What determines oil prices?

Global oil prices are determined by the forces of supply and demand, according to the model of price determination in microeconomics. Supply is controlled by the production rate of the raw material while demand is highly dependent on global macroeconomic conditions.

However, it’s actually not quite as simple as that.

Oil markets themselves are not typically composed, as they once were, of individuals who need to buy or sell the raw material to make their refineries or factories turn a profit. In fact, the majority of people involved in the market are speculators and traders who are betting on price moves – and hedgers already active in oil trading who are limiting exposure risk.

How hedgers and speculators affect oil prices

These speculators and hedgers trade oil futures, speculating on where the oil price is headed next, instead of its value today.

As a result, oil prices are frequently heavily influenced by those traders’ perceptions of the future supply and demand of oil.

This is not unusual in modern financial markets: consider how a company’s stock might start falling even on the same day that it posts impressive results. This may be because investors may have expected those impressive results and are instead looking at future factors that may impact that company’s long-term performance.

Exactly the same principle applies to oil, where expected future supply and demand factors tend to influence current pricing.

Oil is frequently regarded as one of the most volatile commodities, but it is also one of the most economically mature. Major geopolitical events and natural crises can trigger major price swings, but on a day-to-day basis traders are still basing their bids on their perceptions of supply and demand.

Oil supply

Oil’s supply is dictated by how much crude is being drilled at any given time, plus how quickly refineries can turn it into usable oil. And there’s one organisation that’s synonymous with the first half of that equation: OPEC.

What is OPEC?

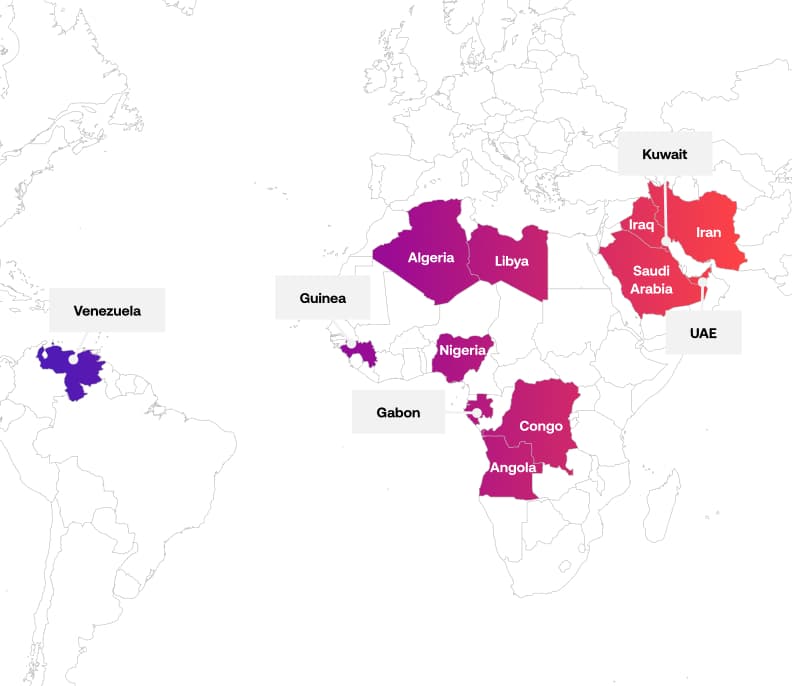

OPEC (or the Organization of the Petroleum Exporting Countries) is an intergovernmental consortium of 13 nations, founded in 1960 by its first five members: Iran, Iraq, Kuwait, Saudi Arabia and Venezuela.

According to data collected by Statista in September 2020, OPEC’s share of global crude oil reserves sits at 79.1%.

OPEC essentially acts as a cartel, attempting to coordinate supply to control oil prices. It is in the organisation’s interests to try to keep the price of oil relatively high in order to maximise profitability.

To achieve this, OPEC will on occasion cut the supply of oil so prices rise. This is a strategic tactic that needs to be carefully deployed. Why? Because a long-term reduction in supply would mean reduced revenues for OPEC’s member countries.

