US futures

Dow futures +0.13% at 35140

S&P futures -0.14% at 4478

Nasdaq futures -0.3% at 14528

In Europe

FTSE +0.01% at 7581

Dax -0.15% at 15205

Euro Stoxx -0.03% at 4118

Learn more about trading indices

Stocks await inflation data

US stocks are set for a mixed open as they struggle for direction ahead of Thursday’s inflation report. Whilst the S&P and the Dow trade just mildly lower, the Nasdaq is underperforming as treasury yields rise.

Attention is one hundred percent on Thursday’s inflation data and what it could mean for the Fed’s monetary policy going forwards. A very hot inflation print, coming on the back of stellar jobs data is likely to fuel bets of a more aggressive move by the Fed to tighten monetary policy. Currently the market is pricing in a 50% probability of a 50-basis point rate hike in March, this could well ramp up quickly on hotter than expected inflation.

Stocks are not likely to benefit from a more hawkish Fed and that’s why traders are on hold right now. Hot inflation and a more hawkish Fed mean growth at firms will be slower.

Treasury yields are pushing higher, reaching 1.95%, a level last seen in December ’19, boosting the greenback.

In other corporate news:

Peloton remains under the spotlight and trades 9% lower pre-market on news that the CEO John Foley will be stepping down to be replaced with Barry McCarthy, the former Spotify and Netflix chief final officer. The fitness equipment maker will also overhaul its board and cut costs. The plan comes the day after reports surfaced that Amazon and Nike were interested in buying Peloton, sending the share price 20% higher.

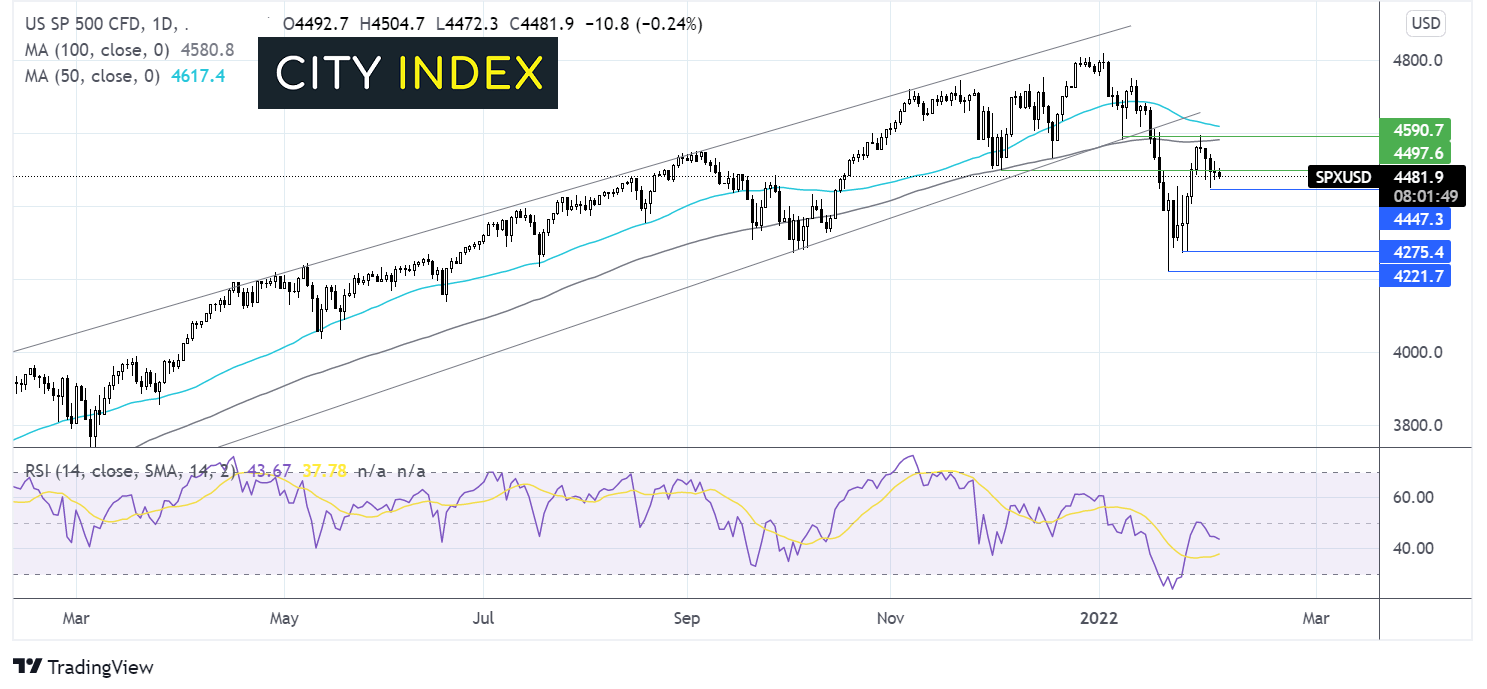

Where next for the S&P500?

The S&P500 is extending is decline from the 100 sma reached last week and has slipped below a key support at 4500. This, in addition to the RSI trading below 50 is keeping sellers’ hopeful of further downside. A move below 4450 could spark a deeper selloff to 4280 the January 27 low. Meanwhile buyers will be looking for a close over 4500 to bring 4590 the 509 sma and last week’s high into focus.

FX markets USD rises, EUR under pressure from less hawkish Lagarde

The USD is pushing higher tracing treasury yields higher as investors look ahead to inflation data due on Thursday. After stellar US NFP results expectations are rising that the Fed could raise rates by 50 basis points. Hot inflation could cement those expectations.

EUR/USD is under performing after ECB President Christine Lagarde cooled expectations of firmly hawkish moves by the ECB. She told the European Parliament that big monetary policy tightening would not be necessary as inflation would return to 2%.

GBP/USD -0.12% at 1.3522

EUR/USD -0.3% at 1.1409

Oil eases from 7 year high on US – Iran progress

Oil prices are heading lower as attention turns to the US – Iran nuclear talks. Progress in the talks could mean that sanctions on Iranian oil are lifted and more supply floods the market.

This would come at a time which tight supply and solid demand has driven oil prices to the highest level in 7 years. Whilst OPEC+ have increased the supply quota the price continued rising amid doubts that the upwardly revised targets could be met.

Exports from Iran could begin rapidly if a deal is reached, the key word there being if. This is not the first time that the US and Iran have made progress in talks only for them to fall apart.

API data is due later

WTI crude trades -1.8% at $88.66

Brent trades -1.4% at $90.55

Learn more about trading oil here.

Looking ahead

21:30 API Crude oil inventories

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.