KEY TAKEAWAYS:

- The US CPI report for January will be released at 8:30ET (13:30 GMT) on Tuesday.

- Traders and economists are projecting headline CPI to come in at 6.2% y/y, with the core (ex-food and -energy) reading expected at 5.4%.

- The US CPI report is now THE single economic release with the largest expected market movement, so traders should be sure to prepare.

When will the US CPI report be released?

The US CPI report for January will be released at 8:30ET (13:30 GMT) on Tuesday.

What are traders expecting from US CPI?

Traders and economists are projecting headline CPI to come in at 6.2% y/y, with the core (ex-food and -energy) reading expected at 5.4%.

US CPI preview

As Federal Reserve Chairman Powell and his band of merry central bankers have been eager to emphasize in recent weeks, the “disinflation process” has undoubtedly begun…but that doesn’t mean that the Fed’s job is done. The central bank wants to see inflation fall closer to its 2% target before waving the “mission accomplished” flag, and this CPI report marks a critical checkpoint along the way.

Looking at implied volatility in the options market, the US CPI report is now THE single economic release with the largest expected market movement, so traders should absolutely have this release marked with the bullet on their calendars.

In terms of the components of CPI to watch, used car prices will be the wild card. After falling sharply in recent months, anecdotes suggest that used vehicle prices rose sharply in January, creating a potential upside risk for the headline report.

Separately, recent benchmark revisions to the December CPI report pushed the figure up to +0.1% from -0.1%, suggesting that price pressures may be relatively more entrenched than previously estimated, and if this CPI report reflects that view (above 6.5% / 5.5% core), we would expect risk assets like US indices and the Australian dollar to fall at the expense of bonds and the US dollar as traders start to price in an outside shot of a 50bps rate hike at the Fed’s next meeting in March.

Meanwhile, a softer reading (below 6.0% / 5.3% core) would validate the market’s view that price pressures are well and truly in remission, likely boosting the bullish case for risk assets and leading to selling in safe haven assets like the US dollar.

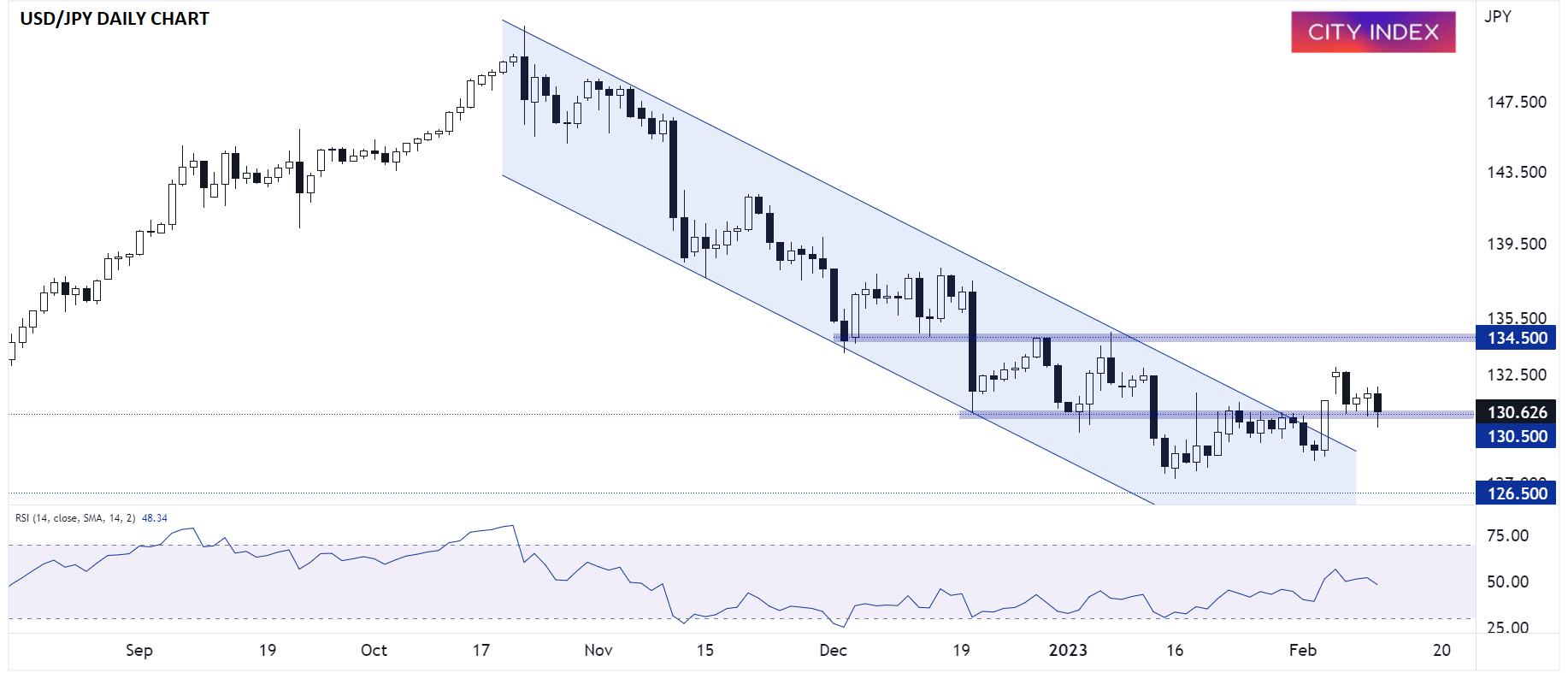

Technical view: USD/JPY

Speaking of the greenback, USD/JPY has clearly broken out of its multi-month bearish trend channel, raising hopes that it could now form an uptrend in the coming weeks. However, we would remind readers that the end of a downtrend doesn’t necessarily mean the immediate beginning of an uptrend; instead, prices could simply move sideways (or even trend lower at a slower pace!), especially if the CPI report is inconclusive.

To the topside, the February high just below 133.00 could be in play on hot CPI reading, with the year-to-date high at 134.50 worth watching above that. Meanwhile, a cooler-than-expected CPI print could quickly take USD/JPY back toward its February lows in the lower 128.00s.

Source: StoneX, TradingView

Regardless of how this month’s CPI report prints, it’s clear that we’re in a new regime where inflation data trumps all other releases, and traders who ignore this shift do so at their own peril.

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade