DAX falls ahead of PMI & economic sentiment data

- German PMI is forecast to return to growth

- ZEW economic sentiment to continue improving

The DAX, along with its European peers is falling on Tuesday as investors await key economic activity data for the region.

The main focus will be on the flash PMI data for the eurozone and Germany. The German composite PMI is expected to show a return to growth in February, rising above the key 50 level, which separates expansion from contraction to 50.4, up from 49.9.

PMI is also expected to shave faster growth at 50.6, up from 50.3.

In addition to the business activity data, German ZEW economic sentiment is also expected to improve in February, rising to 22, up from 16.9. Upbeat data could help to ease recession fears further.

There is also a degree of caution in the markets as Russian President Putin is due to speak later as the Ukraine war heads into its second year.

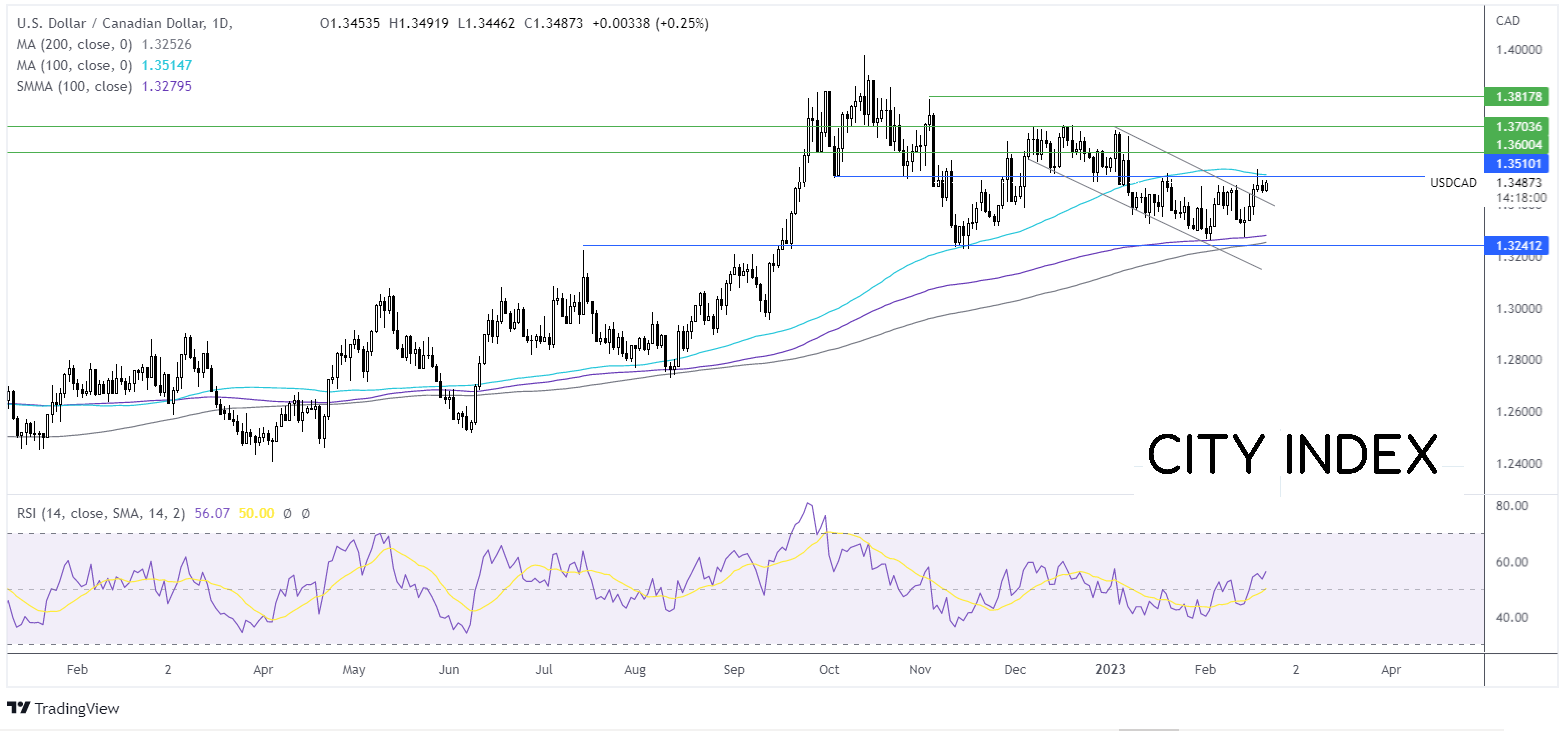

Where next for the DAX?

The DAX continues to trade within the rising channel. The index failed to rise above resistance at 15650 and is consolidating below 15500, bringing the RSI out of overbought territory. The 50 sma is crossing above the 100 sma in a bullish signal.

Buyers would need to rise above 15635 last week’s high to attack 15650 and create a higher high. This would open the door to 15745 the February high and bring 16000 into focus.

On the flip side, it would take a move below 15245, last week’s low to create a lower low, opening the door to 15000 round number and the 14500 zone.

USD/CAD rebounds ahead of CAD CPI & US PMIs

- Hawkish Fed bets boost USD

- CAD inflation set to cool further as BoC pauses rate hikes

USD/CAD is rising, reversing yesterday's losses, as the loonie tracks crude oil prices lower and as investors look ahead US PM and Canadian inflation data.

Oil is falling amid worries that higher interest rates will slow global growth, hurting the demand outlook. WTI, Canada’s main export trades 0.8% lower.

Attention will now turn to Canadian inflation, which is expected to cool further in January to 6.1%, down from 6.3%. However, on a monthly basis, CPI is expected to rise 9.7% after falling 0.6% in January.

Today to come after the BoC raised the interest rate in February but indicated that it will pause its hiking cycle. Cooler than forecast inflation could highlight the BoC – Fed divergence.

Meanwhile, US the USD is pushing higher, boosted by hawkish Fed expectations and ahead of US PMI data later today.

The composite PMI is expected to show that business activity contracted at a slower pace. The PMI is set to rise to 47.1 up from 46.8. The level 50 separates expansion from contraction.

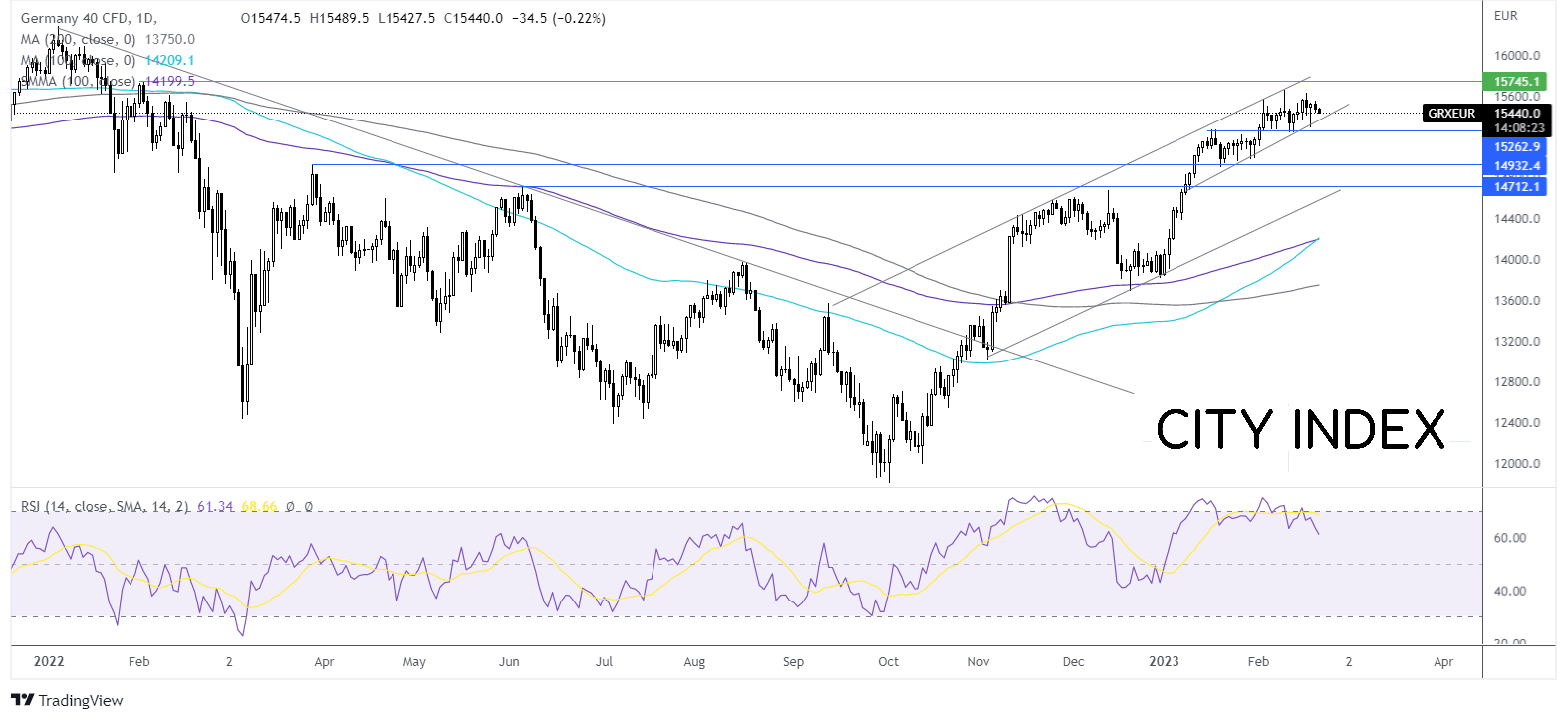

Where next for USD/CAD?

After breaking out from two-month falling channel, USD/CAD is extending its rise, supported by the bullish RSI.

Buyers will look for a rise above 13540, last week’s high to extend the British move towards 1.36 the round Number and 1.3680, the 2023 high.

On the flipside support can be seen at 134 40 the weekly lie with a break below here opening the door to 1.34 the round Number and falling trend line support. A fall below here exposes the 100 sma at 1.3270.