Predicting what OPEC will do next can be a boon when trading oil. But as we’ll see later on, its actions aren’t always easy to follow.

Supply shocks

Oil is hugely important to the global economy, but its supply infrastructure is surprisingly fragile.

Political upheaval, natural disasters and inclement weather can all see the world’s access to oil suddenly restricted. Oil pipelines may break, new governments may impose supply limitations or war may mean drilling ceases entirely.

Even the threat of turmoil in a major oil region can often see futures prices rocket.

Refinery capacity

One often overlooked factor that can have a significant impact on oil’s price is refinery capacity.

Sky-high production levels may not cause rock-bottom prices if refinery capacity keeps supply limited. Many refineries operate with excess capacity when demand doesn’t meet production, maintaining prices while they wait for demand levels to recover.

Global oil demand

As ever on financial markets, supply’s counterpoint is demand. When global demand for oil diminishes, producers are met with a dilemma. If they maintain production, prices will fall. But if they cut supply, another player might eat up their market share.

Let’s examine three factors that often dictate demand for oil: the economy, US dollar and oil alternatives.

Economic performance

Oil is often referred as the ‘building block of the global economy’. Industry revolves around it, it powers most transportation and even provides the basis for many vital materials, including plastics.

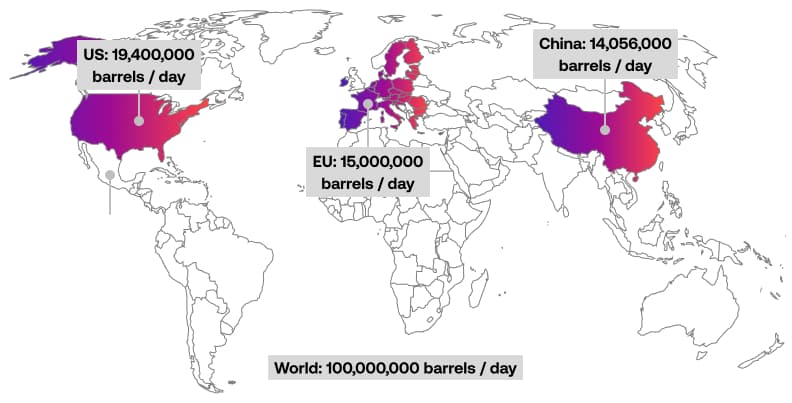

It’s no surprise, then, that global economic performance has a strong correlation with oil prices. When major economic powerhouses like the US, China and Europe are booming, oil demand rises and its price tends to follow. In fallow times, oil can tumble.

The US dollar

Like all commodities, oil is priced in US dollars, which gives it a negative correlation with USD.

Say that a barrel of oil is priced at $100. When the US dollar is strong, that $100 is worth more – making oil more expensive. When USD is weak, on the other hand, oil is comparatively cheap.

This means that oil demand tends to fall off when USD gains strength. All things being equal, oil’s price will then fall, making it worth roughly the same as it was before.

Alternatives to oil

The issues associated with the global economy’s reliance on oil are well known.

The world is moving away from fossil fuels and towards renewable energy. In 2020, almost a third of all electricity was generated using renewable sources. As take up of ‘green’ energy picks up, demand for oil should drop. If supply doesn’t drop at the same rate, oil’s price will fall.

However, the biggest disruptor to oil demand in recent years hasn’t been renewable at all – it’s been US shale.

Drilling for ‘shale’ oil has enabled the US – the world’s biggest consumer of oil – to reduce its reliance on OPEC in recent years. It is no longer just the biggest oil consumer in the world; it is also the biggest producer.

Perhaps unsurprisingly, this has had a huge impact on oil markets. Here’s a quick rundown of some recent history to explain how.

