US futures

Dow futures -0.35 % at 35404

S&P futures -0.22% at 4497

Nasdaq futures -0.01% at 14167

In Europe

FTSE -0.7% at 7652

Dax -1.7% at 14577

Euro Stoxx -1.6% at 3922

Learn more about trading indices

Corporate earnings lift the mood

US stocks are set for a weaker start, extending losses from the previous session, amid concerns over a more aggressive pace to tightening monetary policy by the Federal Reserve and as earnings continue to come through.

All three main Wall Street indices closed sharply lower in the previous session after Fed Powell’s comments spooked the market. Fed Powell cemented expectations for a 50 basis point rate hike in May and raised the prospects of another outsized rate hike in June. Even some of the more dovish Fed policymakers are coming out supporting 50 or even 75 basis point hikes in the coming months. Higher interest rates dampen the growth outlook for corporate America and will hit consumers.

Looking ahead, the PMIs will be in focus. Expectations are for the composite PMI to tick higher to 58.1, up from 57.7 in March.

In corporate news:

Snap warned that high inflation could hit revenue growth. However, the social media platform also forecast DAU between 343 million- and 345 million in Q2, above the 340 million forecast.

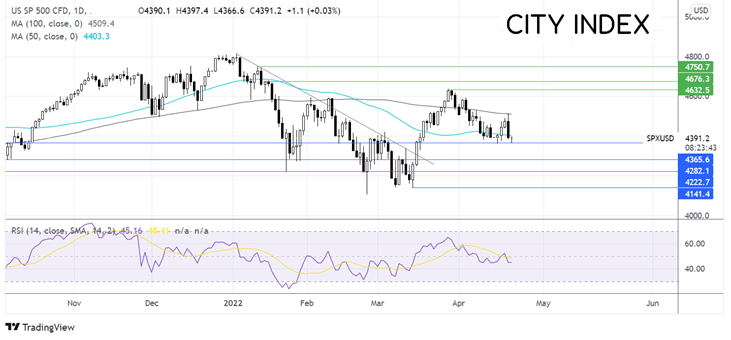

More news on the stocks to watchWhere next for the S&P500?

The S&P faced rejection at the 100 SMA and rebounded lower, falling through the 50 sma before finding support at 4365, the April 18 low. The long lower wick suggests that the price failed to find acceptance at the lower levels, and buyers have returned to the market, pushing the price higher. The price is currently testing the 50 sma; a move above here exposes the 100 sma at 4514 ahead of 4630, the March high. Meanwhile, sellers need to break below 4365 to extend declines towards 4300/4290 support.

FX markets USD rises, GBP tumbles.

USD is charging higher, extending gains from the previous session after Fed Chair Powell cemented expectations of a 50-basis point rate hike and a more aggressive approach to tightening policy towards the summer.

The pound is taking a hammering as a hat-trick of reports highlighting the damage that surging inflation is having on the UK economy. Retail sales were significantly weaker than forecast, which is not surprising considering that consumer confidence plunged to the lowest level since the financial crisis and the S&P global PMI for both services and the whole economy fell to a 3-month low.

Weaker data across the board is sounding alarm signals for UK growth. The cost-of-living crisis is dragging on the economy, yet with inflation expected to rise higher, the outlook is bleak.

This clearly puts the BoE in a very challenging position where they rise, tipping the UK economy into recession if they tighten monetary policy too aggressively to tame 30-year high inflation. The central bank may hike again in May, but any hikes beyond there look doubtful – a very different position to the Fed, which is looking to hike rates faster.

The pound crashed below 1.29 to trade at its lowest level since November ’20.

GBP/USD -1.1% at 1.2890

EUR/USD -0.214% at 1.0818

Oil falls 4% this week

Oil prices are heading lower on Friday, dragged down by the prospect of weaker global growth, a higher interest rate environment, and tighter COVID restrictions in China, overshadowing Russian supply concerns.

This week demand concerns have dominated as the IMF slashed its global growth outlook, Fed chair Powell also signaled an aggressive path to policy normalization, which dampens the growth outlook further, and China has ramped up measures to curb the latest COVID outbreak.

Despite the 4% fall across the week, $100 still offers firm support and is unlikely to be meaningfully breached just yet.

Let’s not forget that supply is expected to be tight in May, which will keep prices elevated, and it will only take a sign that the EU is ready to impose a ban on Russian oil to send the price back up to $100.

WTI crude trades +0.81% at $102.70

Brent trades +1.07% at $107.70

Learn more about trading oil here.

Looking ahead

14:45 US PMIs

15:30 BoE’s Andrew Bailey speaks

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.