DAX falls ahead of GDP data

The DAX, along with its European peers, is pointing to a softer open at the start of the new week after booking gains of 0.77% last week.

The market mood has turned cautious ahead of a key week for central bank meetings, which sees rate decisions from the ECB, the Fed and the BoE.

While the Fed is expected to slow the pace of rate hikes to 25 basis points, the ECB and the BoE are expected to hike by 50 basis points.

Before the looming central bank meetings begin, investors today will look to German GDP data, which is expected to show that the economy stalled in Q4 at 0% growth QoQ.

The data comes as the outlook for the German economy has improved recently, thanks in part to a warmer winter which has helped to cut consumption of natural gas. The German economy is no longer expected to fall into recession this year as the base case scenario, with the German government forecasting 0.2% growth in 2023.

A combination of China re-opening, the improved growth outlook and hopes of a rate cut by the Fed by the end of the year have helped the DAX rally over 8% in January.

However, there are still plenty of risks that could derail the rally, including earnings downgrades, inflation not cooling sufficiently quickly and an escalation of the war in Ukraine.

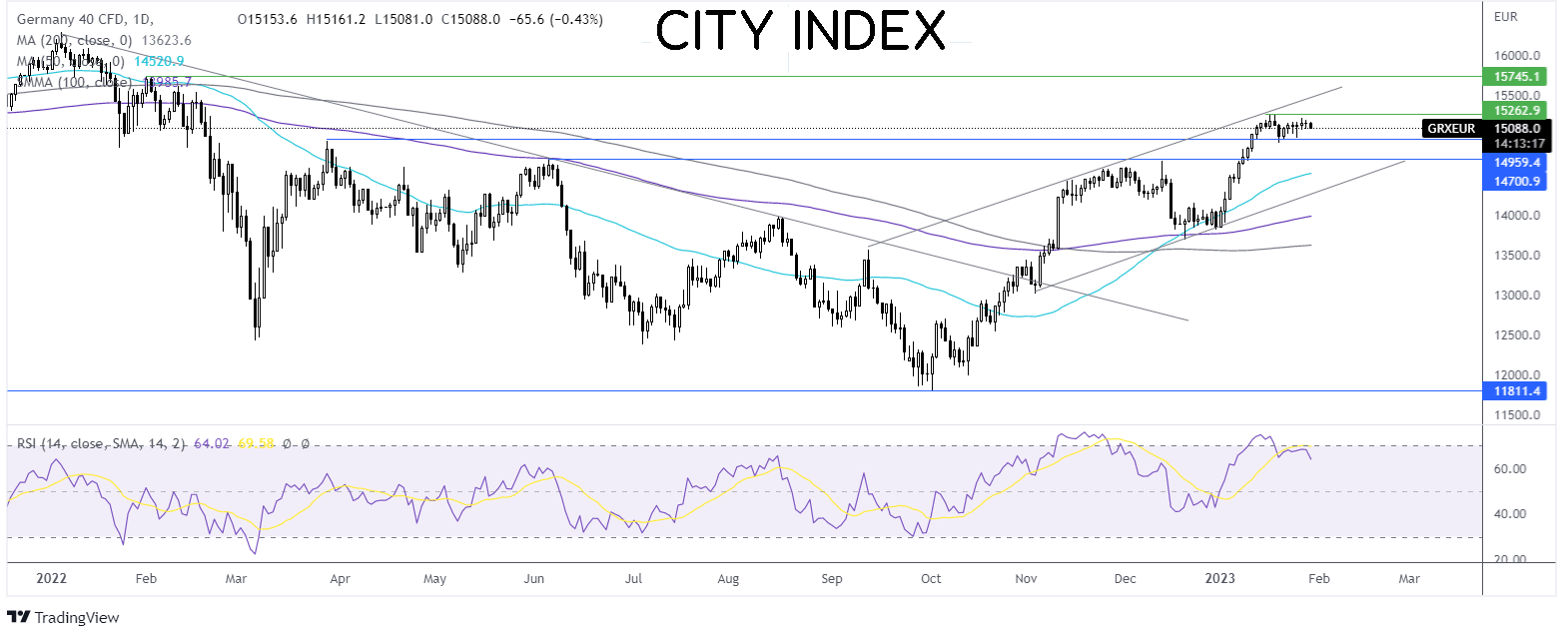

Where next for the DAX?

The DAX is consolidating around below the 2023 high of 15200 but is holding above 15000. The RSI has eased out of the outbought territory and remains within the rising channel dating back to early November.

Buyers will look for a rise over 15270, the 2023 high, ahead of 15500, the rising trendline resistance towards 15745.

Sellers will look for a fall below 15000 towards 14300 the December high. A break below here exposes the 50 sma at 14580.

Oil slips in early trade with OPEC+ coming into focus

Oil prices are falling at the start of the week, paring earlier gains ahead a big week for central banks and the OPEC+ meeting. Ministers are not expected to tweak oil output when they meet on February 1st.

Oil had risen in early trade amid escalating tensions in the Middle East and a drone attack in Iran and as China pledged to support the post-Covid recovery by boosting consumption.

China resumes business this week after the Lunar New Year, and initial figures suggest that domestic travel and consumption have bounced back firmly. However, this is not helping oil prices in early trade.

The risk-off cautious mood in the market ahead of the central bank meetings is hurting risk assets, including oil.

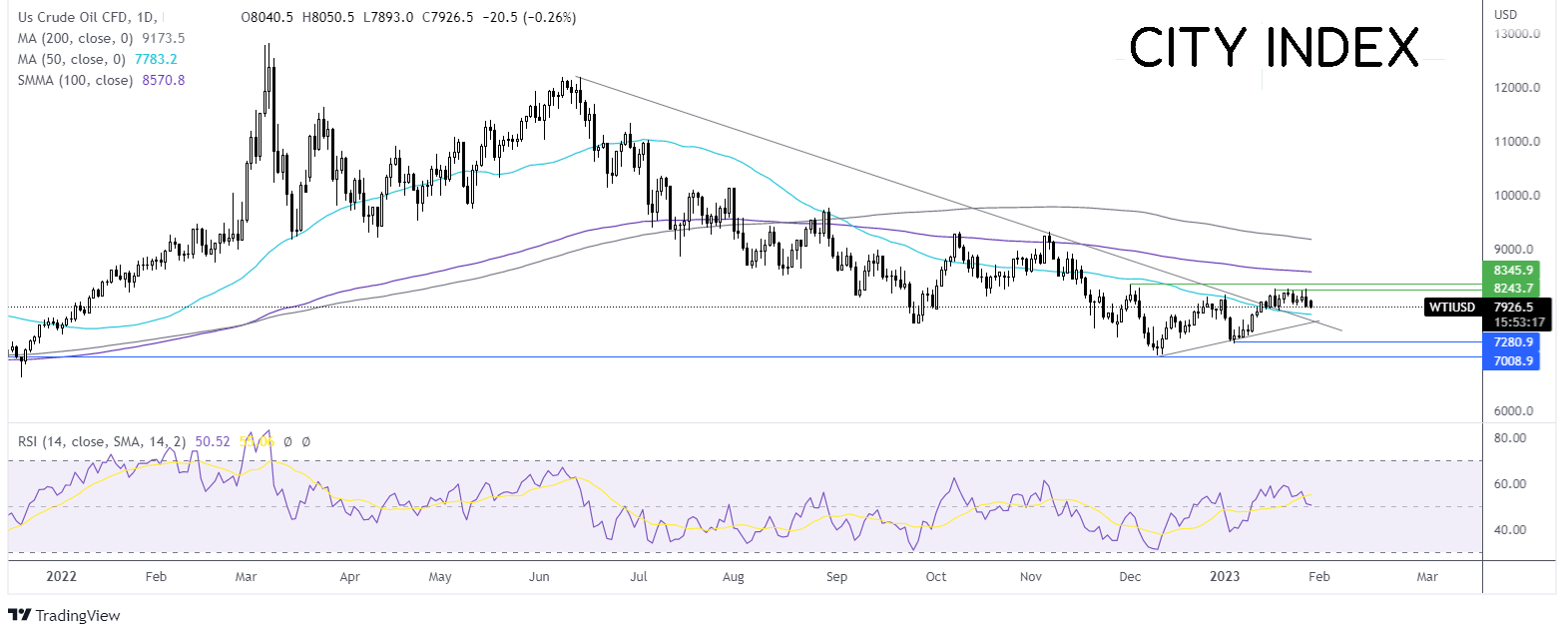

Where next for oil prices?

Oil trades caught between the 50 sma and 100 sma while the RSI is neutral at 50, giving away few clues.

A breakout trade could see buyers look for a break above 82.10, last week’s high, and 83.30, the December high, to expose the 100 sma at 86.00.

Sellers could look for a fall below the 50 sma at 77.8 and 76.80, the multi-month falling trendline. It would take a move below 72.50 to create a lower low.