A partial recovery commenced on Friday following the release of weaker than expected U.S. consumer sentiment data and signs that China is considering easing rules to allow distressed real estate developers to sell off assets to avoid default.

Helping the beleaguered “Aussie battler” edge higher, Chinese economic data released today showed that the Chinese economy has weather the regulatory and Evergrande debt storm better than expected.

Chinese steel production was weak after output controls and power shortages weighed on supply and demand. However, in October, industrial production rose 3.5% above economists’ expectations for a 3% gain, as did retail sales, which increased by 4.9%.

Limiting scope for extended AUDUSD gains, the release tomorrow of the RBA meeting minutes for the November Board meeting, and a speech by RBA Governor Lowe. Both are likely to be dovish and reiterate that interest rate hikes are unlikely to commence until 2024 or late 2023 at the earliest.

On Wednesday, the release of wages data (a crucial component of the RBA’s sustainable inflation jigsaw puzzle) is expected to show only a modest rise of 0.5% q/q due to lockdowns, taking the annual pace to 2.2%. Still well short of the 3-3.5% range targeted by the RBA.

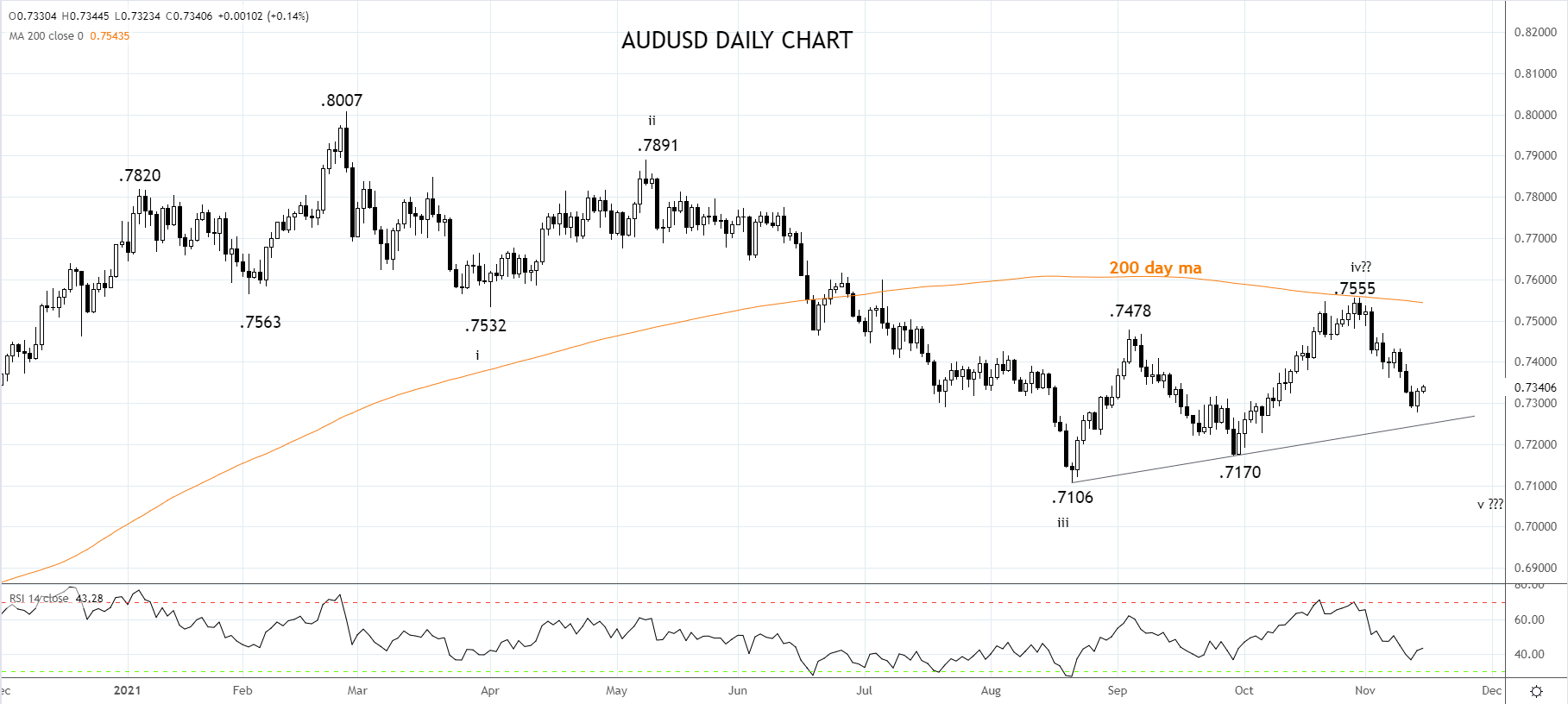

The current bounce in the AUDUSD is viewed as a short-covering rally, and we favour using it to scale into shorts between .7380 and .7420.

If the short entry is achieved, the stop loss will be placed above the recent .7555 high, and the profit target is near .7100c, providing the trade idea with an attractive 2:1 risk-reward ratio.

Source Tradingview. The figures stated areas of November 15, 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade