA, JNJ, URBN

In the afternoon will be released the minutes from the last FOMC meeting.

European indices are searching for a trend. The European Commission has posted final readings of April CPI at +0.3% (vs +0.4% on year expected). The U.K. Office for National Statistics has released April CPI at +0.8% (+0.9% on year expected) and April PPI at -0.7%, vs -0.5% expected.

Asian indices closed in a mixed mood. Japanese Nikkei, Australian ASX and Hong Kong HSI closed on the upside whereas Chinese CSI closed in the red. Japan's core machinery orders slid 0.4% on month in March (-6.7% expected). Australia's preliminary retail sales dropped 17.9% on month in April (+8.5% in March).

WTI Crude Oil Futures remain on the upside. The American Petroleum Institute (API) reported that U.S. crude oil stockpile fell 4.8 million barrels for week ended May 15. Later today, EIA will release crude oil inventories data for last week.

Gold rose 5.05 dollars (+0.29%) to 1750.1 dollars, still firm on weak global economic outlook.

The EUR/USD gained 18pips to 1.0941, still well oriented following the EU common fund proposal.

US Equity Snapshot

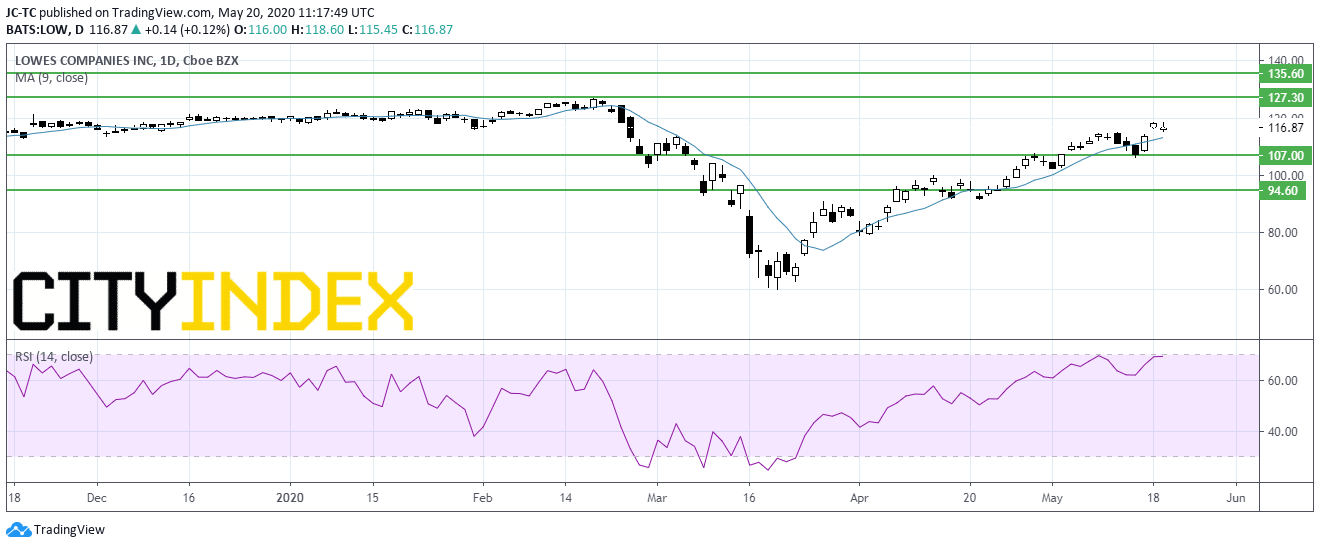

Lowe's (LOW), the second-largest home improvement retailer in the US, surged before hours after reporting first quarter adjusted EPS up 45% to 1.77 dollar. Comparable sales jumped 11.2%. Both figures beat estimates. Also, the company withdraws full year financial guidance.

Target (TGT), the retailer, unveiled first quarter comparable sales up 10.8% vs a 4.8% increase for the same period of last year. Digital sales jumped but the company saw also an increase in labor expenses and fewer sales of high-margin items.

Moderna (MRNA) lost ground in extended trading after STAT reported that vaccine experts say the biotech "didn’t produce data critical to assessing Covid-19 vaccine".

Johnson & Johnson (JNJ), the healthcare giant, announced the discontinuation of talc-based Johnson’s Baby Powder in U.S. and Canada.

Urban Outfitters (URBN), the clothing retailer, posted first quarter loss of 138.4 million dollars, or 1.41 dollar a share, vs a net income of 32.6 million dollars, or 0.31 dollar a share, a year earlier. Sales fell to 588.5 million dollars from 864.4 million dollars a year ago. Those figures missed estimates. The company warned second quarter comparable sales could decrease more than 60%.

Source : TradingVIEW, Gain Capital