Trading with City Index

Guide to short selling

Traditionally, investors could only profit from markets that went up in value. Trading CFDs however provides the opportunity to go short on financial markets, giving you more flexibility over how you choose to trade.

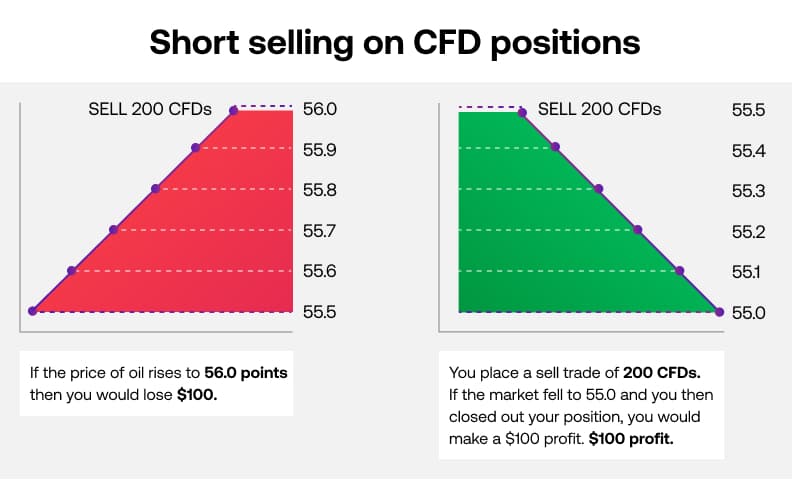

Example

If you think the price of oil is going to go down then you might place a sell trade of 5 CFDs. If the market fell 30 points and you then closed out your position, you would make a $150 profit, 30 times the 5 contracts that you bought.

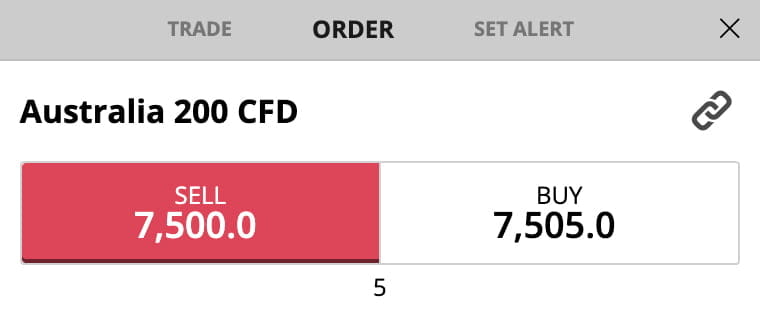

What does short selling mean in practice?

Every market on the City Index platform has a sell order button. This is not just there to sell an existing position – you can also open a sell order to create a short trade on the market if you think that market is going to go down.

To close a short trade, you need to close it by placing a buy order. You are instructing the trading platform to go long on the market, which closes your short position. Think of it like the exact opposite of placing a buy order, and closing it with a sell order.

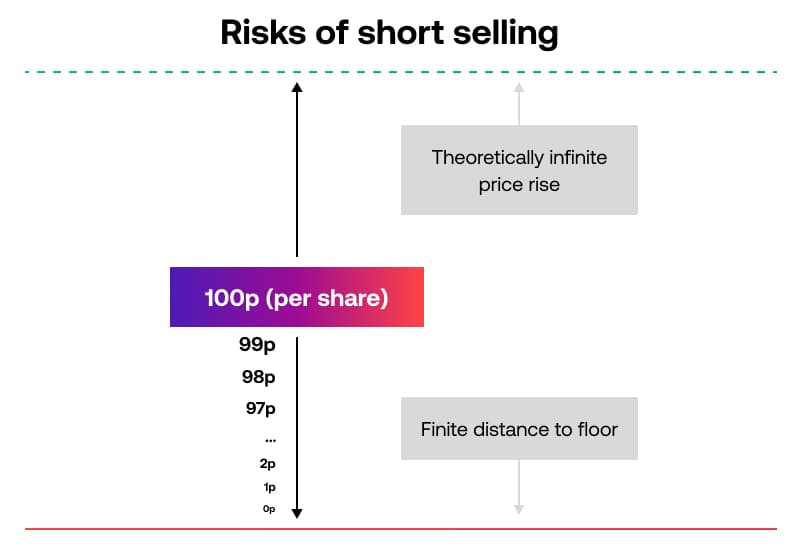

The risk of shorting

The risk with shorting is that while a price has a finite distance to travel to zero, theoretically speaking it has scope for infinite losses. You need to be especially careful when shorting individual shares, as share prices can 'gap' suddenly. A losing position here, when you end up on the wrong side of a short trade, could amount to a substantial loss.

Example

Let's say you are short the price of the shares of a company that has been struggling. With a share price at 100 cents you know that the maximum amount that that share price could continue to fall to is zero.

However, news then breaks that another company is interested in buying it – the price could climb well beyond 200 cents in a day. Remember, the value of the shares is essentially the price someone is prepared to pay for them and while this number can fluctuate, it is more immediately obvious how far the current price would have to fall to reach the floor.

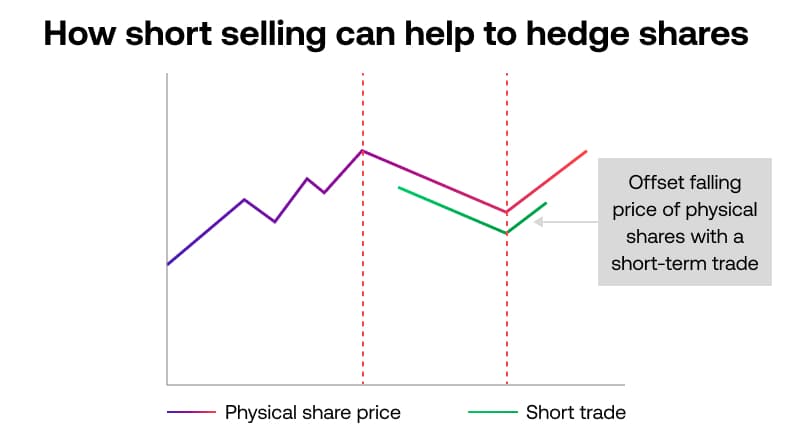

How short selling can help to hedge shares

Short trades are also a means of hedging investments in other markets or even, if you choose, physical shares. A short trade made at the same time as a long position in the physical share market can help to reduce losses you might incur.

This is because if your physical shares are falling in value, a short trade position will simultaneously rise in value, therefore reducing your total loss.

Did you know?

With currency positions, because you are trading one currency against another, one half of your trade is going to be losing value. However if you go short on a currency pair, you are expecting that the second (quote) currency is going to lose value against the currency on the left.