US futures

Dow futures -0.12% at 30475

S&P futures -0.16% at 3690

Nasdaq futures -0.5% at 11060

In Europe

FTSE -0.17% at 6920

Dax -0.3% at 12712

Learn more about trading indices

Tesla disappoints

US stocks are set to open lower as investors continue to digest the latest corporate earnings and as jobless claims unexpectedly improve.

Jobless claims dropped to 214k, down from a downwardly revised 226k and well below forecasts of 230k. The data indicates that the labour market remains tight even as demand cools and interest rates rise. The labour market has been resilient, which could embolden the Fed to keep hiking rates aggressively – which is bad news for stocks.

Fed speakers yesterday, including Lorretta Mester and Neel Kashkari were clear on the Fed’s path to continue hiking interest rates. While core inflation is still rising, the US central bank can’t pause hikes.

Three more Federal Reserve speakers are due to hit the airwaves later today.

Meanwhile, corporate earnings are coming through at a speed.

Corporate news:

Tesla falls after mixed results and warning that it doesn’t expect to reach full-year deliveries. Q4 deliveries are unlikely to arrive at the 50% required. Meanwhile, EPS was above forecasts at $1.05, vs $1.01 forecast. Revenue was short of estimates at $21.45 billion.

AT&T rises on after reporting EPS of $0.68 on revenue of $30 billion. This was higher than the consensus of $0.61 on sales of $29.87 billion. The company also added that it was on track to achieve $4-$6 billion in run rate cost savings.

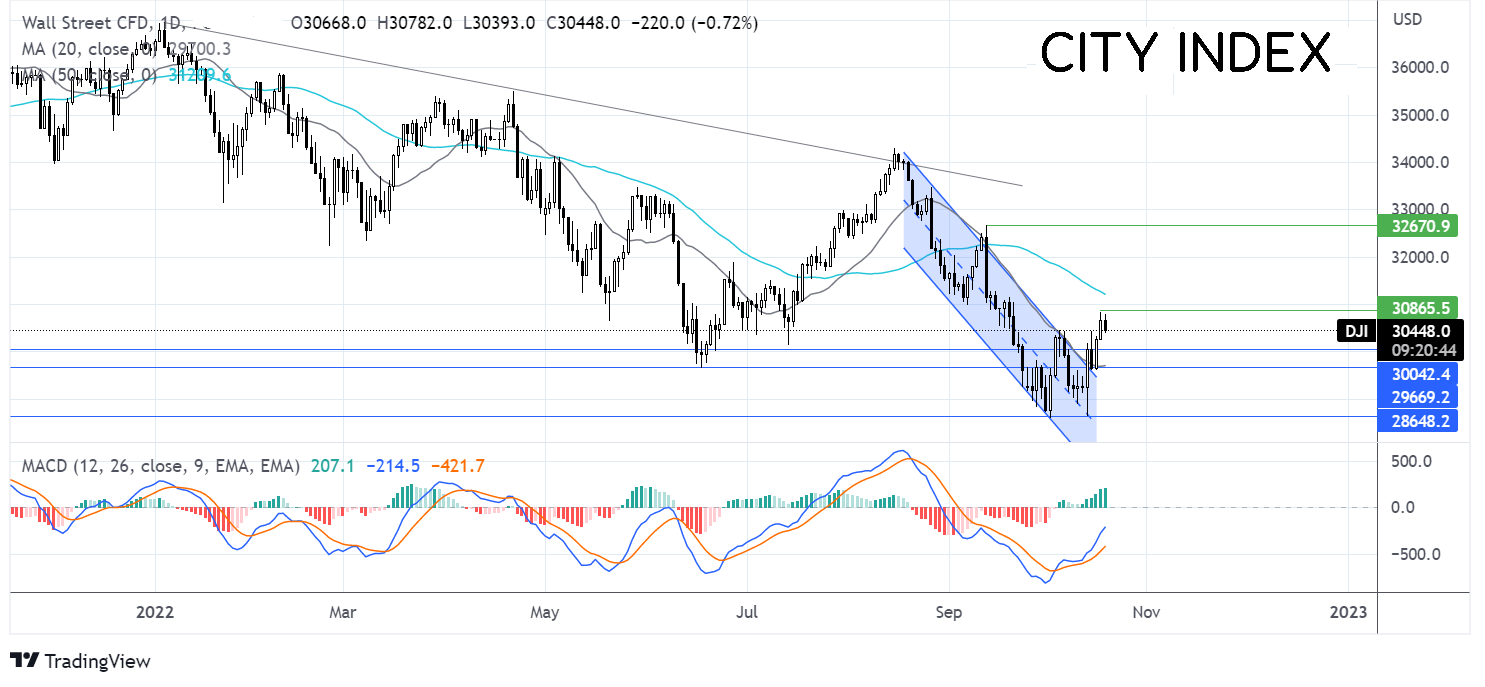

Where next for the Dow Jones?

The Dow Jones has rebounded off the October low of 28600, re-taking the 20 sma, the 3000 psychological level, and rising above the falling channel. The price ran into resistance at 30840 yesterday and is falling today. The bullish MACD is keeping buyer’s hopeful, although a rise over 30840 is needed to expose the 50 sma at 31200. Meanwhile, sellers will look for a move below support at 30,000, to open the door to 29700, the June low, and bring 28600 back into target.

FX markets – USD falls, GBP rises

The USD is falling after solid gains in the previous session. The greenback rallied on hawkish Fed chatter. WUS treasury yields are rising so any losses in the greenback could be capped.

EUR/USD is rising, capitalizing on the weaker USD. German wholesale inflation remained steady at 45.8%, expectations had been for a fall to 44.7%. PPI is considered a lead indicator for CPI, which suggests that CPI will keep rising. The ECB rate decision is next week

GBPUSD is rebounding, rising off session lows after PM Liz Truss resigned. After just 45 days in power, one of the shortest tenures in UK history, the floor will once again been opened with the next leader due to be selected in one week. The pound relief rally comes as Trusonomics comes to an end. The big question is, who is prepared to fill the position? Former Chancellor Rishi Sunak has said initially he is not interested. If the candidates take too long to appear the pound could get nervous.

Oil rises further

Oil prices are rising for a second straight session. Oil rallied 3% on Wednesday and trades over 1.5% higher today.

News that China is considering reducing its quarantine period for inbound visitors is helping to boost prices. China, the largest importer of oil has stuck rigidly to its zero-COVID measures despite the economic cost. An easing of restrictions could help the demand outlook for oil.

Oil markets are set to rise across the week after steep falls last week as recession fears hurt the demand outlook.

WTI crude trades +1% at $82.90

Brent trades +0.63% at $89.70

Learn more about trading oil here.

Looking ahead

N/A