2022 has seen the worst start to the year for U.S equities since the 1970s, best exemplified by the tech-heavy Nasdaq which at its nadirs last week was over 30% below its bull market highs.

There has been no shortage of causes for the sell-down. From the war in Ukraine to hawkish central banks and rising interest rates, to surging inflation and fears of recession all of which have served to undermine the value proposition of growth stocks.

The recent acceleration to the downside has even taken prisoner stocks with solid reliable earnings such as Apple (AAPL US) and Microsoft (MSFT US).

While it’s still way too early to say that the bear market has run its course, the market is overdue a bear market rally, if only to lift the lid on some of the extremely bearish sentiment that has emerged in recent weeks.

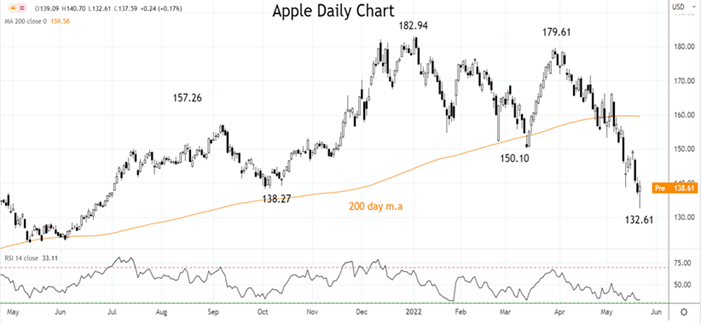

As viewed on the chart below, the share price of Apple has fallen over $50 from its January high to last week’s $132.61 low. At the $132.61 low, a potentially bullish reversal candle formed that hints at seller exhaustion. Additionally, there is evidence of bullish divergence on the RSI indicator which also warns the downtrend is losing strength.

All of which warns that a short-term bounce is possible for the share price of Apple. To take advantage of this we buy Apple on a dip to $134.00 with a stop loss placed at $127.00. We look to take profit at $148, just ahead of the layer of overhead resistance at $150.00, for a trade with a 2:1 risk reward ratio.

Source Tradingview. The figures stated are as of May 23rd, 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade