New month, new quarter…new market trends?

This week has kicked off with a violent counter-trend reversal in the big themes from last month, quarter, and the year to date. Major global indices have rallied 5-7% off the weekend lows, the US dollar has dropped nearly 500 pips from last week’s peak against most of its major rivals, and even gold has rallied over 100 points.

After smaller-than-expected interest rate hikes from the RBA and Bank of Poland, as well as the UN imploring central banks to slow the interest rate hikes, the fundamental narrative is that we may be on the brink of a potential Fed “pivot” to slower interest rate increases.

There’s only one problem with that narrative: Traders aren’t buying it (yet, at least)! Looking at the CME’s FedWatch tool, Fed Funds futures traders are still pricing in about a two-in-three probability of another 75bps interest rate hike in early November and nearly 70% odds of another 125bps of rate hikes by the end of the year. Instead, the recent price action looks more like a temporary counter-trend move from the extreme levels of last week.

Ironically, by easing financial conditions and September’s market dislocations, this week’s rally in the stock market and pullback in the buck makes it MORE likely that the Fed continues on its path to crush inflation at all costs. We’ve also seen US economic data from consumer confidence to Core PCE to initial unemployment claims to this morning’s ISM Services PMI all come in better-than-expected, suggesting that the US economy is holding up relatively well so far.

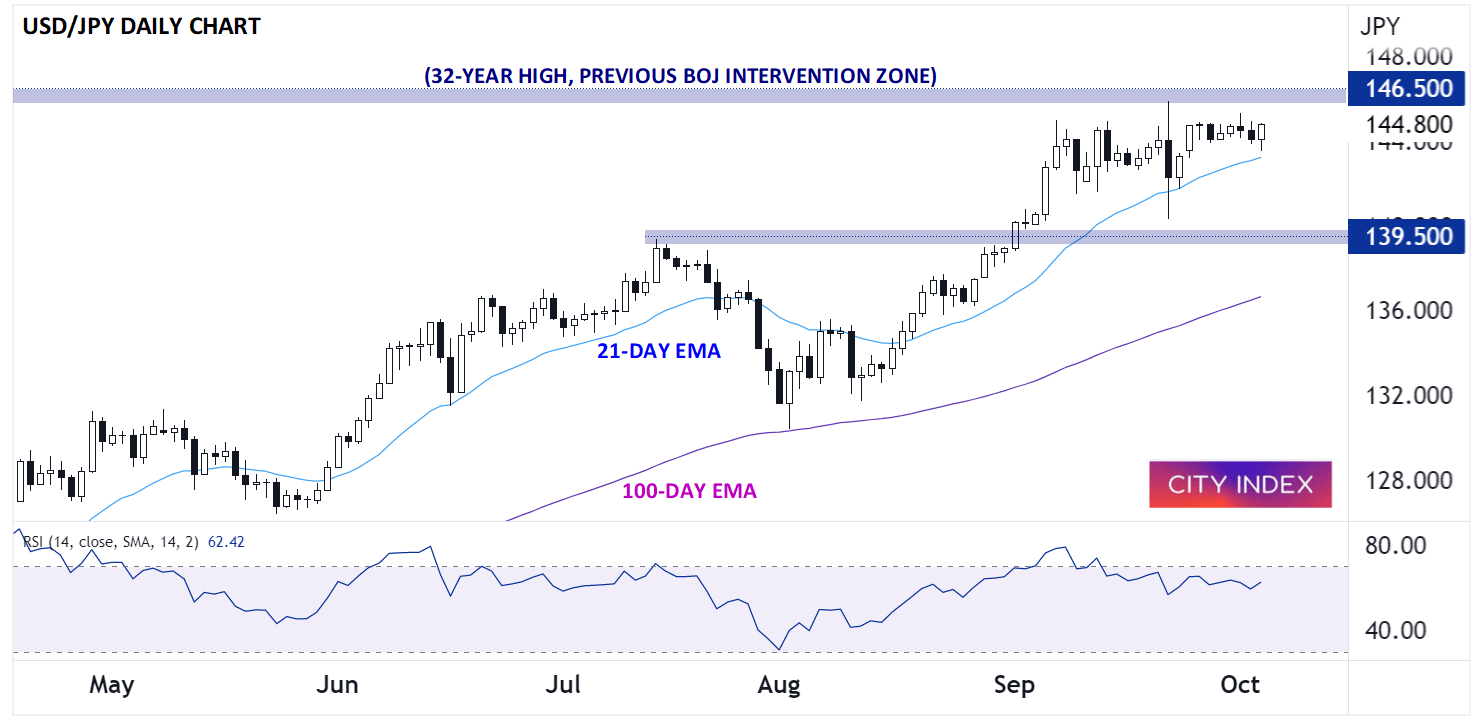

Technical view: USD/JPY

Looking at the daily chart of USD/JPY, the currency pair that is most responsive to monetary policy, rates are currently consolidating near their 32-year highs in the mid-146.00s. Traders remain wary of pushing the pair higher at the moment given the near-term risk of intervention from the BOJ, but the longer-term trend still remains undoubtedly to the topside, so it may only be a matter of time until we see USD/JPY at its highest level since 1990.

Astute traders will also note that the consolidation over the last month has eased the overbought condition in the pair’s RSI indicator, allowing the unit to correct through time rather than through price and potentially setting the stage for another leg higher in the coming weeks. A sustained break above 146.50 could clear the way for a continuation toward 150.00 as the BOJ retrenches, whereas only a break below previous-resistance-turned-support at 136.50 would call the longer-term bullish trend into question.

Source: TradingView, StoneX

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade