The USD/CAD turned sharply lower today, breaking though some key levels including 1.3500 in a clean move. The sell-off has been trigged by broad US dollar weakness ahead of the US nonfarm jobs report on Friday. Consequently, the USD/CAD outlook has turned bearish, at least in the short-term anyway.

Why is the dollar selling off?

The reversal in the USD/CAD means it has now given up all of the gains made last week and some, when rising Fed rate hike bets saw the dollar rally across the board. But those expectations have been slashed following a speech by Jefferson, who has been nominated to take over as vice chairman of the Fed. Jefferson hinted of a “skip” in June, which prompted a quick reversal in rate-hike pricing. Harker also made similar comments.

As a result, the odds of a hike in June have fallen to around 30% from around 70%, and the dollar’s response has been a swift one.

The dollar has also come under pressure because of a soft ISM manufacturing PMI report, which also revealed a sharp drop in its prices paid index. We also saw a softer print on the Unit Labor Cost index. However, a rather strong ADP jobs report means the employment sector remains hot and argues against a rate cut any time soon.

Canadian data suggests BoC will remain hawkish

Recent data out of Canada suggests the North American nation is holding its own rather well. First quarter GDP, for example, was stronger than expected, suggesting the economy has maintained a lot of momentum. What’s more, recent inflation reports have revealed a steady rise in core goods prices while we have also seen an unexpected surge in shelter prices. In terms of employment, well there are not many concerns here. In recent months, we have also seen above-forecast jobs data, with the headline employment change beating expectations in every single of the past 8 months. The May jobs report will be published next Friday, a full week after the US nonfarm payrolls report is published.

If Canadian data continues to point towards an economy remain hot, then this should increase the odds of an additional 25 bps hike from the Bank of Canada in the upcoming month. At its next meeting on Wednesday, though, we are doubtful the BoC will deliver a hike as it will want to await more data to support the case for a hike. The BoC lifted rates to the current 4.5% at its January 25 meeting and has since sat pat for the next two meetings in March and April.

USD/CAD outlook: Technical Analysis

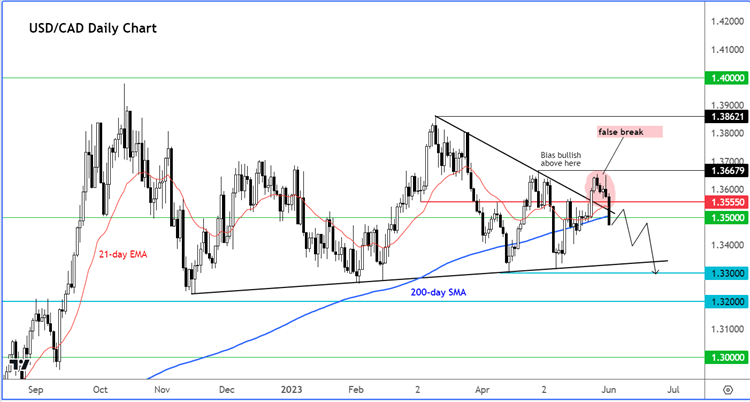

The breakout above the trend line couldn’t hold, which means we now have a failed breakout scenario on the USD/CAD. This means the USD/CAD is most likely heading to levels where trapped traders’ stops would be resting. One of those levels was below 1.3500, the base of last Wednesday’s breakout. This area has now been cleared. The bigger liquidity pools are likely to be below 1.33 and 1.32, given the multi-month higher lows that have been created between these levels.

This bearish technical setup will become invalidated should rates go on to climb back above 1.3550 resistance in the coming days.

Source: TradingView.com

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade