When will Tesla release Q4 earnings?

Tesla will release fourth quarter and full year results after US markets close on Wednesday January 25. A live Q&A webcast will be held on the same day at 1630 CT (1730 ET).

The company has also announced it plans to hold an investor day on March 1, which will be live streamed from its Gigafactory in Texas. ‘Our investors will be able to see our most advanced production line as well as discuss long term expansion plans, generation 3 platform, capital allocation and other subjects with our leadership team,’ Tesla said in a statement.

Tesla Q4 earnings consensus

Tesla is forecast to report a 34% year-on-year rise in revenue to $24.34 billion in the fourth quarter of 2022. Operating income is expected to increase 62% from last year to $4.24 billion while GAAP net income is set to climb 58% to $3.67 billion.

If achieved, that puts Tesla on course to report a 52% rise in annual revenue to $81.7 billion over 2022, while both operating profit and net income are both forecast to more than double from last year to $13.95 billion and $12.48 billion, respectively.

Tesla Q4 2022 earnings preview

Tesla saw its valuation plunge by $850 billion in 2022 – making it the worst year for the company’s share price on record as it was hit by a myriad of headwinds from Covid-19 disruption in China and logistical issues to Elon Musk’s controversial takeover of social media platform Twitter and the share sales that helped fund it.

The big question for Tesla in 2023 is how much demand will be tested in the tough economic climate and how much profitability the electric carmaker is willing to sacrifice as it slashes prices to drive demand and fend off more intense competition.

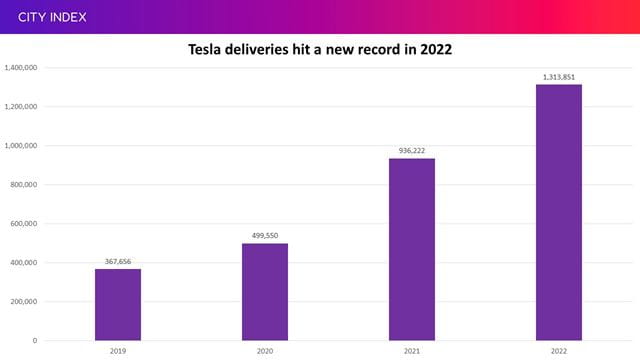

The company managed to increase production by 47% in 2022 to 1.369 million vehicles while deliveries rose by 40% to 1.313 million. While impressive, this fell short of Tesla’s ambition to grow annual output by 50% each year.

(Source: Company reports)

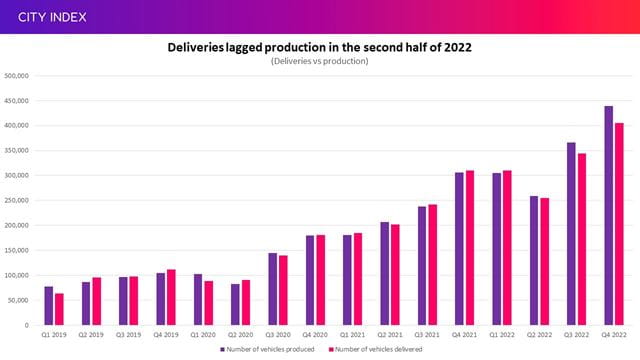

For now, Tesla is blaming the shortfall in volumes on logistical issues. Although it is not uncommon for there to be a gap between the production and deliveries each quarter, the gap has been minimal up until the second half of 2022, when we saw a larger difference between the two metrics emerge.

(Source: Company reports)

However, this has sparked concerns that deliveries are lagging production because of weaker demand. We saw Tesla produce 22,000 more cars than it delivered in the third quarter of 2022, and this widened to over 34,000 in the fourth – leaving it with more inventory to shift.

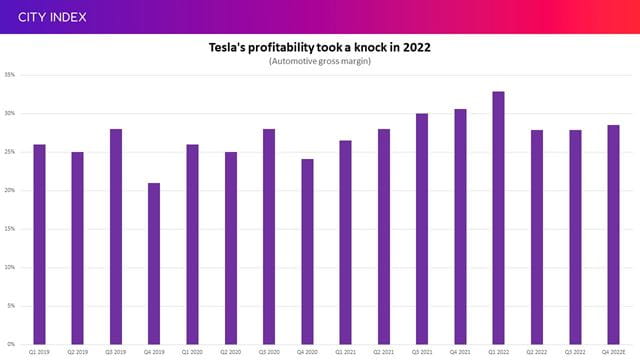

Tesla has been slashing prices in recent months and some are concerned that it is having to offer discounts to prop-up demand. Tesla recently reduced prices across the US and Europe by as much as 20% following cuts made in Asia. Some of this is down to easing inflation and the reversal of price hikes made last year, but investors remain worried because Musk has previously warned that tougher times are on the horizon and that a recession is coming, confessing that this could force Tesla to prioritise volume growth over profitability, which weakened in 2022.

(Source: Company reports, with estimates from Bloomberg)

The electric vehicle market is becoming more competitive as smaller startups ramp-up output and traditional automakers transition away from combustion engines. Fortunately, Tesla looks to be in a much stronger position than most.

Tesla is the only pure-play electric vehicle maker that makes a profit and one of its biggest advantages is the superior profitability it boasts not just over its smaller electric vehicle rivals but also traditional automakers. This could be at risk if it continues to cut prices when inflation is still high, but it also means the company has more wiggle room to play with than its rivals in the current environment.

The vast majority of smaller electric vehicle makers, from Rivian to Lucid Group, are still in the early days of production and burning through cash. They too are being hit by concerns that demand is waning as recessionary fears continue to build but they are at much greater risk considering they are not profitable like the market leader Tesla. We have already seen several smaller electric vehicle startups collapse and more could follow in 2023.

