CFD trading

Costs of CFD trading

Commission charges

CFD trades on indices, currencies, commodities, and bonds are commission free however trading share CFDs is subject to commission charges on opening and closing the trade. The commission charge is based on the overall value of the trade.

The charges vary by market and details can be found under the market information sheets in the platform. There is also a minimum commission charge in place.

For most equities, the commission charges are as follow:

| UK | European | US | Asian | |

|---|---|---|---|---|

| Commission | 0.1% | 0.1% | 0.15% | 0.2% |

| Minimum | £10 | €25 | $25 |

Example

Spread

City Index quote a two way price on all our markets, the bid price at which you can sell and the offer price at which you can buy.

The spread is the difference between the sell and the buy price and is in effect your cost of trading the market.

The tighter the spread, the quicker the trade can potentially move into profit earning territory.

CFD trades on indices, currencies, commodities, and bonds are commission free.

Overnight financing

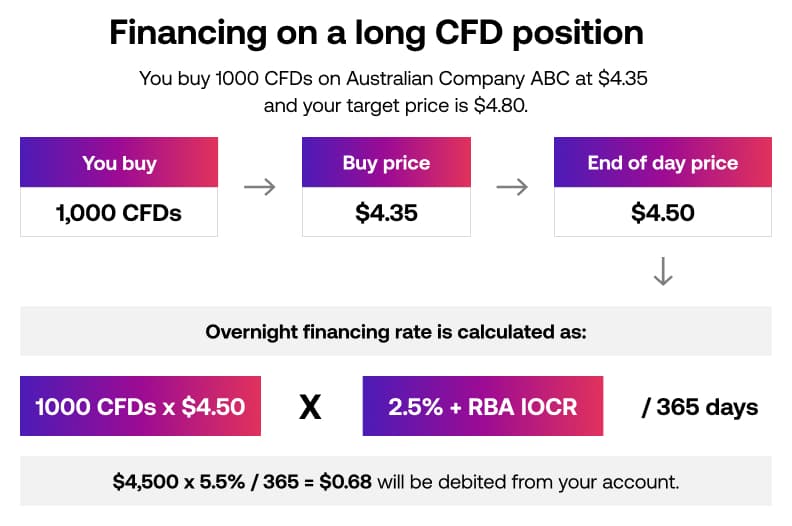

Financing is a fee that you pay or receive to hold a trading position overnight on CFD trades that have no set expiry date.

It is an interest payment to cover the cost of the leverage that you use overnight. These charges are competitive in order to keep your trading costs low.

There is no financing charge for CFDs with expiry dates. These contracts have wider spreads as the cost of carry (financing charge) has been incorporated into the price.

Financing charges reflect the cost of borrowing or lending the underlying asset and are charged at AUD Deposit Rate (or equivalent base rate of instrument) +2.5% on long positions. You will alternatively receive AUD Deposit Rate -2.5% on short positions.

However, there may be instances when a daily financing fee is charged to you on short positions, rather than paid to you if the underlying base rate is at an particularly low rate.

For example you decided to go long 3 CFDs on the UK 100 at 7310. The trade is doing well and the price has increased to 7340 at the end of the day. However, it is still some way from your target price of 7380. You decide to keep the trade open overnight.

The overnight financing is calculated as:

You must have sufficient funds in your account to cover both your open positions and any financing charges you may incur or your position could be closed out.

The daily financing fee will be applied to your account each day that you hold an open position (including weekend days).

Guaranteed stop loss orders

There is no charge for placing standard orders such as stops and limits. There is, however, a charge when you place a guaranteed stop loss order (GSLO).

These are charged upon trigger of your GSLO and are non-refundable.

Please note, GSLOs are only available on certain markets and the charges associated with them vary. Please see the relevant Market Information sheet on the trading platform for full details.

Rolling CFD futures

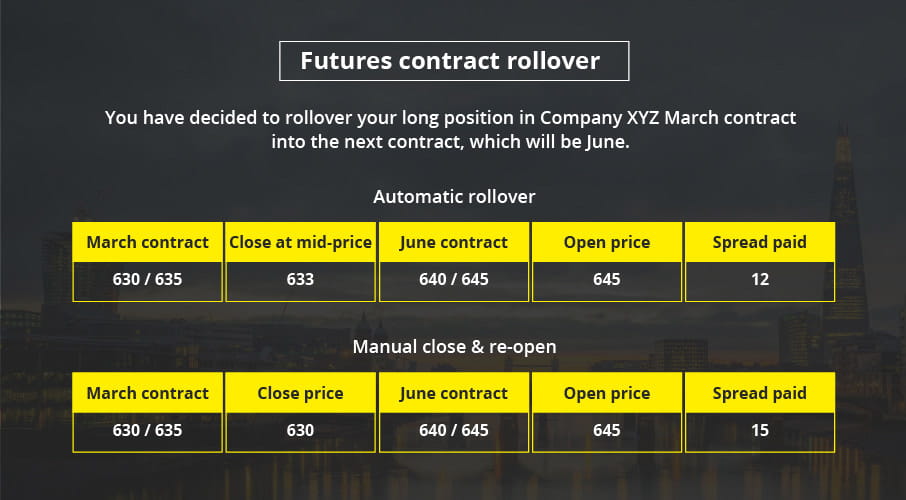

When futures contracts are near to expiry, you can, if you wish, roll your trade into the following contract.

You can do this by selecting the auto–roll tick box in the order ticket. You pay half the spread to carry out this transaction. If you’re going long, your position will be closed at the mid-price and re-opened in the next contract at the buy price.

If you’re going short, your position will be closed at the mid-price and opened again at the sell price in the following month.

It’s cheaper to roll over to the next contract than to close the trade yourself and then reopen it. This is because when closing and opening a trade manually, you pay the full spread, whereas by "rolling over" you pay just half.

For example, you have decided to roll over your long March CFD position in Company XYZ into the next contract.

At the time of the rollover the March price is 630 / 635 and the June price is 640 / 645. Your long CFD position is closed at the March mid-price of 633 and then automatically reopened at the June buy price of 645.

Any P&L as a result of a Futures contract trade is registered on your account automatically.

Had you closed the trade yourself, you would have closed at 630, before re opening at 645, therefore paying a wider spread.