US futures

Dow futures +0.07% at 32868

S&P futures +0.13% at 3987

Nasdaq futures +0.05% at 12162

In Europe

FTSE +0.17% at 7925

Dax +0.4% at 15618

Learn more about trading indices

ADP job creation beats forecasts

US stocks point to marginal gains as investors lick their wounds after yesterday’s steep selloff and as traders sit on the sideline ahead of Fed Powell’s second day of testifying before Congress.

Yesterday Powell's hawkish commentary sent jitters through the market. The head of the Fed warned that interest rate rises at a faster pace and that interest rates could remain higher for longer. The market is now pricing in 50 basis point rate hike at the March meeting, up from 25 basis points initially expected. The market is also pricing in a 6% terminal rate, up significantly from the previously expected 5.5%.

The focus is now shifting to jobs data as we head toward the nonfarm payroll report on Friday. The February ADP private payrolls report showed that 240,000 jobs were added in the private sector in February, well above the 119k created in January and above the 200k forecast.

JOLTS job openings are expected to fall to 10.6 million, down from 11 million.

Following these reports, attention will be on Friday’s NFP to see whether the blowout January numbers were a one-off. A hot labour market piles pressure on the Fed to keep raising interest rates aggressively.

Corporate news

Crowdstrike rises 7.9% pre-market after the cyber security company passed fourth quarter results which beat expectations and offered encouraging full-year guidance amid ongoing demand for cyber security solutions.

Tesla falls 1.3% after analysts at Berenberg downgraded their stance on the EV maker to hold from buy. Data from China's passenger vehicle sales fell 20% in January and February.

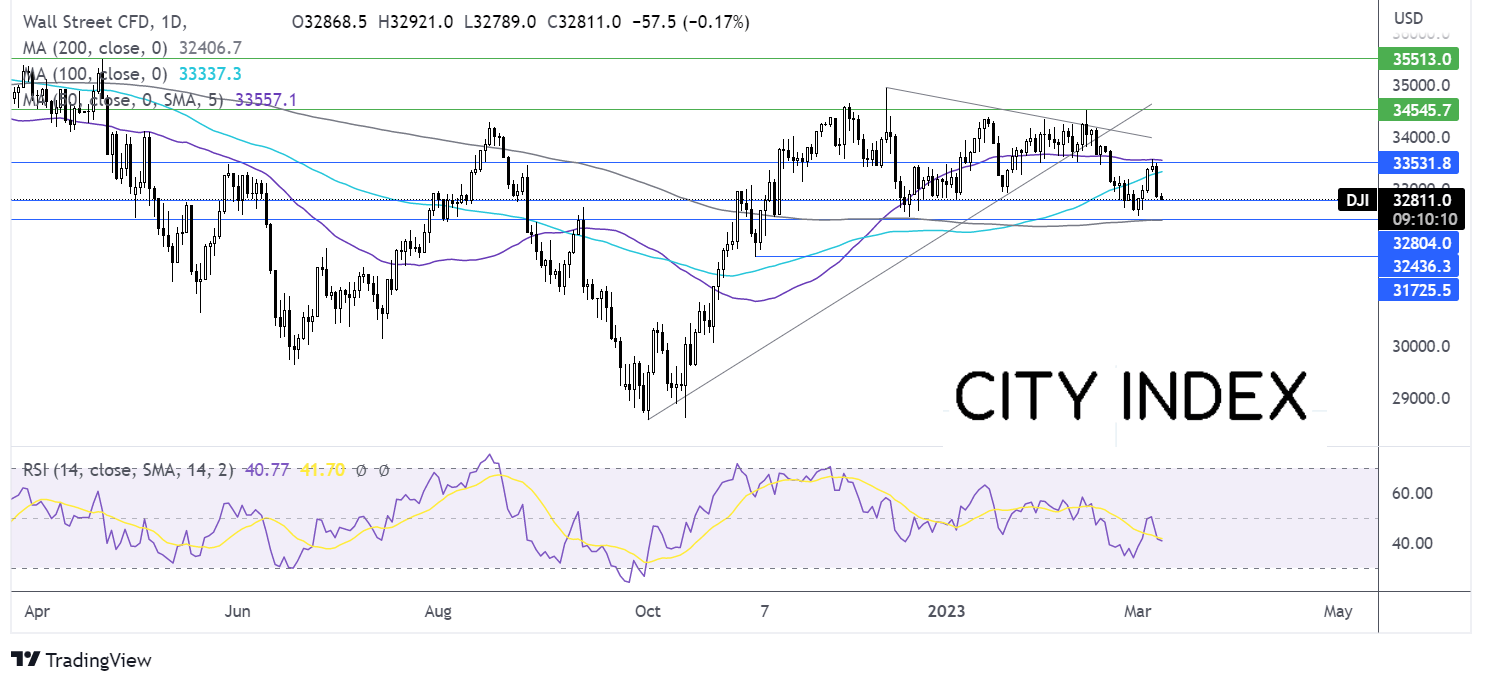

Where next for the Dow Jones?

After running into resistance at the 50 sma at 33575 the Dow plunged lower, taking out the 100 sma and is currently testing support at the 32800 level, the January low. The RSI supports further downside. A break below 32800 is needed to extend the bearish trend towards 32500, the March low and 32470 the December low. A break below here, which is also the 200 sma would create a lower low and could see a sell off gather momentum. On the flip side, buyers need a rise above 33000 the round number to pave the way to 33500 the March high and 50 sma. A rise above here creates a higher high.

FX markets – USD rises, EUR falls

The USD is rising, adding to gains from the previous session, reaching a 3-month high. The USD is rising on expectations that the Fed will raise interest rates higher for longer.

EUR/USD is pressurized below 1.0550, on USD strength and after data showed that German retail sales unexpectedly fell -0.3% MoM in March, after falling -5.3% in December. Expectations ha been for a 2% rise. Eurozone GDP was confirmed at 0% in Q4.

GBP/USD has fallen to a fresh 2023 low on USD strength. BoE policymaker Catherine Mann warned that the pound could fall lower if the ECB and Fed keep hiking interest rates. Meanwhile, BoE’s Dhingra could keep the pound under pressure after saying that it would be prudent to leave rates on hold.

EUR/USD -0.19% at 1.0540

GBP/USD -0.04% at 1.1840

Oil steadies after steep Powell inspired drop

Oil prices are steadying after dropping over 4% in the previous session after Federal Reserve Chair Powell hinted at higher interest rates for longer, a move which threatens a recession in the US and a possible global economic slowdown, both of which would be bad news for oil demand.

Meanwhile, the stronger USD is likely to limit the upside in oil. A stronger USD makes it more expensive for buyers with foreign currencies.

Yesterday the API oil inventory data showed that crude oil stockpiles fell for the first time in 10 weeks. The API data showed that inventories fell by 3.8 million barrels, defying expectations of a 400k barrel rise. Investors will be watching the EIA inventory data closely to see it this is confirmed.

WTI crude trades -0.2% at $80.30

Brent trades at -0.3% at $85.82

Learn more about trading oil here.

Looking ahead

15:00 Fed Powell speech