Trading Strategies

Options trading strategies

Strangles and straddles are popular trading strategies with clients who are looking to trade volatility rather than the direction of the market.

Both strategies involve buying an equal number of call and put options with the same expiration date. The difference is that a straddle has one common strike price whereas a strangle has two different strike prices.

Strategy 1: Straddle

A straddle is a strategy that involves the simultaneous buying of a call and put option with the same strike price and expiration date.

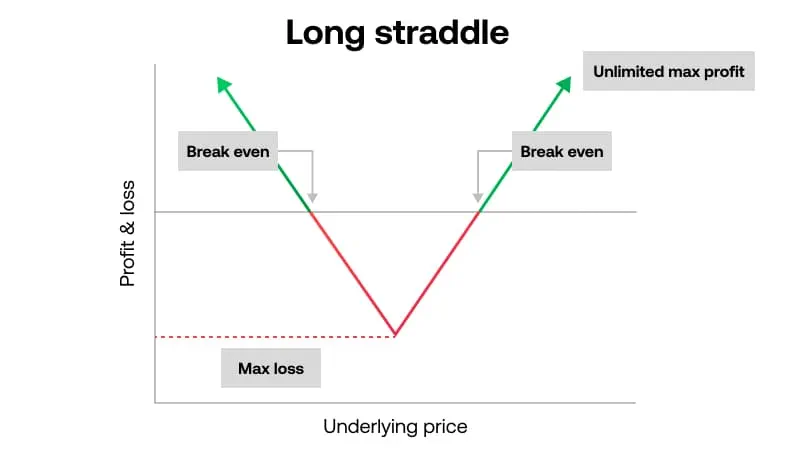

Long straddle (buying a straddle)

- A long straddle is created by purchasing a put and a call option on the same underlying security with the same strike prices and expiry dates.

- Typically, an investor will buy a straddle if he or she thinks the market will be volatile but is unsure of the direction the market will take

- You would make a profit if the underlying price moves, either up or down, by more than the premium you paid for the strategy.

- In the right market conditions, being long a straddle can potentially be very rewarding.

- Losses are limited to the premium paid for the two options and so the straddle has what is known as ‘limited risk’.

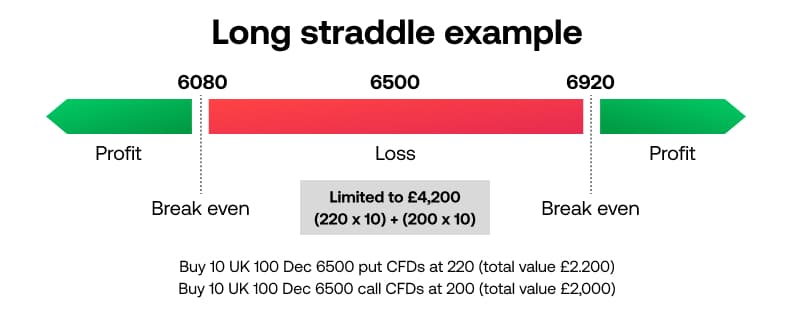

Example:

Let’s say you:

Buy 10 UK 100 Dec 6500 put CFDs at 220 (total value £2,200)

Buy 10 UK 100 Dec 6500 call CFDs at 200 (total value £2,000)

Best-case scenario:

If the UK 100 falls well below 6080 or rallies well above 6920, you will make a profit for every point that the UK 100 expires below 6080 or above 6920.

Break-even points:

You’ll break even if the UK 100 expires at 6080 (220+200 points below 6500) or at 6920 (220+200 points above 6500) on the expiry date.

Worst-case scenario:

If the UK 100 expires at 6500 on the expiry date, your loss will be limited to £4,200 (220 x 10) + (200 x 10).

