Support centre

Get all the help you need to start trading with our dedicated FAQs and how-to guides to the markets, from understanding margin and leverage to navigating funding and withdrawals.

Here to help

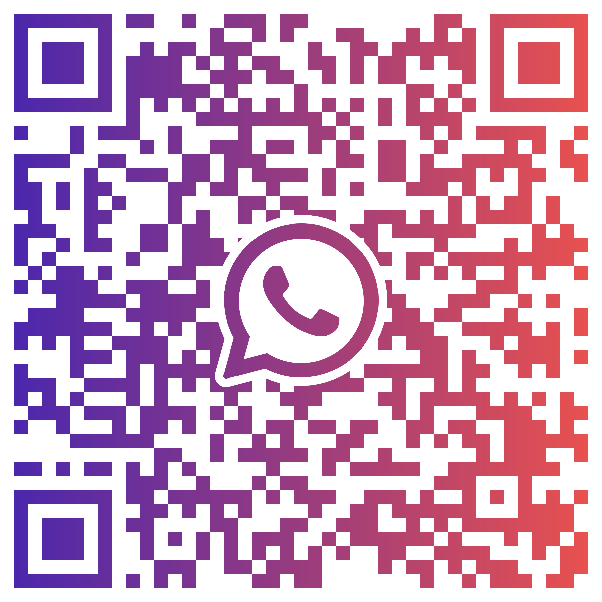

If you have any questions or queries about your City Index trading account, get in touch with a member of our support team who’ll be happy to help.