Oil price history

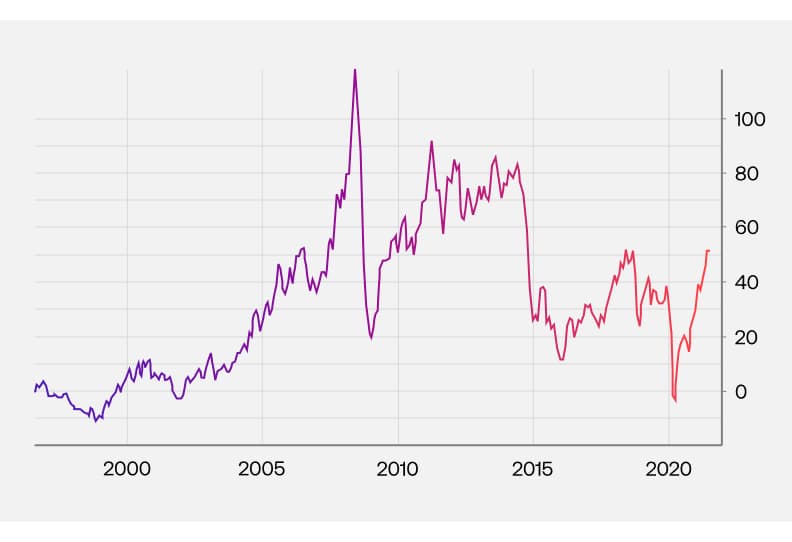

From 1999 to 2008, crude oil rose from under $25 per barrel to more than $160 per barrel as thriving economies like China and India drove an increase in demand.

This period was followed by a severe recession, sparked by the financial crisis of 2007-08. A key by-product was diminished demand for energy, and oil prices moved steeply downwards.

The recovery was swift, with prices jumping 78% in 2009 and continuing to rise in each of the next two years. It was this recovery that created the right conditions for the mining of shale oil in North America and elsewhere – and partly led to a brand-new oil price crash.

In 2014, the price of oil tumbled by 46% and it fell by a further 31% the following year.

Why oil prices dropped in 2014

Between 2011 and 2014, US shale oil production multiplied by a factor of five to around 4.8 million barrels per day. This increase in production was enough to create an oil glut – with production outstripping demand.

US demand for oil exports fell, and crude flooded the market. But Saudi Arabia, a key member of OPEC with one of the world’s biggest oil reserves, opted to maintain steady production instead of cutting supply to grow prices.

Why? Because if they cut oil production, they’d cede their market share.

Two other factors created a perfect storm for oil prices:

- The US dollar grew massively after the Fed decided to cut back QE measures, building price pressure on commodities

- Chinese industrial growth finally showed signs of slowing down, diminishing its requirement for oil

Prices fell below $30 a barrel in 2016 from over $100 two years earlier. Eventually, OPEC cut production and worked on an agreement with non-OPEC nations to try to reduce supply across the board and meet global demands more accurately.

After crude prices bounced off the bottom, North American oil companies were emboldened to increase investments in new wells. In the years since, oil has large bounced around between $50 and $70 levels, never returning to pre-2014 prices.

And in 2020, oil futures did something they’d never done before.

Negative oil prices in 2020

In January 2020, many governments began restricting travel and closing businesses to stem the coronavirus pandemic. Consequently, demand for oil fell steeply and the oil futures market was spooked.

Falling demand was accompanied by a supply glut. Russia surprised the markets by announcing it would actually increase production in April. To maintain its market share, OPEC announced it would do the same.

As storage facilities filled, prices plummeted into negative territory for the first time in history. Oil producers were effectively paying buyers to take the commodity off their hands over fears storage capacity could run out in May.

Some companies even resorted to renting tankers to store surplus supply. Finally, OPEC and Russia jointly agreed to drop production, global economies saw lockdown restrictions eased and prices soon returned to something approaching normality.

How to trade commodities at City Index

You can trade commodities with City Index using CFDs. Follow these steps to start trading now.

- Open a City Index account or log in if you’re already a customer

- Search for the commodity you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade