A mixed end to last week as the Dow Jones closed higher on Friday. However, the S&P and Nasdaq closed lower as tech stocks strained under the weight of new cycle highs in U.S yields.

The unrelenting march higher in bond yields resumed during the Asian time zone on Monday. Combined with a surge in new virus cases in China and higher than expected Chinese inflation data, regional equity markets slumped to start the week.

In Hong Kong, the Hang Seng Index fell by 3.46%. In Tokyo, the benchmark Nikkei 225 index fell by 0.6%. While, U.S. equity futures, led by the tech-heavy Nasdaq, are trading 1% lower at 14181.

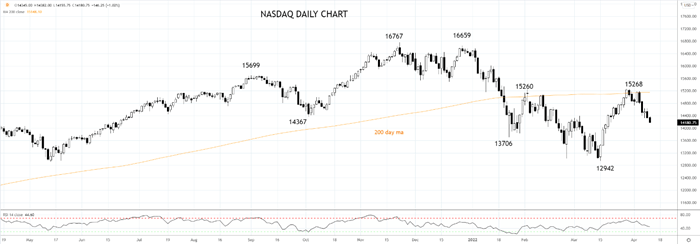

The start of Q2 2022 now resembles the shaky opening weeks of Q1 2022. For those that may have forgotten, in the opening two weeks of Q1 2022, the Nasdaq fell over 7% as bond yields began their impulsive move high.

As regular readers of our Morning Brief know, we hold the view that "an already troubling backdrop is deteriorating" for U.S. stocks markets as the Fed tries to tighten monetary to tame inflation while at the same time attempting to engineer a soft landing.

A gentler version of the thoughts echoed by former Fed President Bill Dudley, who said at the end of last week, "One thing is certain: To be effective, the Fed will have to inflict more losses on stock and bond investors than it has so far."

For the second time in as many months, the Nasdaq has rejected the resistance coming from the 200 days moving average at 15148 and formed an internal double top of shorts at 15260.

Leaning against the two resistance levels, sell bounces in the Nasdaq to 14,400, leaving room to add at 14,800.

The stop loss would be placed at 15,275, and the profit target is a test of support at 13,200/00, providing a trade with a risk-reward ratio of more than two to one.

Source Tradingview. The figures stated are as of April 11th 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade