When is the UK Budget?

Chancellor Jeremy Hunt will unveil the Spring Budget on Wednesday 15th March, usually around 12:30pm.

What to expect?

This will be the first budget following former PM Liz Truss and her chancellor Kwasi Kwarteng’s budget in October, which unleashed chaos into the financial markets, sending gilt yields sharply higher and the pound to a record low against the USD.

Jeremy Hunt will be keen to make this a quieter affair after the wild market swings following last year’s mini-budget, with any major policy changes expected to be kept on hold until an election moves closer into view.

The latest public finances figures show that Jeremy Hunt secured a £30 billion windfall, thanks in part to higher than anticipated tax receipts in 2022/23. The lower headline inflation projections and lower debt interest, combined with borrowing undershooting the OBR’s forecast by £22 billion, are helping towards an improved near-term fiscal situation.

What to watch?

Growth forecasts

As is customary, the Office of Budget Responsibility will publish its updated economic and fiscal forecasts for the next 5 years.

The OBR could well upwardly revise its 2023 GDP growth forecasts after projecting -2% contraction at the end of last year. A stronger growth forecast could support the outlook for the pound, but a big reaction is not expected, particularly if the growth outlook over the next five years is revised lower.

As a result, there is little wiggle room for the Chancellor.

Public sector pay

There is huge pressure on the government to increase public sector salaries as teachers, nurses, and civil servants continue to strike over pay, hurting the economy. That said, higher wages would create inflationary pressures. A 5% pay increase would cost the government £4 billion and raises concerns of a wage inflation spiral. The BoE has highlighted strong wage growth as a cause for concern.

Pensions are also likely to be reviewed but are unlikely to see widespread reform.

Business tax

Corporation tax is due to rise to 25% on profits over £250,000 and a Hunt is expected to use the Spring Budget to set out a new capital allowance regime for businesses which could offset the sharp rise in corporation tax. There have also been reports that Hunt will dish out an £11 billion 3-year tax break by replacing the UK’s investment allowance with a temporary measure.

Energy

Gas prices have been falling, which means the cost of the current gas support has been falling Chancellor is expected to extend the energy price guarantee for three more months, keeping the price at £2500, rather than increasing it to £3000; this comes at a cost of £2.7 billion. However, this is a move which could be considered inflationary, giving households more disposable income. As a result, this could lift gilts and the pound higher. Given that gas prices are falling, this should just be for a short period of time.

Back to work

Chancellor Hunt is also expected to set out measures to encourage workers back to the workplace as the UK experiences a tight labour market. Currently, low unemployment is keeping wages rising higher. More workers in the jobs market could help ease this.

All in all, this is expected to be a peacemaker Budget that doesn’t bring many changes and the Chancellor will be hoping it doesn’t provoke much of a market reaction.

The pound will be the market to watch as a reflection of confidence in the UK economic outlook.

Where next for GBP/USD?

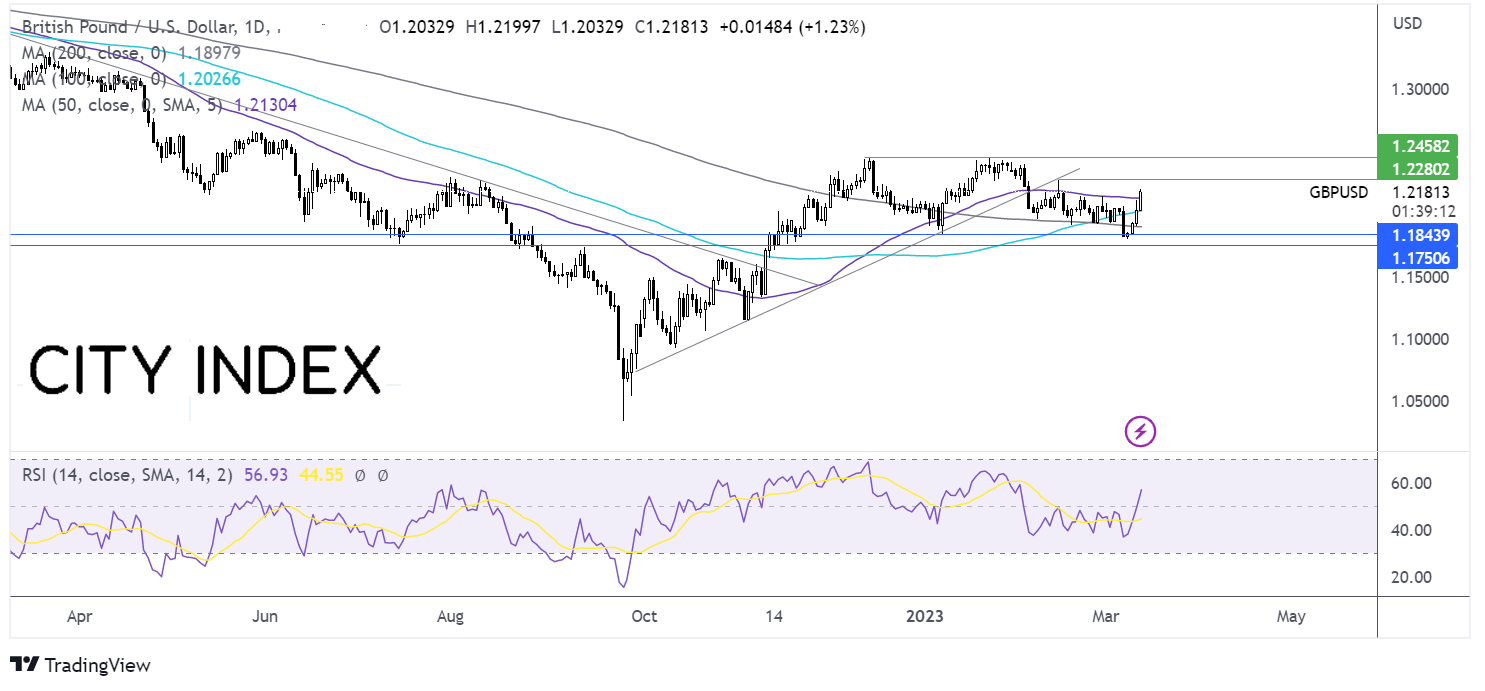

GBP/USD has rebounded from 1.1803, the 2023 low, rising above the 50, 100 & 200 sma, which, combined with the bullish RSI, keeps buyers hopeful of further upside. Buyers could look for a rise over 1.2270, the February 14 high, ahead of 1.2448, the 2023 high.

Failure to hold above the 50 sma, could see sellers test the 100 sma at 1.20. As long as the price holds above here, the uptrend remains in place. It would take a move below the 200 sma at 1.19 to open the door to 1.18 .

Stocks to watch ahead of the UK Spring Budget 2023

Let’s have a look at some stocks and sectors that could be worth watching when the budget is delivered.

Defence stocks

The war in Ukraine has not only heightened the need to bolster defences but has also eaten into inventories, with the UK having provided over £2.3 billion in military assistance to Ukraine since the invasion by Russia started over a year ago. Hunt has already conceded that defence spending needs to increase. That means the debate is over how much it will be raised.

A damning report in January from Sky News, citing unnamed sources, said a senior US general privately told UK defence secretary Ben Wallace that the British Army is no longer regarded as a top level fighting force, claiming the UK would run out of ammunition within days and would be unable to defend its own skies if it went to war. The report also suggested the country is struggling with aging armoured vehicles and would take too long to recruit and supply new divisions of war-ready troops.

Notably, the UK government is currently updating the Integrated Review of Security, Defence, Development and Foreign Policy and this is set to be highly influential on how much money is funneled to the military.

We have already seen the Ukraine war push up the price of some defence stocks such as BAE Systems and QinetiQ, suggesting the benefits from larger military budgets may already be priced-in. That would suggest a significant hike would be needed to provide further upside, gearing the risk to the downside should the defence budget disappoint.

Stocks to watch: BAE Systems, Rolls Royce, Babcock International, QinetiQ

Energy stocks

The windfall tax on oil and gas companies has not been regarded as a success so far. The levy has not raised as much money as hoped and behemoths like BP and Shell reported record profits last year whilst UK households struggled to keep the heating on.

That could prompt the chancellor to adjust or tighten the levy. The government wants to raise as much cash from the elevated profits of oil and gas producers, but it also needs to balance this with the need to nurture the UK’s oil and gas sector. Producers are able to offset the additional tax by investing more money into the UK, but this is also proving unsuccessful.

Harbour Energy, the largest producer of oil and gas in the UK North Sea, said just last week that the windfall tax ‘all but wiped out our profit for the year’ in 2022, prompting it to start investing more cash outside of the UK. Still, the company has managed to return $1 billion to shareholders since December 2021.

The big players like BP and Shell understandably grab the headlines concerning the windfall tax but, with operations spanning far beyond the boundaries of the UK, only a small proportion of their output is subject to the levy. The onus is therefore on smaller companies focused on the UK. Harbour Energy’s CEO Linda Cook said the levy ‘disproportionately impacted the UK-focused independent oil and gas companies that are critical for domestic energy security’.

The outcome of this week’s budget is geared toward the downside as there is not much the chancellor could announce that would be favourable for the industry, with the budget, if anything, likely to prioritise helping households in the current environment.

Stocks to watch: BP, Shell, Harbour Energy, Ithaca Energy, EnQuest, Serica Energy, Centrica

Housebuilders

The UK housing market is dealing with the most challenging conditions since the last financial crisis. Inflation has forced people to spend more money on essentials and save less, while higher interest rates have made getting onto the property ladder all the more difficult and expensive. This has seen demand slump and is prompting housebuilders to build fewer homes and develop less land in response, despite the fact that there is still a critical shortage of homes across the country.

There are some reports that there could be some tax cuts introduced to help revive demand by making it cheaper for those buying and selling property, which in turn would encourage builders to accelerate their development and be supportive for house prices.

Stocks to watch: Persimmon, Barratt Developments, Bellway, Redrow, Berkeley Group, Taylor Wimpey

Pub stocks

The government confirmed in December that alcohol duty rates would remain frozen until the Autumn budget in 2023. The Truss-Kwarteng budget had looked to raise levies on alcoholic beverages at the start of February but this plan was swiftly reversed. Treasury minister James Cartlidge said if any changes to alcohol duties are announced in the Spring Budget that they will not come into force until the start of August.

That is good news for pubs, although this will already be priced in. Therefore, an extension of the freeze or further measures would need to be announced for it to provide a tailwind for stocks.

Stocks to watch: JD Wetherspoon, Fuller Smith & Turner, City Pub Group, Mitchells & Butlers

Government contractors

Companies that conduct a lot of work on behalf of the government, such as construction and outsource firms, are always worth watching during the budget. Any increased investment or new growth initiatives can lead to more work for these firms, while any tightening in spending can starve them of new contracts.

Stocks to watch: Balfour Beatty, Capita, Kier Group, Mitie, Serco