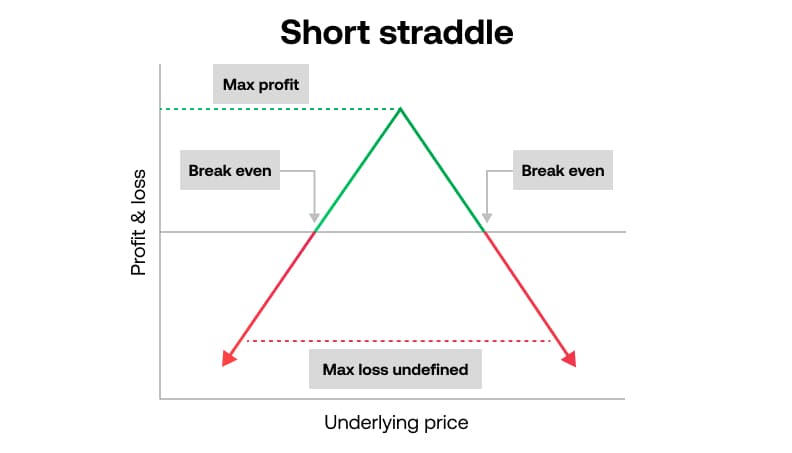

Short straddle (selling a straddle)

- A short straddle is the sale of both a put and a call option on the same underlying security with the same strike prices and the same expiry dates.

- Typically, this strategy is used by clients to profit in low volatility markets.

- Positions can be closed before the expiry date. An investor might sell a straddle in a range-bound market or if he expects a market to stay at current levels.

- You could make a profit at expiry if the market stays within a range based on the premium received from the straddle.

- Profits are limited to the premium of the straddle while losses can potentially be considerable.

Strategy 2: Strangle

A strangle involves buying an equal number of put and call options with different strike prices.

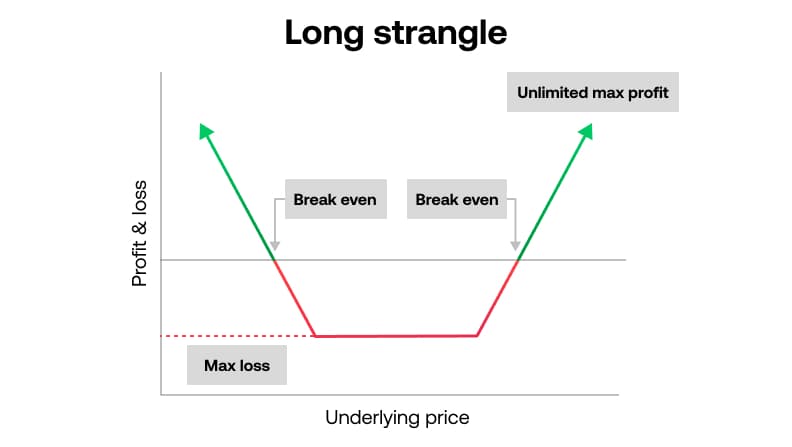

Long strangles (buying a strangle)

- Long strangles are created by purchasing a low-strike put option and a high-strike call option on the same underlying security with the same expiry dates.

- A client who owns a strangle can profit if the market is volatile and moves by more than a certain amount in either direction.

- The profit is potentially considerable while the maximum loss is known at the time the trade is executed and will be equal to the total premium paid for the two options.

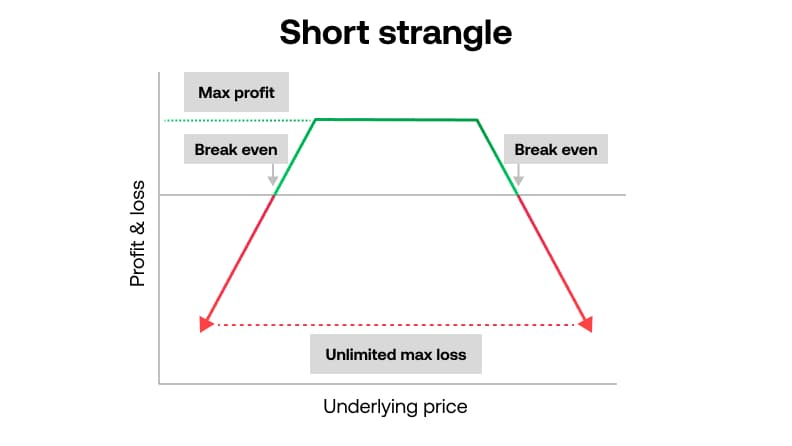

Short strangle (selling a strangle)

- Short strangles involve the sale of a low strike put option and a high strike call option on the same underlying security with the same expiry dates.

