US futures

Dow futures +0.4% at 33100

S&P futures +0.5% at 4195

Nasdaq futures +0.8% at 13155

In Europe

FTSE -0.6% at 7170

Dax -0.7% at 13837

Euro Stoxx -1% at 3726

Learn more about trading indices

Marktet edges higher on mixed mood

US stocks are heading higher as investors digest mix messages with Russia, Ukraine optimism amid ongoing cease-fire talks along with more Russia sanctions, upbeat China data but surging COVID cases and higher PPI inflation.

There is so much information coming in today for investors to digest and make sense. But given the geopolitical tensions in eastern Europe and the COVID issues in Asia, the US looks like the best of a bad bunch today.

Russia, Ukraine peace talks are continuing, and reports have been ones that bring cautious optimism.

Overnight data from China showed that the world’s second-largest economy had a strong start to 2022 with industrial production and retail sales jumping higher. However, the Omicron outbreak is also spreading quickly and China, with its zero-COVID policy, has locked down 45 million people in important Chinese cities such as Shenzhen which is a tech hub and manufacturers iPhones.

Oil prices are also easing, trading at a three-week low, which is bringing some relief to the markets.

That said US PPI inflation hit 10% YoY in February, up from 9.7% in January, suggesting that consumer prices still had higher to run even before energy prices surged following Russia’s invasion.

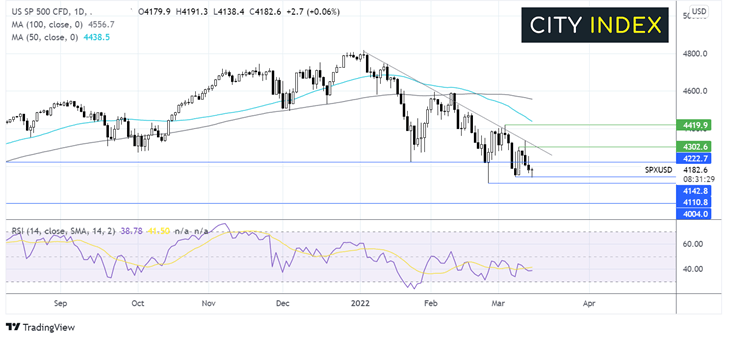

Where next for the S&P 500?

The S&P tested a support level at 4120 for the second time before rising, The long lower wick on the candle suggests that the price failed to find acceptance at the lower level before buyers rushed back in to push the price higher. Buyers would need to push the price over 4220 in order to bring 4300 into play and 4420 which would bring a more bullish bias. Meanwhile, sellers will look for a break below 4120 to open the door to 4100 the 2022 low. A break below here would be significant bringing a new lower low and 4000 the psychological level in focus.

FX markets USD falls, EUR rises

USD is heading lower as investors digest a mixed picture between the improving eastern European outlook and a deteriorating Chinese outlook as more lockdown restrictions are imposed.

EURUSD is rising amid continued optimism surrounding the Russia, Ukraine cease-fire talks. The EUR is on the rise despite data showing the investor sentiment in Germany tumbled in March, posting a record drop to -39.3, from 54.3 in February, as Russia invades Ukraine.

GBPUSD is rising after upbeat UK jobs data. Unemployment fell to 3.9% a level last seen pre-pandemic. The claimant count continued to fall, and wages jumped 4.8% YoY in a move that will pile pressure on the BoE to hike interest rates on Thursday.

GBP/USD +0.4% at 1.3058

EUR/USD +0.48% at 1.0993

Oil Tumbles 8% as Russia backs the revival of Iran’s nuclear deal

Oil prices fell 5% yesterday and are tumbling a further 8% today as the volatility in the oil market shows few signs of cooling.

Optimism surrounding Russian, Ukraine cease-fire talks in and more lockdown restrictions in China, as COVID cases rise are dragging the price of oil sharply lower.

Additionally reports that Russia is keen to see the resumption of the Iran nuclear deal is adding to the downward pressures. There had been concerns that Russia would be a problem, getting the deal agreed. But should the deal be revived, sanctions on Iranian oil could be lifted, increasing supply

WTI crude trades -7.6% at $93.93

Brent trades -7% at $97.30

Learn more about trading oil here.

Looking ahead

15:15 ECB’s Lagarde to speak

20:30 API crude stock pile data