US futures

Dow futures -0.4% at 33630

S&P futures -0.5% at 3945

Nasdaq futures -0.5% at 11559

In Europe

FTSE -0.27% at 7479

Dax +0.2% at 14337

Learn more about trading indices

Core PPI is higher than forecast

US stocks are set for a weaker open after stronger-than-forecast PPI data raises questions over the extent to which the Federal Reserve can ease back from its aggressive monetary policy stance.

Data across this week has broadly been stronger than expected. US nonfarm payrolls showed stronger job creation and higher wages, and the ISM services PMI was also ahead of forecasts, as were factory orders. With PPI also moving southwards at a slower pace than unexpected, the US central bank is likely to be more cautious about adopting a less hawkish stance towards monetary policy.

The data suggests that the market has once again gotten ahead of itself and the road to target-level inflation is likely to be a very long one.

Looking ahead, investors were now focused on the University of Michigan consumer confidence data which is expected to show that consumer morale fell in December. The consumer confidence index is expected to fall to 53.3, down from 56.8 in November. Weakening consumer confidence would support a less hawkish stance from the Federal Reserve.

Corporate news:

Netflix rises 2.9% after US bank Wells Fargo upwardly revised its stance on the streaming giant to overweight up from equal weight, fighting a clear improvement in content.

DocuSign trades 11% higher premarket after beating expectations for both earnings and revenue in the third quarter.

Costco falls 0.6% after missing first-quarter expectations as surging inflation meant consumers reined in spending and operating expenses jumped.

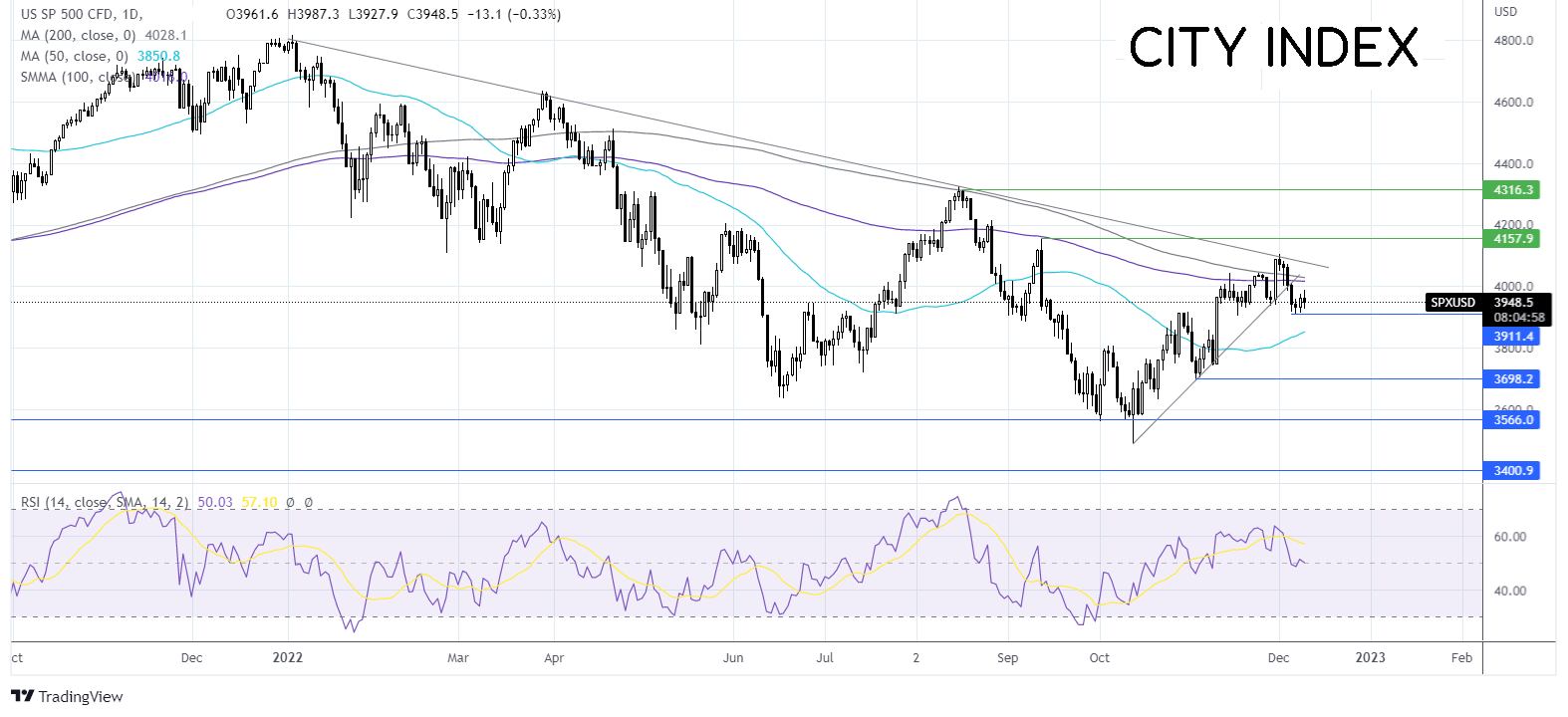

Where next for the S&P500?

After running into resistance at 4100, the multi-month falling trend line, the S&P500 slipped lower, falling below the 100 & 200 sma. The price has since found support at 3910 and is rising. The RSI supports further gains. Buyers will look for a rise over 4015/30 the 100 & 200 sma to bring 4100 back into focus, with a rise over here creating a higher high. Sellers could look for a fall below 3900 to expose the 50 sma at 3850.

FX markets – USD rises, GBP jumps

The USD is rising, recovering from session lies after PPI inflation missed forecasts. Hotter-than-expected inflation supports a more hawkish Federal Reserve.

EURUSD trades flat amid a lack of fundamental drivers, which means the euro is struggling for direction. The ECB meet next week to discuss monetary policy and is expected to raise interest rates by 50 basis points amid the ongoing battle against inflation.

GBP/USD trades higher for a third straight day after data showed that inflation expectations had crept higher to 3.4% in two years’ time, up from 3.2%. Higher inflation expectations raise the risk of inflation becoming embedded in the economy. Expectations of a hawkish Bank of England meeting next week are also driving the pound higher

GBP/USD +0.20% at 1.2287

EUR/USD +0.01% at 1.0550

Oil drops 10% this week

Oil prices are edging higher today but are still set to fall over 10% across the week in the worst weekly performance since March. Worries over a weakening global economic outlook is hurting the demand outlook. The U.S. economy is expected to fall into a recession next year which will hurt oil demand and a recent spell of bad data from China suggests that the road to recovery from zero Covid be long.

These factors have overshadowed a potential tightening of supply as the G7 price cap on Russian oil came into effect this week and also any optimism surrounding the easing of COVID curbs in China.

Brent is in contango, which indicates we could demand as contracts for near-term delivery are cheaper than delivery in six months.

WTI crude trades +0.6% at $72.00

Brent trades at +0.3% at $76.56

Learn more about trading oil here.

Looking ahead

15:00 University of Michigan consumer confidence

18:00 Baker Hughes rig count