Technical analysis

Bollinger bands

What are Bollinger bands?

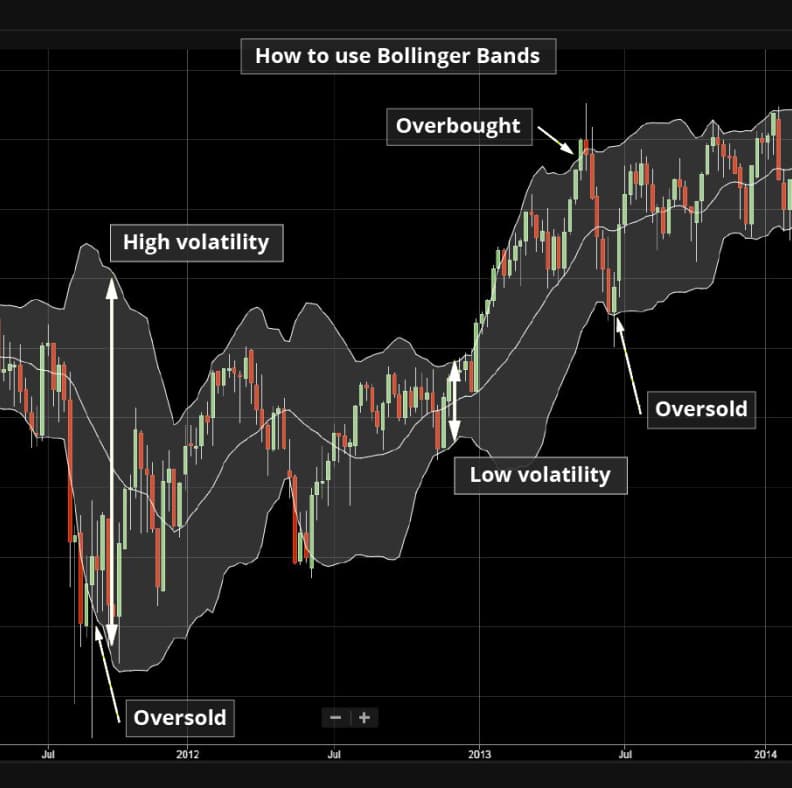

Bollinger bands forecast the potential high and low prices for a market relative to the moving average. They help traders visualise volatility and determine when a trend may continue or reverse.

An upper band is created above the moving average and a lower band below the moving average. The bands widen during volatile periods and contract during non-volatile periods.

You can overlay Bollinger bands directly onto charts in our advanced Advantage Web platform as well as on our mobile apps.

How to use Bollinger bands

Bollinger bands consist of three bands:

-

The middle band

Calculated on the average price of an instrument over a specific time period -

The upper band

Uses the middle band plus two standard deviations; a standard deviation measures how close prices are to the average -

The lower band

Also uses the middle band, minus two standard deviations

Which signals to look for

During normal market conditions, the bands usually appear to move in a synchronous pattern, but you can use them to view market volatility.

- If the distance between the bands is tight, it indicates low volatility in the market.

- If the distance between the bands is wide, it shows high volatility in the market.

When price movements closely follow the middle band, traders consider the instrument to be trading within its average.

Trading signals

These bands are continually changing based on the real-time price movements of the instrument and traders read the bands in a number of different ways.

When price moves are close to the upper band, the current price of the instrument is considered high relative to recent prices. If they cross the upper band, traders consider the instrument to be overbought.

When price moves are close to the lower band, the current price is considered low relative to recent prices. If they cross the lower band, traders consider the instrument to be oversold.

When price movements closely follow the middle band, traders consider the instrument to be trading within its average.

Choosing the right timeframe

Bollinger bands can be used on multiple timeframes, ranging from minutes, hours, days and weeks. The common time frames are daily for short term traders and weekly for longer term traders.

Which type of trader are Bollinger bands suitable for?

This indicator could be useful for traders who are seeking to find trend reversals when either the upper or lower channels of the Bollinger bands have been reached. The reversals can last from short to longer periods of time, and can therefore be used for all types of traders who may consider intraday trading to position trading.