Popular instruments

Commodities explained

Is commodity trading good for beginners?

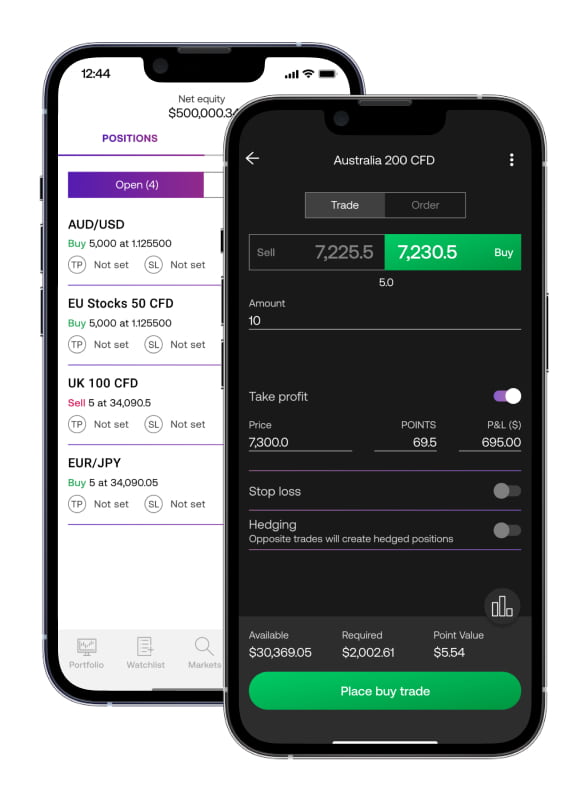

Commodity trading can be a good option for beginners, as long as you understand the risks involved and have a solid trading strategy in place. If you’re new to the markets, though, we’d recommend going through the City Index Academy and trying out trading risk-free in our free demo before opening a live account.

You can use your City Index demo to buy and sell our full range of markets, including commodities, with virtual capital. It’s a great way to see which asset classes are a good fit for you without risking any real capital.

How do I calculate how much margin I need to trade a commodity?

To work out how much margin you need to trade a commodity market, you divide the notional value of your position by its margin factor. Say, for example, that you want to open an oil position worth $5000 and oil has a margin factor of 10%. You’d need (10% of $5000) $500 as margin.

How you calculate the notional value of your trade depends on how you’re trading the commodity. With CFDs, it’s the number of contracts you’re trading multiplied by the value of each individual contract.

Learn more about how to trade commodities.

Can anyone trade commodities?

Anyone can trade commodities, as long as they meet the requirements to open a City Index account. Commodity trading is leveraged, though, which means it’s riskier than traditional investing. Learn more about the risks of CFD trading.

With City Index, you can trade commodities alongside stocks, indices, forex and more – all on a single platform with one login. All City Index clients get access to our full range of markets, including 25+ commodities.

To get started, open a trading account.