Meanwhile, traditional carmakers such as General Motors and Ford are also gaining ground. Tesla is still the market leader in North America with around 65% of the electric vehicle market in 2022, but that declined from 70% in 2021 and 79% in 2020 as its rivals gain ground.

There is also a threat from China, where it is facing the likes of BYD, NIO, Li Auto and XPeng. We have already seen some of them follow Tesla and cut prices, which may cause a price war in the country. There are some early indicators that Tesla’s recent price cuts have had the desired effect after reports suggested average daily sales in the country between January 9 and January 15 rose 76% from the same period the year before, according to data compiled by China Merchants Bank.

That will be welcomed considering most had anticipated weaker demand in January and February because some attractive subsidies expired at the end of 2022 and demand usually drops off ahead of Chinese New Year. The fact Tesla outperformed the wider market, with electric and hybrid vehicle sales in China rising 36.5% in the same period, suggests Tesla’s strategy to drive demand through lower prices is working – and investors will be hoping for a similar reaction in the US and Europe following the latest price cuts.

What to expect from Tesla in 2023

Estimates for 2023 have fallen significantly in recent weeks and months as brokers digest softer demand, an uncertain outlook and a potential price war.

Markets currently believe that Tesla will struggle to meet its goal to grow volumes by 50% in 2023 even if they anticipate another year of strong growth. Consensus numbers show Wall Street is expecting Tesla to produce 1.947 million vehicles this year and deliver 1.853 million of them to customers, putting both metrics on course to climb around 41% to 42% in 2023.

Meanwhile, its automotive gross margin is expected to tighten to 27.6% in 2023 from the 29.3% pencilled-in for 2022. The company is now in a position where it may have to see its margin deteriorate in order to deliver its goal to grow volumes by 50% each year, or temporarily give up that ambition to protect profitability. With this in mind, cost control will be key even though inflation appears to be past its peak.

Tesla is forecast to grow revenue by 31% this year, lagging the anticipated rise in volumes as lower prices bite. Earnings are set to increase at an even slower pace as costs continue to rise at a faster pace, with operating profit expected to rise 21% in 2023 while net income is seen climbing 17%.

There could also be a number of other events to watch out for this year.

We will see it undertake an expansion of its Gigafactory in Texas that should be completed by early 2024 – which will be crucial considering Tesla will be testing the limits of its existing capacity this year. That is also all the more important following reports that it has had to delay the expansion of its factory in Shanghai, where annual output may remain constrained at around 800,000 units. It is likely we will hear about new greenfield developments too. Tesla could ultimately open up to 12 more Gigafactories across the world over the coming years as it tries to build-out annual output to 20 million cars by 2030. Canada and Mexico have been touted as potential locations for new plants, while Asia could also be on the cards considering it has expanded into new countries across the region.

Meanwhile, we should finally be able to see the finished version of the long-awaited Cybertruck that has been delayed on several occasions. Tesla worked on finalising development in 2022 to ensure that it could be launched sometime this year, with markets hopeful this could happen in mid-2023. Still, investors should not have high ambitions for the Cybertruck to materially contribute toward volume growth in 2023 and should expect this to come more into play in 2024.

Is Tesla’s valuation fair?

Softer demand and weaker profitability have hit Tesla shares and prompted brokers to downgrade their estimates for 2023, which in turn has hurt its valuation prospects that are still underpinned by its goal to grow volumes by 50% each year and its superior margins.

Currently, 37 brokers that cover Tesla have an average target price of $197, implying there is over 54% potential upside from current levels. However, this has been slashed from close to $290 less than three months ago.

Some are more cautious, with BofA Securities recently stating that Tesla ‘appears fairly valued’ as it trimmed its target price to $130 from $135 and reiterated its Neutral rating as it believes tougher conditions will persist. Meanwhile, Jefferies recently cut its target price to $180 from $350 after slashing its estimates and said that, while Tesla still ‘leads the industry towards a better business model’, the trajectory is bumpier than anticipated.

Where next for TSLA stock?

Tesla shares have rebounded since hitting their lowest level in over two years in early January, but the downtrend that can be traced back to September remains intact and appears to be making it harder for the stock to find higher ground.

Breaking out of the downtrend is the immediate goal on the upside, after which it can look to target a move above $151.50, which was a strong ceiling that held throughout late 2020. From there, the 50-day moving average at $156 can recaptured before the November-low of $167 comes back onto the radar. We have seen daily trading volumes rise for four consecutive sessions and the five-day average of 183.2 million shares is considerably higher than the 100-day average of 101.8 million shares to suggest there is some momentum.

We could see the stock move back toward the lows seen in late 2022 and early 2023 if the downtrend holds and the stock remains under pressure. We could see some support emerge around the $107 to $108 level, but any slip below here brings back the threat of the 28-month low of $101.80. Fresh lows are likely to see it slip below the $100 threshold, which should prove to be a key psychological level for traders.

Take advantage of extended hours trading

Tesla will release earnings after US markets close and this means most must wait until they reopen the following day before being able to trade. But by then, the news has already been digested and the instant reaction in share price has happened in after-hours trading. To react immediately, traders should take their positions in pre-and post-market sessions.

With this in mind, you can take advantage of our service that allows you to trade Tesla using our extended hours offering.

While trading before and after hours creates opportunities for traders, it also creates risk, particularly due to the lower liquidity levels. Find out more about Extended Hours Trading.

How to trade Tesla stock

You can trade Tesla shares with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for ‘Tesla’ in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade

Or you can practice trading risk-free by signing up for our Demo Trading Account.