Technical analysis

Support and resistance

What is support?

There are times when markets will fluctuate between one price level to another and this is referred to as support and resistance.

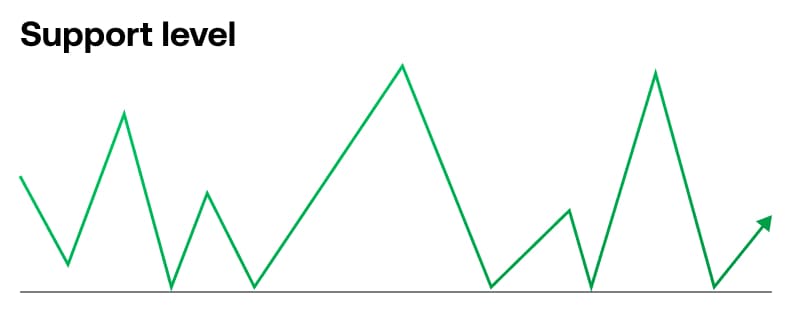

Assume a market has been rising during an uptrend and reaches a point where it reverses and declines to a level where it holds its price without falling lower. This level where it fails to break through on the downside is known as the 'support level'.

The support level is a price level where the sellers are unable to drive prices any lower and where buyers may feel that it is the right price to buy and expect higher prices.

Support levels can be tested several times before traders become confident that prices will hold at this level before moving higher. Support levels can also last from a short-term timeframe to a longer term timeframe and are sometimes referred to as a base or floor.

During a bull market, support levels become higher as each decline or corrective price move takes place.

What is resistance?

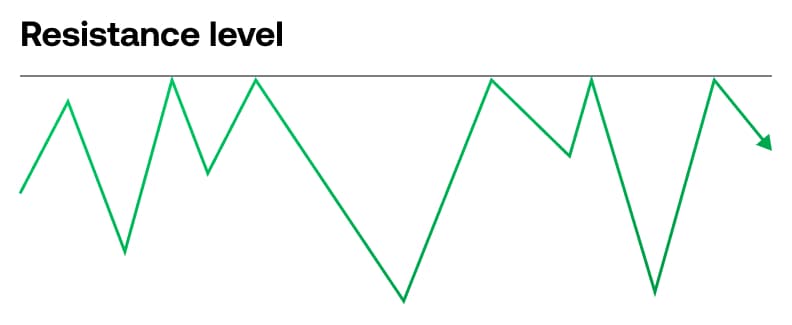

When a market has been moving higher and stops at a certain price level where it is unable to move any higher, this is known as the 'resistance level'.

At this point the sellers enter the market to drive prices lower. The buyers feel that the market may have reached a point of exhaustion and decide to take profits. With a lack of buyers and more sellers at hand, the price reverses and moves lower.

Like support levels, the resistance levels may also be tested several times over a period of time. The resistance level is sometimes referred to as the ceiling.

In a bear market where prices fall and attempt to rally, the resistance levels would be lower on each attempt to move higher.

Buying at support and selling at resistance

Traders looking to enter a trade often use support and resistance levels as a point of entry and exit.

A simple example is when a market has reached a price level where it is unable to fall any further; a trader may look to buy on the second or subsequent attempts, assuming that the market may have reached a point of exhaustion on the downside and may not fall any lower. Remember, this is not guaranteed and markets can be affected by a variety of factors.

If a market is attempting to move higher but fails each time it reaches the same price level, traders may step in and short the market, expecting markets to fall lower.

A buyer at support may use higher resistance levels to exit their trade and a seller at resistance levels may use lower support levels to exit their short positions.

Support and resistance levels are important price levels in all markets and all time frames. These price points should be respected as key levels.

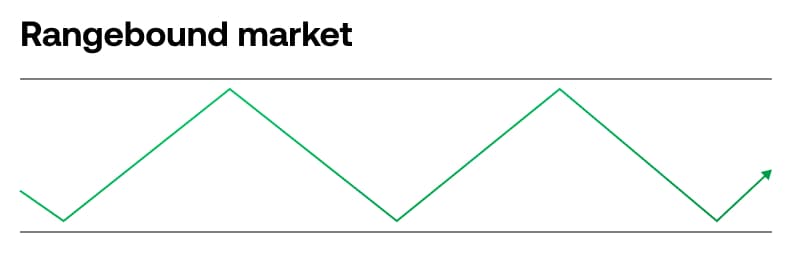

Range-bound markets

Sometimes you will hear a market described as 'range-bound'; this means the price is moving consistently between support and resistance levels, i.e. within a specific range.