Introduction to financial markets

Trading indices

An index measures the collective price performance of a group of Shares, usually from a particular country. Indices are often used to track and compare the performance of stock markets.

The performance of each index is dictated by the performance of the underlying share prices that make up that index. An index is constructed and calculated independently, sometimes by a bank or by a specialist index provider like ASX Limited. The choice of the companies included in the index is determined by index calculation rules or by a committee. Not all indices use the same rules, however.

DNA of a stock market index

Price-weighted indices

The index is calculated by adding together the share price of each stock in the index which is then divided by the number of stocks in that index. Higher priced stocks exert more influence on the performance of the index. The Dow Jones Industrial Average is an example of a price weighted index.

Market capitalisation weighted indices

The index is calculated by adding up the market capitalisation of each stock and then dividing by the amount of companies. Larger companies with a higher market cap will exert more influence on the performance of the index. The ASX 200 is an example.

Composite indices

Composite indices provide a statistical measure of a market or sector’s performance over time. They are useful for measuring an investor’s portfolio performance. They may be price-weighted or market capitalisation weighted. The NASDAQ is an example of a composite index as it measures the performance of an index that is heavily weighted towards technology stocks.

Not all companies in an index are created equal

The composition of an index will change from time to time, based on the rules the index calculator has established. Some companies can be given a larger weighting than others. This means they make up more of the index, and their share price will have more influence over the performance of the index.

Consider for each index:

- Which companies are included

What are the rules for companies to be added or removed? - How often is the index changed?

This is sometimes referred to as rebalancing; some companies will be removed and others added on a periodic basis. - What area of the market is covered?

Not all indices cover the largest stocks, some, like the FTSE 350 and the Russell 2000, are calculated to measure the performance of smaller companies.

The price of an index is changing all the time, as the prices of the underlying shares change.

Benchmark indices

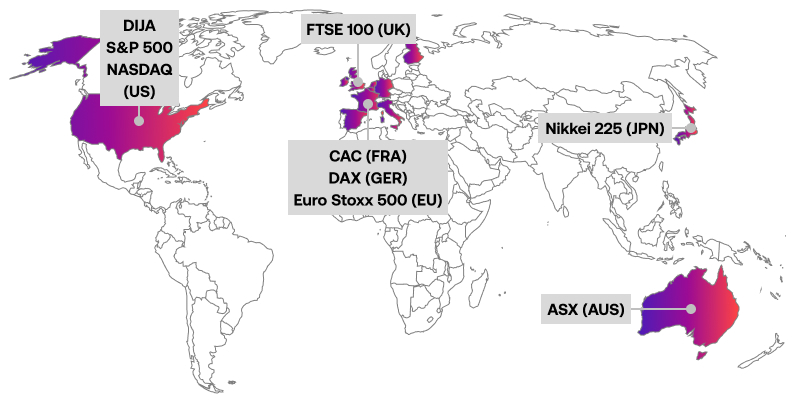

Sometimes you will hear journalists and analysts refer to a market’s benchmark index – this is the index most commonly used to track where a particular market is heading. A few of the main ones include:

- ASX – the benchmark index for the Australian stock market is the ASX 200, which follows the prices of the 200 largest companies listed on the Australian Stock Exchange, ranked by market capitalisation.

- The Dow – the Dow Jones Industrial Average, the original stock market index, was created by Charles Dow in 1884. It follows the price of the 30 biggest companies on the New York Stock Exchange.

- Standard & Poor’s 500 (S&P 500) – this is the most widely tracked measure of the US stock market. It tracks the prices of the biggest 500 companies listed on the New York Stock Exchange and the NASDAQ.

- FTSE 100 – launched in 1984, the FTSE tracks the prices of the biggest companies by market capitalisation listed on the London Stock Exchange.

- Nikkei 225 – this is the main stock market index for Japan, tracking the shares of 225 companies listed on the Tokyo Stock Exchange.

- Euro Stoxx 500 – this index was created to follow the prices of the biggest 50 shares in the Eurozone countries.

- DAX – founded in 1988, the DAX follows the shares of the largest 30 companies listed on the Frankfurt Stock Exchange.

- CAC – tracks the largest 40 companies listed on the Paris bourse.

What moves indices?

Indices tend to be affected by broader market moves which affect the price of many companies. Typical examples include:

- Political unrest or uncertainty

- Economic data – e.g. inflation statistics or unemployment numbers

- Changes to interest rates

- Good or bad news affecting several big companies in the same industry– e.g. mining or banking

- The performance of the shares within that index

Start trading indices with City Index

- At City Index we provide a wide range of global indices

- We use our own names for the major indices – for example, we call the ASX 200 the AU 200 and we refer to the FTSE 100 as the UK 100

- Find out more about our index spreads and pricing