US futures

Dow futures -0.5 % at 33211

S&P futures -0.7% at 4187

Nasdaq futures -0.96% at 13112

In Europe

FTSE +1.2% at 7536

Dax +1.5% at 14034

Euro Stoxx +1.64% at 3750

Learn more about trading indices

Stocks edge lower despite a strong jobs market

US stocks are set to open roughly flat after a steep selloff in the previous session and better than expected non-farm payroll data.

Stocks dropped sharply yesterday with the Nasdaq plunging 5%, paring the 3% gains from the previous session, and more. Fears over rising inflation, and a hawkish Fed, curbing growth dragged stocks southwards yesterday. Those fears continue to hit sentiment today, despite the upbeat headline jobs number.

Data showed that 428k jobs were added in the US in April, well above the 390k forecast and in line with March’s revised print. Unemployment remained steady at 3.6%. Strong jobs growth shows that surging inflation and rising interest rates still haven’t had any impact on the labor market. But it is still early days. The Fed tightening monetary policy will turn into a headwind for the jobs market.

The market has shrugged off a slowdown in average wages. Average hourly wages fell 0.3% MoM after rising 0.5% in March. However, with 11.5 million job vacancies, around 1.5 for every person unemployed, pressure on wages is likely to stay.

Looking ahead, there is no more high-impacting data due for release. Attention will shift to the Fed’s Williams, who is expected to speak shortly.

In corporate news:

Under Armour plunges 16% pre-market after unexpectedly posting a loss in quarterly earnings and forecasts a lower full-year profit as it struggles with supply chain difficulties and a hit from more lockdown restrictions in China.

More news on the stocks to watch

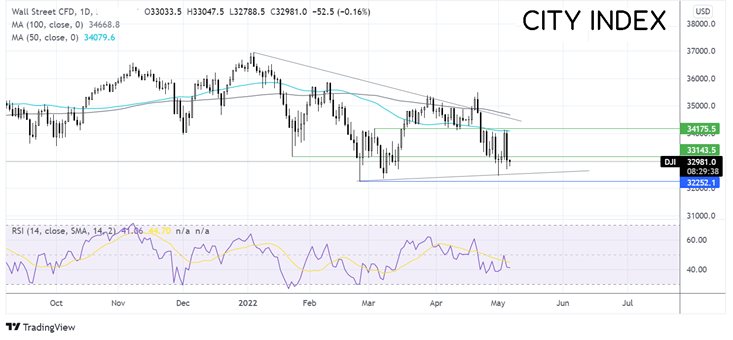

Where next for the Dow Jones?

The Dow Jones trades below its multi-month falling trendline and its 50 & 100 sma. Failure to break above the 50 sm, combined with a fall below 33150 support and a bearish RSI, keeps sellers hopeful of further downside. A break below 32550 rising trendlines could open the door to 32280, the 2022 low, and continue the bearish trend. Buyers will look for a move over 33150 to make another attempt on 34000 the 50 sma to create a higher high.

FX markets USD steadies, GBP extends the decline

USD pauses for breath after a 1% surge in the previous session. US Dollar index rallied to a 20-year high in early trade before edging lower.

GBP/USD fell 2% yesterday and is falling again today after the BoE raised interest rates yesterday and warned of double-digit inflation and a contraction in 2023. Stagflation and recession fears continue to drive the pair lower, which is unsurprising given that the BoE gave the gloomiest outlook of any major central bank this year.

EUR/USD is rebounding after steep losses yesterday and despite German industrial production falling by much more than expected -3.90%. Momentum appears to be building at the ECB for a rate hike in July, which is helping to support the pair.

GBP/USD -0.13% at 1.2340

EUR/USD +0.3% at 1.0570

Oil extends gains on EU embargo, OPEC+ in focus.

Oil trades higher for a third straight day and is set for a second straight week of gains as supply fears continue to hound the market amid the looming EU sanctions on Russian oil. These concerns are overshadowing worries over slowing global growth.

The EU still needs to convince Hungary and Slovakia before a final vote. The proposed deal to phase out Russian oil will almost certainly need to be tweaked to get the reluctant states onboard.

The prospect of an EU ban comes as OPEC+ refuses to be drawn into the mix. The oil cartel hasn’t deviated from their previous agreement to raise output only very slightly in the coming month. Even then, the actual increase is even more minor, given the group’s continual failure to reach output targets.

Meanwhile, concerns over the health of the global economy are capping gains. COVID lockdown continues in China, and the BoE warned of recession.

WTI crude trades +1.7% at $109.35

Brent trades +1.4% at $113.40

Learn more about trading oil here.

Looking ahead

N/A

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade