US futures

Dow futures -0.40% at 31860

S&P futures -0.43% at 3940

Nasdaq futures -0.65% at 12250

In Europe

FTSE +0.61% at 7347

Dax -0.5% at 13122

Euro Stoxx +0.5% at 3585

Learn more about trading indices

Walmart’s warning hits retailers, energy stocks to rise

US stocks are set to start the day lower after Walmart spooked the retail sector with a profit warning amid increasing signs that consumers were reining in their spending as they contend with multi-decade high inflation.

The after-the-bell warning comes as US earnings season ramps up in the busiest week of earnings season. In addition to inflation concerns, USD strength is also likely to be a hot topic, with 40% of S&P500 revenue earned abroad.

The USD rose to a 20-year high earlier this month ahead of the Federal Reserve rate announcement on Thursday. The two-day meeting kicks off today. The Fed is widely expected to hike rates by 75 basis points.

Separately mining and energy firms are expected to outperform as commodities rise after EU counties agreed to cut their gas use on fears of a complete cut-off from Russian gas supplies in the not-so-distant future.

Looking ahead, US consumer confidence is expected to show that consumer confidence fell again in July to 97.2, down from 98.7.

In corporate news:

Walmart falls 9.6% after cutting its full-year profit outlook by 13% as surging inflation sees US consumers changing habits by buying less profitable groceries.

Coca-Cola rises 1.3% pre-market after the drinks giant raised its full-year revenue growth forecast as demand stays strong even as price hikes are passed on to the consumer.

Looking ahead, Microsoft and Alphabet are due to report after the closing bell.

What to expect from Microsoft’s earnings?

What to expect from Alphabet’s earnings?

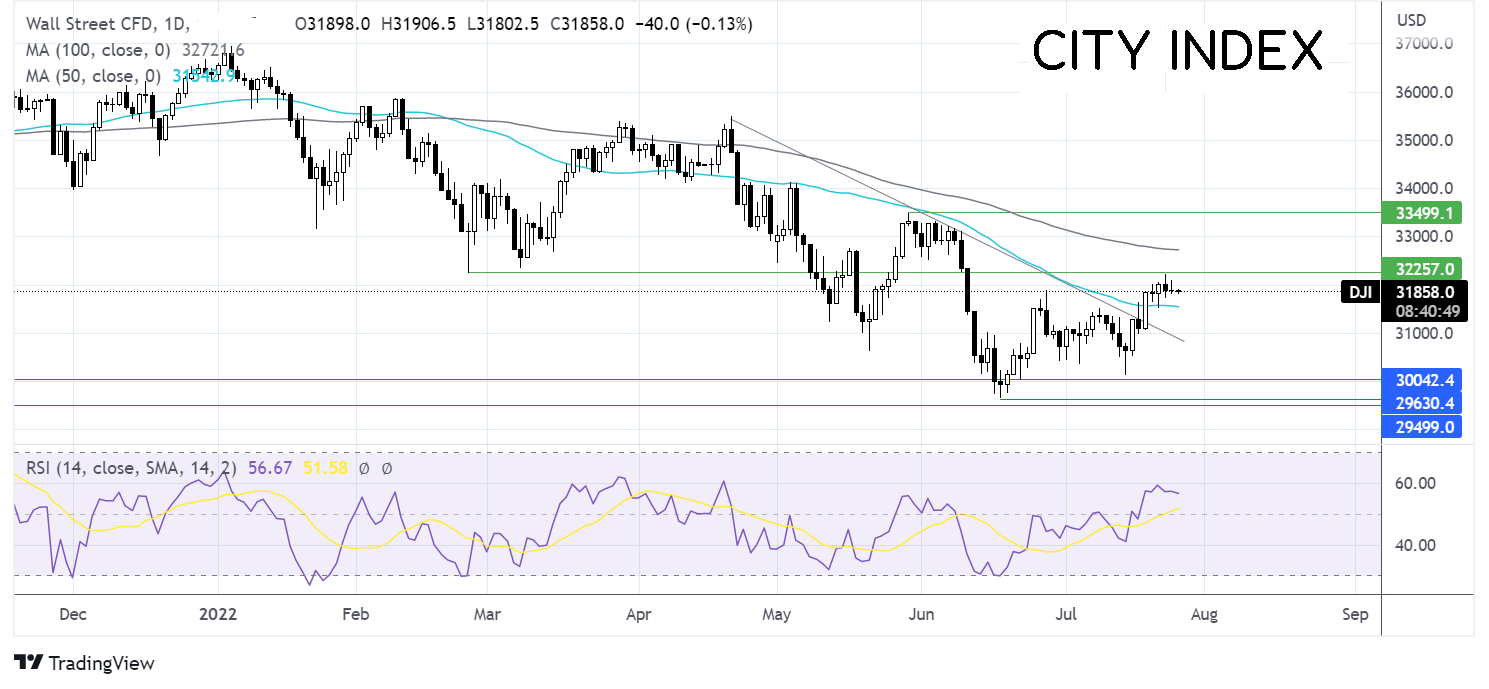

Where next for the Dow Jones?

After extending its recovery from the 2022 low of 29630, the Dow Jones ran into resistance at 32250, the February 24 low, and is easing lower. The price is supported by the 50 sma, which along with the bullish RSI, keeps investors hopeful of further upside. The price needs to break above 32250 to continue the bullish trend and expose the 100 sma at 32725, and brings 33500, the June high, into play. On the flip side, failure of the 50 t; hold could see the price back towards 31000, the falling trendline resistance.

FX markets – USD rises, EUR tumbles.

USD is rising firmly on a combination of safe haven demand and hawkish expectations as the US 2-day FOMC meeting kicks off today.

EURUSD is falling steeply on the news that the Nord Stream 1 pipeline will operate at just 20% capacity from Wednesday. EU energy ministers have voluntarily agreed to cut gas by 15% from August to March. The move has seen gas prices soar, which will keep inflation in the bloc high and could accelerate the move into a recession.

GBP/USD is falling on risk-off flows and as political uncertainty continues in the UK. The leadership race will continue until 5th September, when a leader will be announced.

GBP/USD -0.5% at 1.1979

EUR/USD -0.9% at 1.0130

Oil extends its rise.

Oil prices are rising for the second consecutive day on Tuesday amid increasing fears that Russia’s slowing supply of natural gas to Europe could prompt a switch to crude oil. Yesterday, Russia-owned state-owned Gazprom announced that gas flows through the Nort Stream 1 pipeline would be reduced to just 20% of capacity owing to what they say is a technical issue.

As a result, European countries will struggle to refill natural gas storage ahead of winter. As a result of Russia’s squeeze on gas, higher prices could well result in a switch from gas to oil, supporting oil prices.

Meanwhile, with recession fears rising, the deteriorating demand outlook as recession fears rise could help keep a lid on oil price rises.

The gap between the price of European and US oil benchmarks has widened to levels last seen in June 2019 amid easing gasoline demand in the US, which weighs on US crude prices, and tight supply In Europe supports Brent.

WTI crude trades +1.7% at $98.00

Brent trades +1.6% at $102.34

Learn more about trading oil here.

Looking ahead

15:00 US consumer confidence

15:00 New Home Sales