US futures

Dow futures +0.50% at 31910

S&P futures +0.93% at 3916

Nasdaq futures +1.5% at 12269

In Europe

FTSE +0.51% at 7360

Dax +0.65% at 13190

Euro Stoxx +0.85% at 3605

Learn more about trading indices

Microsoft & Alphabet impress

US stocks are set to open on the front foot boosted by earnings ahead of the Federal Reserve interest rate decision.

Better than expected numbers from the likes of Microsoft and Alphabet helped calm a jittery market after Walmart’s profit warning yesterday.

The tech-heavy index, the Nasdaq, is leading the charge higher after being the worst-hit major index across the year on fears of the Fed hiking rates aggressively.

The Fed is expected to raise interest rates by 75 basis points, which has been reined in from expectations of 100 basis points just a few weeks ago. Attention will also be on what the Fed is planning for September? A 50 basis point hike or a 75 basis point hike?

How worried the Fed is over a recession is likely to be key. Should the Fed show that it won’t be knocked off course by some areas of weakness in the economy the USD could surge and stocks tumble.

Prior to the Fed announcement US durable goods orders unexpectedly rose by 1.9% in June, up from 0.8% and well ahead of forecasts of -0.2%

In corporate news:

Microsoft is rising pre-market after the tech giant forecast revenue this year would grow by double digits as demand for clouds computing ramped up.

Alphabet rose 3.6% following Q2 sales from Google beating forecasts boosting optimism surrounding the full year outlook. The fact that advertising revenue at Google remains strong, after Snap’s disappointment last week is being cheered.

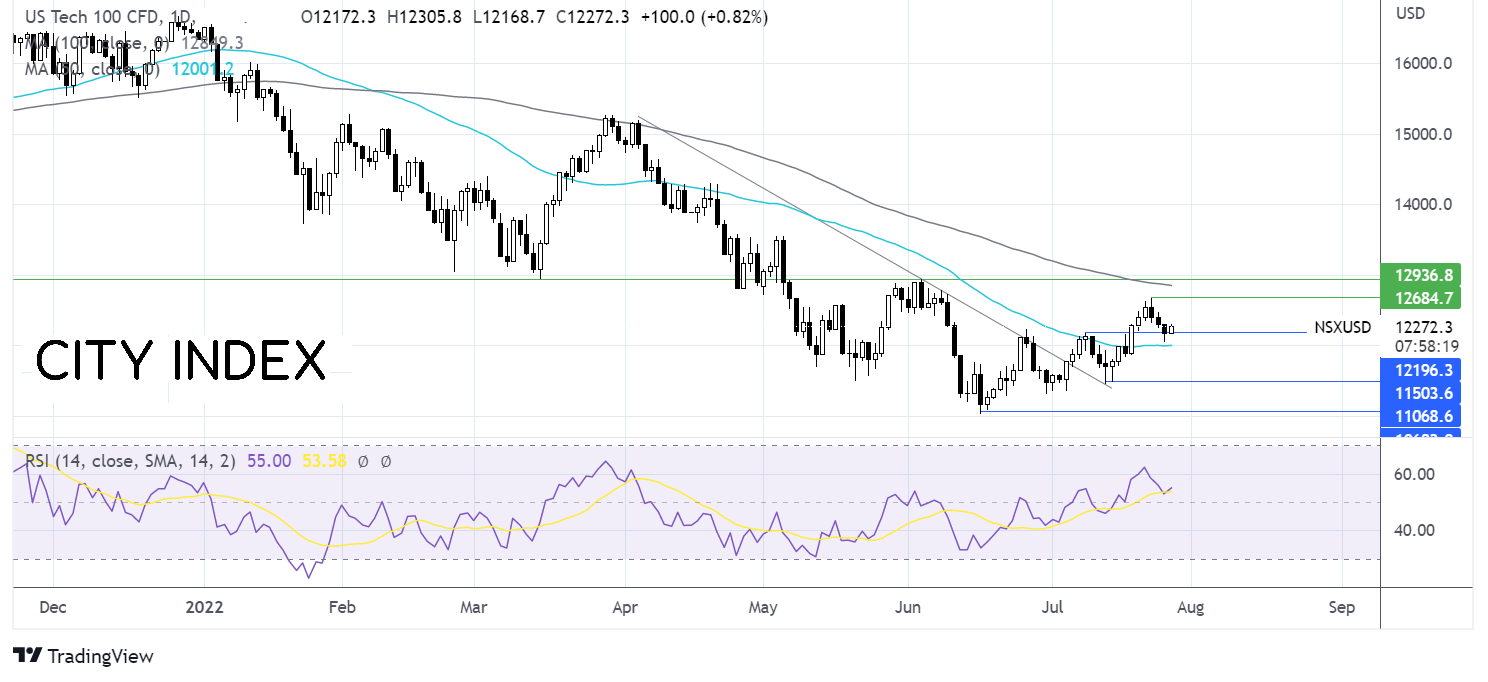

Where next for the Nasdaq?

The Nasdaq’s rebound from 2022 lows ran into resistance at 12670 and has eased lower. The price trades caught between the 50 and 100 sma and the RSI is in bullish territory, indicating that there could be more upside to come. Buyers will look to rise above 12670 horizontal support, exposing the 100 sma at 12850 and the June high of 12950. Sellers could look for a move below the 50 sma at 12000, with a move below here opening the door to 11500.

FX markets – USD falls, EUR rises.

Yesterday’s USD rally has lost steam today as investors await cautiously for the Federal Reserve rate decision. Still, the USD is trading just off 20-year highs but investors are broadly on the sidelines waiting for fresh clues from Fed Chair Jerome Powell.

EURUSD is rebounding after steep losses yesterday. However, the rise in the EUR is likely to be capped owing to dismal data and worries surrounding gas supply. GFK German consumer confidence slumped to a record low as food and energy prices surge

GBP/USD is rising on the back of the weaker USD and despite weaker data. Recent reports show that employers are the most pessimistic about hiring and investment opportunities since the depths of the COVID pandemic.

GBP/USD +0.3% at 1.2067

EUR/USD +0.3% at 1.0150

Oil rises after inventories drop

Oil prices are heading higher following reports that US inventories fell sharply in the US and amid cuts to Russian gas flows to Europe.

According to the API, US crude oil inventories fell by 4 million barrels, four times the amount forecast. The markets will be watching the EIA data due out later today, for confirmation.]

An announcement from Gazprom that gas supplies are being cut along the Nord Stream pipeline to just 20% of capacity from today is helping to support prices across the energy complex.

Attention will also be on the Federal Reserve, as demand concerns have also been in play in recent sessions as recession fears rise. Hawkish noises from the Fed could reignite those recession fears and pull oil lower. Conversely, if the Fed looks like it’s starting to ease its hawkish stance then we could see a relief rally in oil prices.

WTI crude trades +1.17% at $95.52

Brent trades +1.06% at $100.64

Learn more about trading oil here.

Looking ahead

15:00 US pending home sales

15:30 EIA oil stockpiles

19:00 FOMC rate decision

19:00 FOMC rate decision