Cast your mind back to the start of last week: Major cryptoassets like Bitcoin and Ether were trading at multi-month highs as the fallout from this summer’s volatility finally appeared behind us and concerns about the world’s second-largest crypto exchange, FTX, and its wunderkind founder Sam-Bankman Fried (SBF) were mostly dismissed as unfounded “FUD” (Fear, Uncertainty, and Doubt).

What a difference a week makes! As of writing, major cryptoassets are trading down ~20% from the levels seen early last week, FTX has declared bankruptcy, and SBF has gone from billionaire prodigal son to bankrupt pariah in record time. So what’s next for the cryptoasset markets? Will we ever seen a return to the euphoric bull market highs we saw almost exactly a year ago?

A colossal loss of trust

One thing is clear: The implosion of FTX has set the industry back tremendously. Thanks to aggressive sponsorship deals, including commercials with Tom Brady and Larry David among others, FTX was a household brand name among retail traders in the often-opaque crypto markets. Likewise, institutions trusted the exchange as a trustworthy, ethical counterparty in the space. Even US lawmakers had a positive view of SBF from his aggressive lobbying efforts and willingness to explain the nuances of the crypto industry.

All of this trust has been destroyed, leaving behind massive financial losses and extreme cynicism toward the crypto markets. After all, if even SBF and FTX were running illegal undercollateralized businesses, who can be trusted at all? It will take months and months, if not years, for many market participants to move past last week’s trauma enough to consider re-entering the crypto market again.

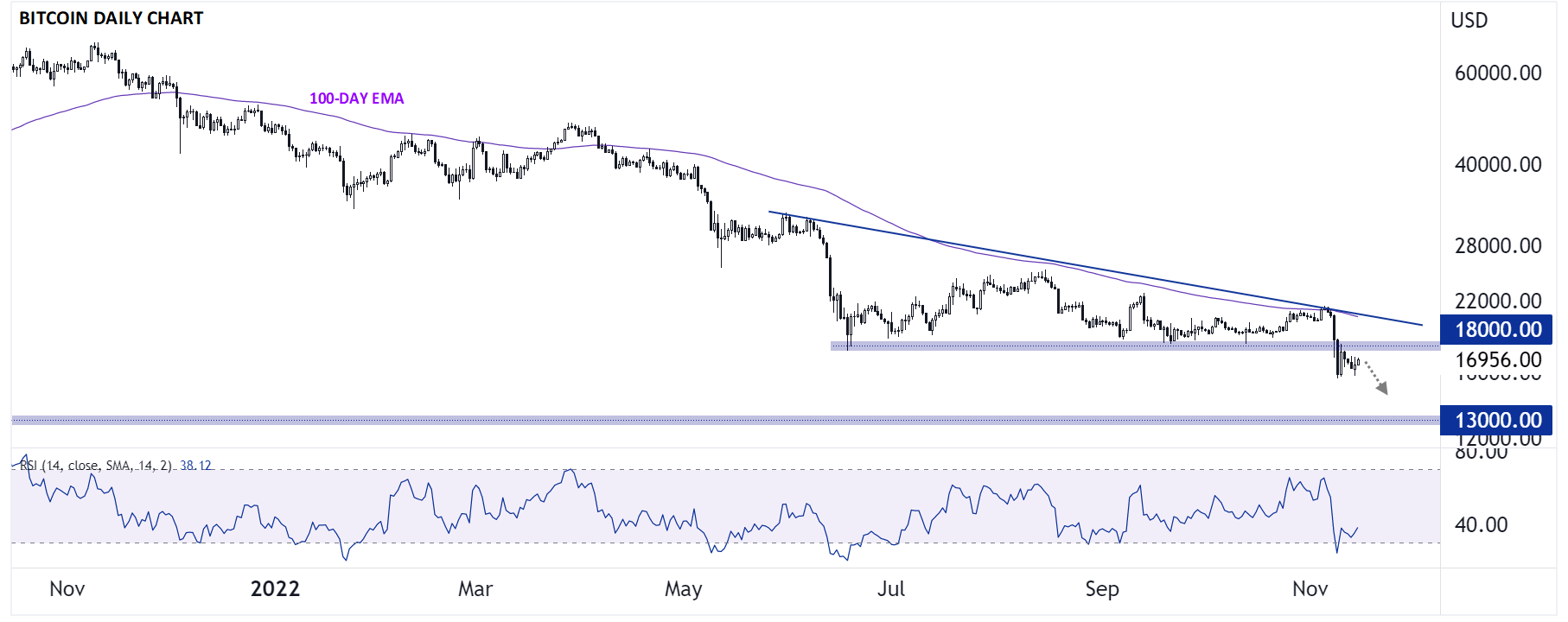

Bitcoin still tracking the 2018 analog

A couple weeks ago, we highlighted the spooky parallels between the current price action for Bitcoin and the price action that we saw heading into the trough of the last cycle in 2018. Specifically, in both of these cycles, Bitcoin traced out the following moves:

- Bitcoin formed a euphoric peak at record highs in the previous Q4

- Spent months bouncing along support ($6,000 then, $18,000 now)…

- …Putting in lower highs along the way.

- Broke support heading into the holidays…

- …Leading to a sharp drop to fresh cycle lows, exactly a year after the peak.

If this analog holds, Bitcoin may put in a long-term bottom in the coming months, but we wouldn’t expect an immediate return to the strong uptrend and bullish price action that we saw through most of 2021. Instead, Bitcoin and the rest of the surviving cryptoassets are more likely to consolidate in relatively quiet trade as “tourists” to the space lose interest and developers continue to build out the tools and decentralized applications that will power the next bull cycle.

Source: TradingView, StoneX

Fallout: Bitcoin and Ethereum win again?

As some readers know, Bitcoin was invented in the wake of the Great Financial Crisis, seemingly as a result of its pseudonymous founder’s frustration with bank bailouts and the interdependent nature of our modern financial system. Against that backdrop, it’s not suprising Bitcoin has continued to chug along, transparently creating blocks and transferring billions of dollars of value each day, and its radically simple structure will be relatively appealing after another prominent scandal in the space.

Another longer-term winner from last week’s turmoil may be Ethereum. The world’s second-largest cryptoasset supports the most vibrant decentralized finance (DeFi) ecosystem, where loans are always overcollateralized by definition and there’s no need to trust any third-party. Likewise, the massive transaction volume in the wake of FTX’s implosion has turned the supply of Ethereum deflationary, and one of its biggest competitors in the smart contract space, Solana, is struggling from its close association with Sam Bankman-Fried. Notably, Bitcoin is trading down -74% from last year’s peak, while Ethereum is trading down -73%, suggesting that traders view both tokens as reserve assets in the space.

As more information continues to trickle out around FTX’s collapse and SBF’s betrayal (not too mention any contagion from the abrupt disappearance of one of the largest shops in the entire cryptosphere and the accompanying regulatory actions across the developed world), the broad crypto market will likely remain under pressure in the coming weeks and months; in other words, don’t expect an imminent return to the halcyon days of a half-dozen crypto-focused Super Bowl commercials and $60K+ Bitcoin any time soon. Longer term, purging illicit actors out of the ecosystem and reminding those that remain of the importance of trustless systems will benefit the space, but scars as deep as these will take a long time to heal.

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade