US futures

Dow futures -0.15% at 33670

S&P futures -0.3% at 3979

Nasdaq futures -0.6% at 11740

In Europe

FTSE +0.45% at 7358

Dax +0.4% at 14294

Learn more about trading indices

Fed still has much work to do

US stocks are heading set for a softer start to the week after surging across the previous week. While cooler inflation data sent stocks soaring last week, as investors priced in a less aggressive Fed, today, a more cautious tone is dominating following a warning from Fed Governor Christopher Waller.

Waller warned over the weekend that the market shouldn’t get carried away with one data point and that the Fed still has much work to do to rein inflation. His words tamed last week’s optimism which had resulted in the Nasdaq rising 8% and the S&P closing up almost 6%.

Today the economic calendar is quiet. Attention this week will be on US retailers, with the likes of Walmart, Target, Lowe’s Home Depot, Macy’s, and Kohl’s all set to release earnings this week, as well as the latest retail sales data. The data will provide solid insight into the health of the consumer as inflation remains elevated and interest rates rise.

Earlier today, President Biden had his firth face to face meeting with China’s Xi Jinping, looking to stabilize the relationship.

Corporate news:

Tyson Foods is rising after the packaged food producer forecast full-year sales above estimates suggesting that demand remains strong even though inflation is at multi-decade highs.

Tesla falls pre-market after Elon Musk says he has too much work on his plate. His comments come as he looks to turn Twitter around and raises fears that Tesla could suffer.

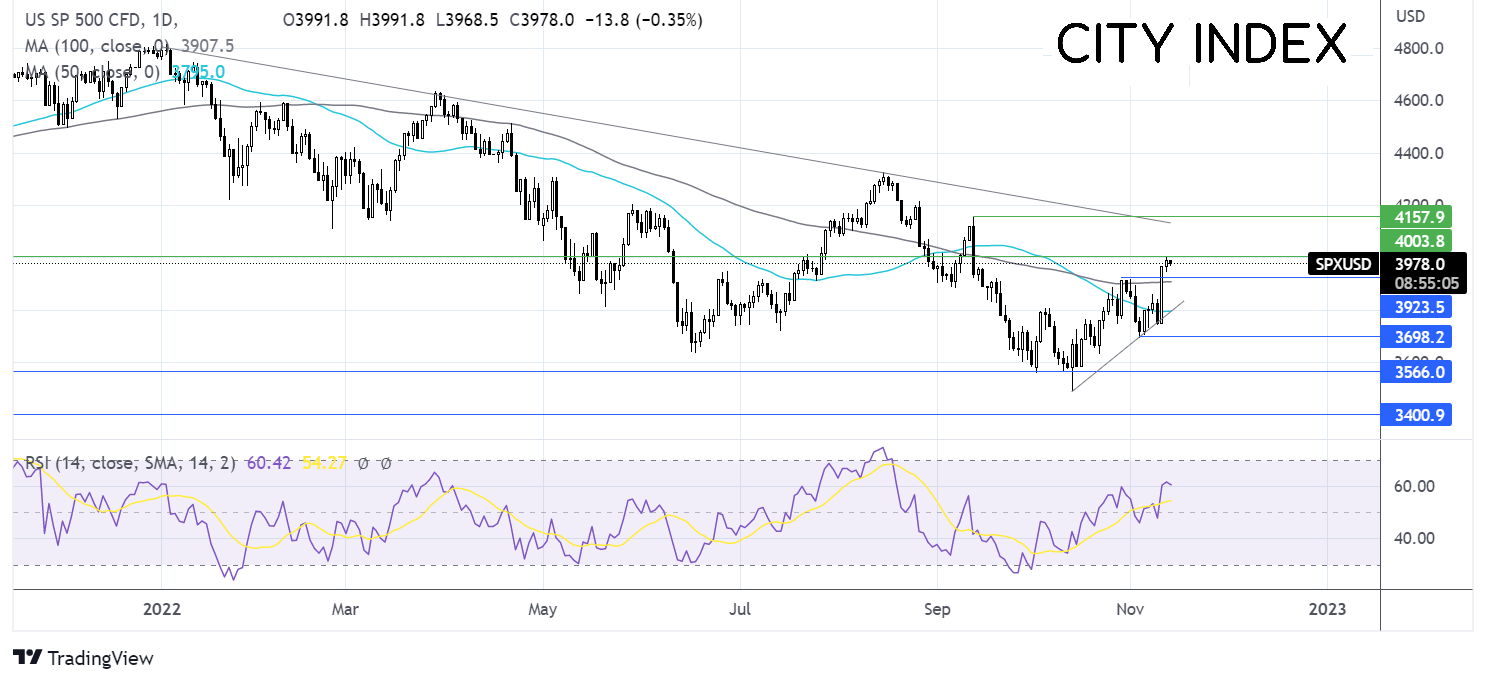

Where next for the S&P500?

The S&P5000 Is struggling to push over resistance at 4000, the psychological level. The price has pushed over the 50 & 100 sma, and the RSI is bullish, keeping buyers hopeful of further gains. A move over 4000 is needed to extend the bullish trend to 4130, the falling trendline resistance, and 4150, the September high. On the flip side, sellers could look for a move below 3900 the 100 sma to open the door to 3800 the 50 sma and rising trendline.

FX markets – USD rises, GBP falls.

The USD is edging higher after losing over 4% last week. The greenback is being lifted by hawkish comments from Fed Governor Chris Waller, who suggested that the Fed still had much work to do to tame inflation.

EURUSD is falling towards 1.03 despite stronger-than-expected industrial production data. Investors are shrugging off the 0.9% rise in industrial output in September. The euro is struggling for find demand in the risk-off environment.

GBPUSD is falling as investors look ahead to the Chancellor’s Thursday budget. Fears are growing that Hunt could tighten fiscal policy too far with tax hikes and spending cuts that pro-long a recession in the UK.

GBP/USD -0.45% at 1.1757

EUR/USD -0.25% at 1.0330

Oil falls as China COVID stays in focus & OPEC cuts demand growth outlook

After losing almost 4% last week, oil prices are heading lower again on Monday as COVID cases in China keep rising; OPEC cuts its demand outlook a stronger USD adds to headwinds.

OPEC cut its 2022 global demand growth for a fifth straight time in just six months as economic challenges mount. OPEC now sees demand in 2022 increasing by 2.55 million bpd, or 2.6%, down 100k barrels from the previous report.

USD strength is pulling oil and commodities across the board lower. A stronger USD makes oil more expensive for buyers with foreign currencies, denting demand.

However, COVID in China remains a key theme. With cases soaring, any optimism that China could be about to exit the zero-COVID strategy seemed far-fetched right now. The market got ahead of itself on Friday after Health authorities eased some restrictions. With little clarity over the COVID picture in China, the market is jumping from one conclusion to another in a somewhat haphazard manner

WTI crude trades -1.5% at $87.14

Brent trades -1.4% at $94.14

Learn more about trading oil here.

Looking ahead

N/A

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade