Forex trading

Types of forex trades

At City Index we offer different ways to trade FX:

- CFD trade

- Spot FX trade

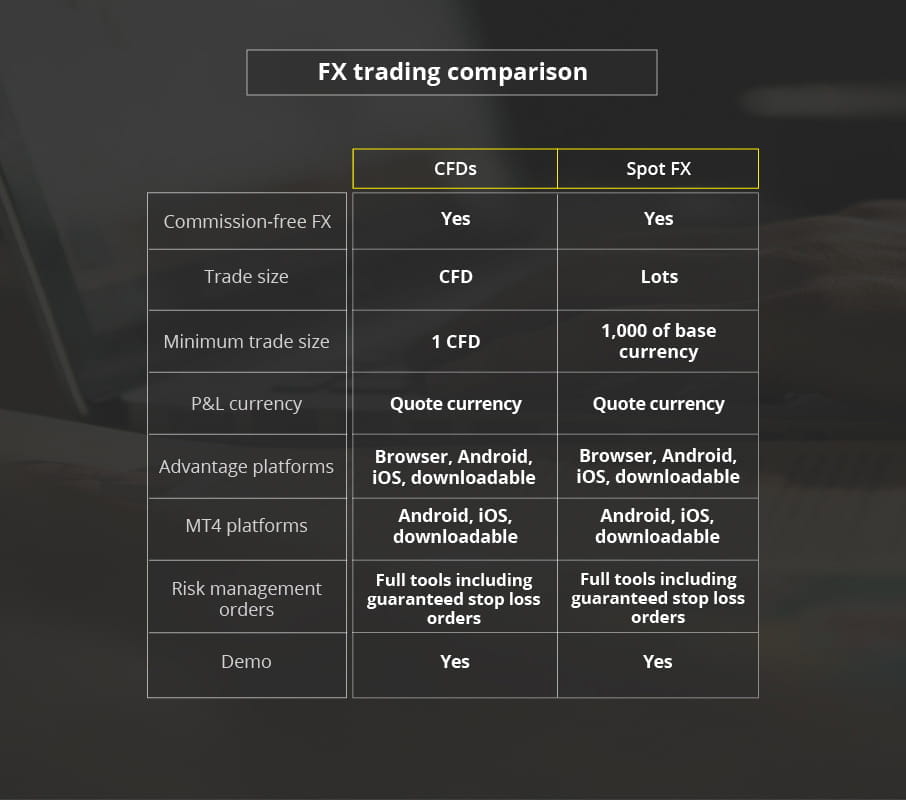

The fundamentals of FX trading through CFDs and spot FX trading are in fact very similar, but there are some key differences. This section looks at those similarities and differences so that you can decide which is the most appropriate way for you to trade FX.

Key similarities

- Leverage:

All forms of FX trading at City Index benefit from being traded on margin. - Stop losses & guaranteed stop losses:

These are available to both products - Range of currency pairs & margin factor:

We offer over 84 currency pairs and the margin factor is the same for each pair regardless of whether the currency pair is being traded as a CFD or as spot FX - Commission free:

There are no commission charges when trading FX as a CFD trade or as a spot FX trade - Trading platform:

You can gain access to browser-based and downloadable platforms as well as native mobile and tablet trading platforms. Learn more about our trading platforms in our platform section

Key differences

- City Index MT4:

One of the most popular forex trading platforms today and fully compatible with expert advisors, available for spot FX trading only - Trade Sizes:

Trade sizes differ across CFDs and forex trading. When trading CFDs you buy a number of CFDs. With spot FX trading you buy lots in units of the base currency - P&L currency:

Both CFDs and spot FX trading have the p&l calculated (and denominated) in the quote currency

Examples of CFD trading and Forex trading

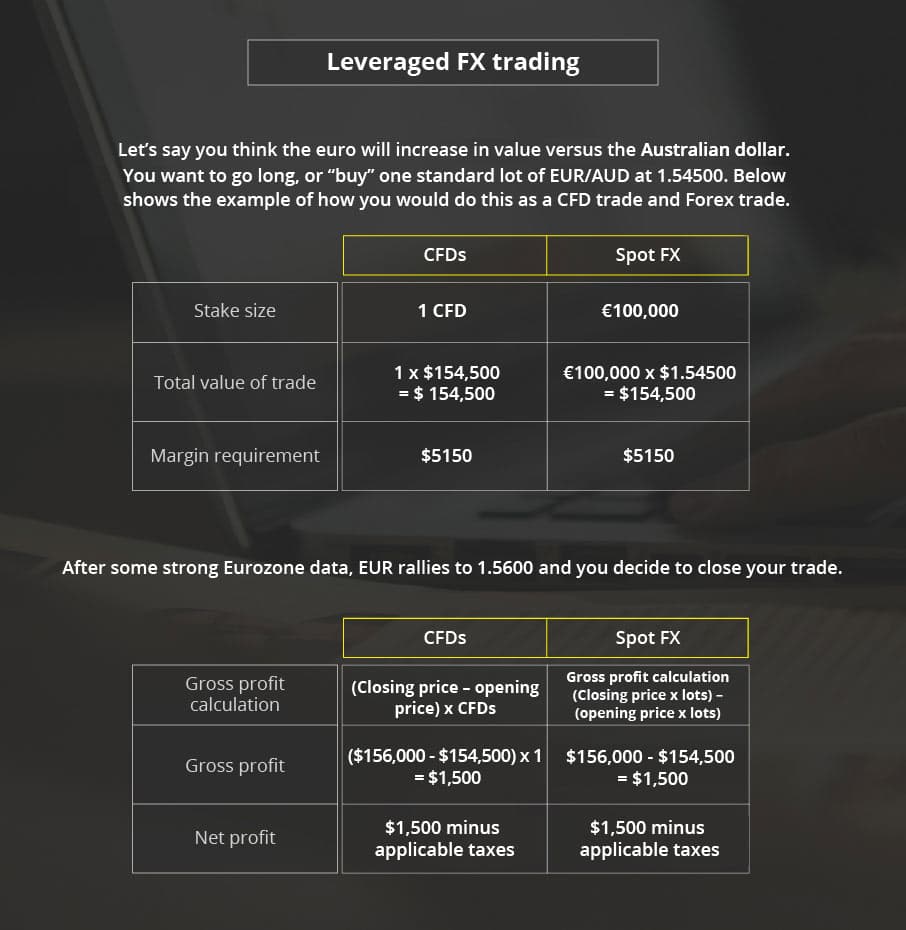

Let’s say you think the euro will increase in value versus the Australian dollar. You want to go long, or ‘buy’ one standard lot of EUR /AUD at 1.54500. Below shows the example of how you would do this as a CFD and forex trade.

Should you hold a position overnight, there will be an overnight financing adjustment. We use swap points to calculate the daily overnight financing adjustment amount for FX pairs.