The woes of Wall Street deepened overnight, and after another session of heavy losses, the S&P500 is trading back at levels last seen in April last year.

Signs of contagion into other asset classes have been relatively limited so far despite the S&P500s 17% fall. There are concerns that if the equity market falls much further, it will lead to position reduction in other asset classes, particularly in those markets where positioning is the most acute.

In that respect, the FX market has two obvious contenders, the JPY and GBP, with investors heavily short both against the U.S dollar.

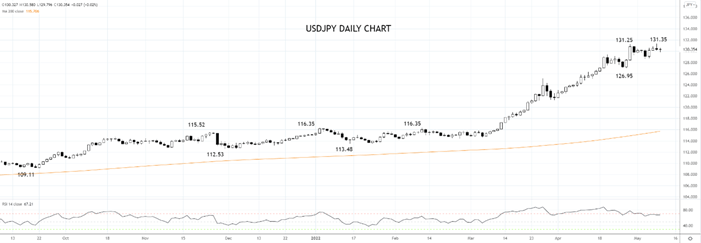

Notably, the eye-watering rally in USDJPY during March and April has stalled in May and overnight, USDJPY closed lower on the back of a retracement in U.S. yields and risk aversion buying of Yen.

While we are the first to acknowledge that fundamentally USDJPY remains supported by the monetary policy divergence of a hawkish Federal Reserve contrasted with a dovish Bank of Japan, the technical picture has clouded.

Firstly, in the form of a loss of momentum candle that formed overnight at the 131.25 high. Secondly, the bearish divergence has become more pronounced via the RSI indicator. Finally, the overbought nature of the rally and the stretched positioning suggests that if contagion does creep into the FX market, a pullback to 127.00 in USDJPY looks relatively achievable.

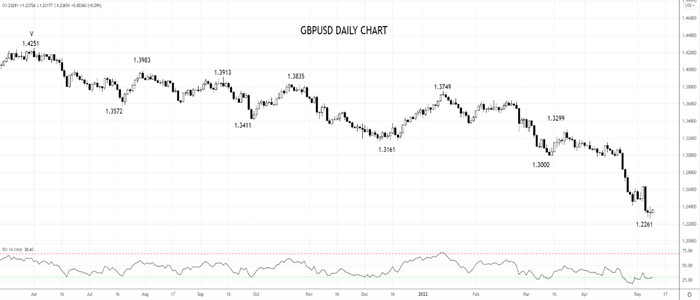

Turning to GBPUSD, there is a similar technical set-up to the one in USDJPY, including a loss of momentum type candle evident at last night's 1.2261 low, signs of bullish divergence on the RSI indicator. On the first hint of contagion and despite the bearish macro backdrop, a rally back to last week's 1.2640 high seems achievable.

Source Tradingview. The figures stated are as of May 10, 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade