US futures

Dow futures -0.43% at 35183

S&P futures -0.56% at 4607

Nasdaq futures -0.6% at 15150

In Europe

FTSE +0.1% at 7540

Dax -1.5% at 14580

Euro Stoxx -1.2% at 3945

Learn more about trading indices

Stocks drop, oil rallies

Stocks on Wall Street are pointing to a weaker open after strong gains in the previous session. Optimism surrounding the Russia, Ukraine peace talks boosted risk appetite yesterday, lifting stocks and pulling oil prices lower. Today as that optimism fades, stocks are falling.

The Kremlin has said that there is no sign of a breakthrough in talks yet, pouring cold water on yesterday’s relief rally. Yesterday Russia had vowed to cut its military activity around Kyiv, but this has yet to be translated into action on the ground.

Concerns over the war, rising energy prices, and surging inflation have hit sentiment in the first quarter of the year.

Data wide, ADP data revealed that 455K jobs were added in the private sector in March, roughly in line with estimates of 450k. The US labour market remains tight, and the data bodes well for an upbeat non-farm payroll on Friday.

However, US Q4 GDP was 7.1% QoQ, slightly short of the 7.2% forecast but still up firmly from 5.9% previously.

In corporate news:

Micron Technologies rises over 3% premarket following a solid forecast for the current quarter, indicating that demand for memory chips from data centres remains strong.

BioNTech rises 7% premarket after beating Q4 estimates, helped the strong COVID vaccine sales and also announced a special dividend and a $1.5 billion share buyback programme.

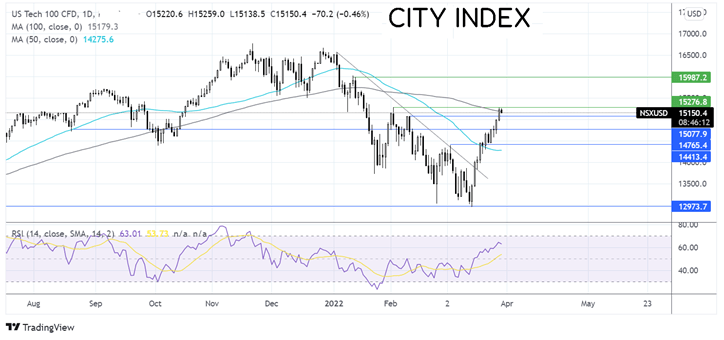

Where next for the Nasdaq?

The NASDAQ has extended its rebound from the 12950 March low. It has retaken the 50 SMA and ran into resistance at 15275, the February 2nd high and a potential double top formation. The RSI supports further upside, although the 4-hour chart shows overbought, so today’s selloff could also be technical. Buyers will need to recapture 15200 to target 16000 the January 12 high. Should momentum slow, the NASDAQ could fall back to test 15070, the Feb 10 high and 14700, a level that has offered support and resistance on several occasions across the past six months.

FX markets USD drops, EUR extends gains

USD is trading sharply lower for a second straight session. USD was out of favour on safe-haven outflows yesterday, with the selling coming across today, despite equity markets falling.

The euro continues to charge higher, building on gains from yesterday on optimism of a diplomatic solution to the war. Investors have looked past falling economic sentiment in the region. German inflation rose to 7.6% YoY in March, well above the 5.5% registered in February.

GBP/USD rises for a second day on USD weakness and as investors shrug off a cautious sounding BoE vice Governor Broadbent. Broadbent said that the interest rate outlook was unpredictable given the shocks that the UK economy is experiencing.

GBP/USD +0.5% at 1.3156

EUR/USD +0.4% at 1.1130

Oil rebounds on tight supply concerns

After falling 8% across the first two days of this week, oil prices are rebounding higher on tight supply and potential new sanctions on Russia.

Despite suggestions that peace talks made progress yesterday, the fact that oil is rising today suggests that the market is far from convinced that war is ending soon.]

Furthermore, concerns over more sanctions on Moscow are keeping oil prices supported. So far, Europe is split over whether to apply sanctions on Russian oil.

API data revealed that crude stockpiles fell by 3 million barrels; this was three times the expected draw, highlighting how tight the market is. EIA data is due later.

OPEC+ are due to meet tomorrow and are not expected to ride to the rescue, considering that there is sufficient supply and that this is a geopolitical problem.

WTI crude trades +2.17% at $106.14

Brent trades +2.2% at $110.07

Learn more about trading oil here.

Looking ahead

15:30 EIA crude oil inventory

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.