- Short strangles are popular with clients, because they allow you to potentially profit when market volatility is low and in a range-bound market.

- However, your profits are limited to the premium of the strangle and losses are potentially unlimited.

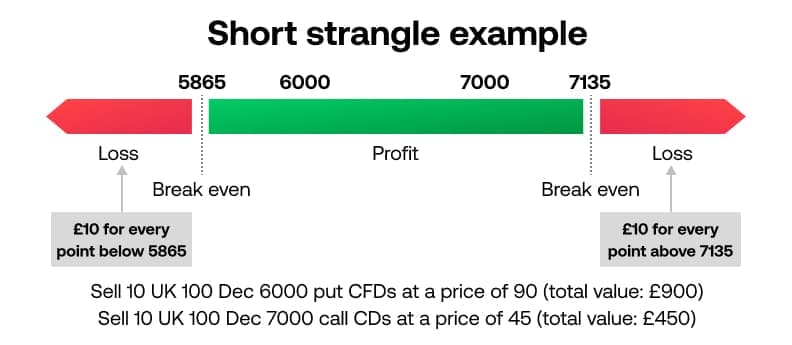

Example of a short strangle

Let’s imagine you:

Sell 10 UK 100 Dec 6000 put option CFDs at a price of 90 (total value: £900)

Sell 10 UK 100 Dec 7000 call options at a price of 45 (total value: £450)

Best-case scenario:

If the UK 100 expires between 6000 and 7000 on the expiry date, you could make a profit of £1,350 (90 x 10) + (45 x 10).

Break-even points:

You’ll break even if the UK 100 expires at 5865 (90 + 45 points below 6000) or at 7135 (90 + 45 points above 7000) on the expiry date.

Worst-case scenario:

If the UK 100 falls well below 5865 or rallies well above 7135, your loss will be equal to £10 for every point that the UK 100 expires below 5865 or above 7135.

For example, if the UK 100 expires at 5700, your loss will be £1,650 ([6000 - 5700] x 10 [90 + 45] x 10 CFDs).

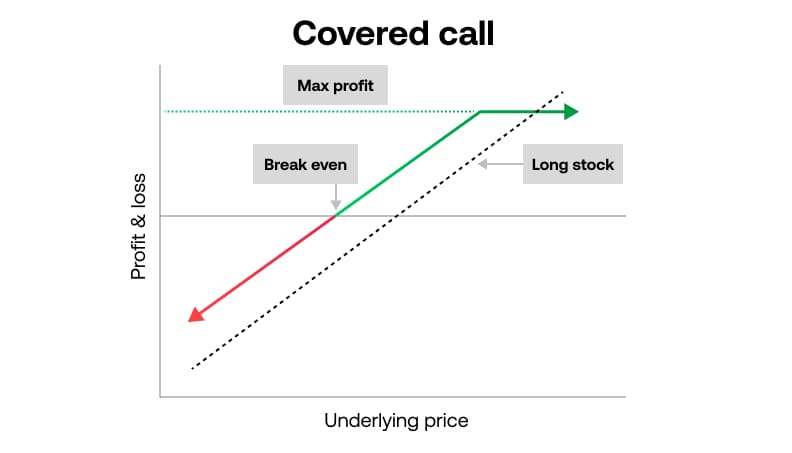

Strategy 3: Covered call

- This is a strategy where you already own the underlying instrument. If you believe the underlying instrument will stay the same, or you’re happy to sell it if the price increases, then you could sell a call option against it.

- If the price of the underlying instrument stays the same or increases, the covered call strategy will give you a profit equal to the premium (price x stake) of the call option.

- At the same time, if the underlying instrument falls in price and you have decided to use a covered call, you will have limited your potential losses.