When are Rivian Q3 earnings?

Rivian will release third quarter earnings after markets close on Wednesday November 9. An audio webcast will be held on the same day at 1700 ET.

Rivian Q3 earnings consensus

Wall Street is looking for third quarter revenue of $551.6 million and an adjusted Ebitda loss of $1.4 billion. The net loss is estimated to amount to $1.8 billion, according to consensus numbers from Refinitiv.

Rivian Q3 earnings preview

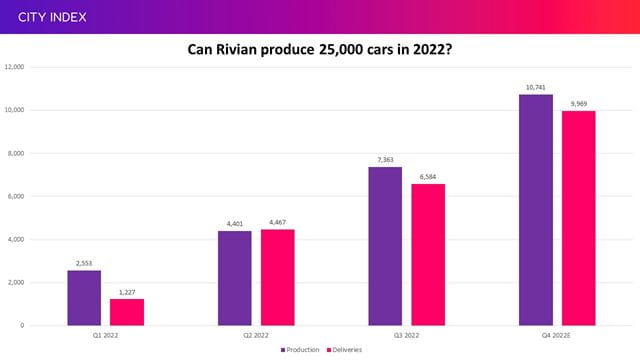

We already know that Rivian, which tentatively started production in 2021, made 7,363 vehicles during the third quarter and delivered 6,584 of them to customers.

Rivian is aiming to make 25,000 cars in its first full year of production in 2022 and has produced 14,317 of them over the first nine months, meaning it will need to churn out at least 10,683 vehicles before the end of 2022 to achieve its goal. Wall Street believes it will narrowly achieve its ambition with current consensus numbers pointing toward production of 10,741 cars in the final three months of this year.

Reiterating that annual production goal is the most crucial thing it needs to do this week if it is to maintain what has so far been reliable and impressive quarter-on-quarter rises in production, albeit over a fairly short period of time.

(Source: Q4 estimates from Bloomberg)

Notably, Rivian said it was planning to add a second assembly shift at its factory towards the end of the third quarter, which should provide the boost needed to hit its target this year.

Still, we saw it manufacture over 770 more vehicles than it delivered in the third quarter, which is thought to be down to widespread logistical issues that has hit other automakers that sell directly to customers and don’t have a dealer network, including market leader Tesla. However, the lag between the number of cars reaching customers compared to the number being made is forecast to continue in the fourth quarter. Keep an eye on any updates on how supply chains are faring and whether there has been any improvement.

Rivian still has plenty of demand. It had 98,000 pre-orders for the R1 in the US and Canada alone at the end of June and saw an acceleration in purchases in the second quarter compared to the first. It will need to satisfy these orders as quickly as possible to keep customers happy. Any delays in getting vehicles to customers risks seeing them turn to alternative models offered by rivals.

It has also started to supply its Electric Delivery Vehicle (EDV) to major shareholder Amazon, which has ordered 100,000 of them to be delivered over several years. Around 700 of them had been deployed across several US cities by the end of June.

Rivian has the ability to produce up to 150,000 vehicles at its factory in Normal, Illinois, and using this capacity will be vital not only operationally but financially as it will bring the cost of production down, making it key to getting Rivian out of the red, into the black, and making the company sustainable. That headroom also shows that Rivian has the ability to take on more orders so long as the ramp-up continues.

Rivian is still losing money on each car it produces, partly because of low volumes and rising material costs. For example, the price of lithium is thought to have been around three times higher in the third quarter than a year earlier, according to Bloomberg Intelligence. Rivian has said it is also looking to improve margins by introducing its new Lithium Iron Phosphate battery, updated electronics and a new single motor drive unit called Enduro.

‘As we produce vehicles at low volumes on production lines designed for higher volumes, we have and will continue to experience negative gross profit related to labor and overhead costs. This dynamic will continue in the near term, but as we have already started to experience, we expect it will improve on a per vehicle basis as production volumes ramp up faster than future labor and overhead cost increases,’ Rivian said in the last quarter.

Meanwhile, markets forecast Rivian will burn through $1.87 billion in free cashflow during the third quarter and that is expected to swell closer to $2.00 billion in the fourth.

Importantly, with almost $15.5 billion in cash and equivalents on its books at the end of June, the company has the resources needed to cover anticipated losses for the foreseeable future. Markets believe Rivian will still be burning through significant sums for years. Current consensus numbers from Bloomberg suggest it won’t generate positive free cashflow until the final three months of 2026. Still, Rivian has said it believes it can survive through until at least 2025, when it hopes to launch the new R2, with its current cash balance.

Rivian has said that it is hoping to limit annual adjusted Ebitda losses in 2022 to $5.45 billion, although this remains vulnerable to change given the challenges associated with the ramp-up, disrupted supply chains and the inflationary effect on material and freight costs. Consensus numbers from Bloomberg are already pencilling-in a slightly larger loss of $5.49 billion.

Where next for RIVN stock?

Rivian went public a year ago at $78 per share in what turned out to be the biggest new listing in the US in 2021. The stock initially rallied to as high as $179.50 within days of going public before shifting down a gear and heading lower. Today, the stock trades at just under $32.

The stock has gained some ground since closing at an all-time low of $20.60 back in May, but has struggled to break above the $41 mark. The share price has generally drifted above and below the 50-day moving average.

The share price has narrowly held above the $31 mark during the past three sessions to suggest this could emerge as a new level of support going forward. However, any fall below here risks seeing it drift back toward the $25.70 floor we saw in May and July, which must hold to avoid opening the door to the all-time low.

On the upside, a break above the $41 ceiling could lead pave the way to considerably higher ground, with the initial target being the level of support-turned-resistance around $53. The 20 brokers that cover Rivian see slightly greater upside potential over the next 12 months with the average target price sat at $51.70, some 62% above the current share price.

How to trade Rivian stock

You can trade Rivian shares with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for ‘Rivian’ in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade

Or you can practice trading risk-free by signing up for our Demo Trading Account.