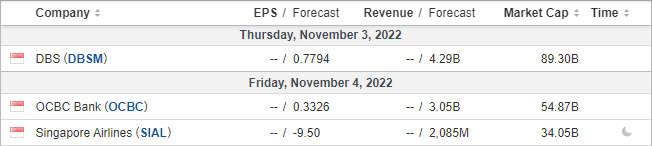

Two of Singapore’s ‘big three’ banks are yet to report this season

DBS Group Holding (D05.SI) release their Q3 2022 earnings on Thursday, with a media briefing scheduled for 10:30 SGT (13:30 AEDT) and the analyst briefing is at 11:30 SGT (14:30 AEDT).

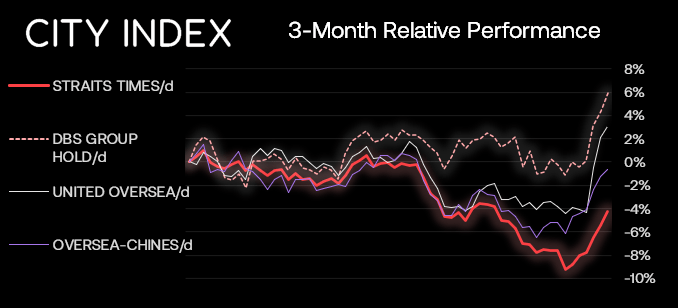

It will be the second earnings report for one of Singapore’s big three banks’. With United Overseas Bank (UOB) having released earnings last Friday and Oversea-Chinese Banking Corporation (OCBC) to release earnings this coming Friday.

UOB realised a net profit of S$1.4 billion (+34%) in Q3 and, whilst they admit the global economic outlook “remains challenging”, the banks expect to see resilience from ASEAN economies and avoid a recession.

Overall, analysts are bullish on banks and expect both DBS and OCBC to post strong earnings.

OCBC are looking to expand their empire in Indonesia according to their CEO Helen Wong. Speaking with Reuters, she said that their capital is good for the bank to enter a decent phase of growth. According to Reuters, 13 analysts have buy recommendations (4 of which are a strong buy), 5 recommend a hold, and one has a sell.

According to Reuters, 13 analysts recommend DBS stock for a ‘buy’ (4 of which are a strong buy) with 4 holds and no sell recommendations. The stock currently trades at 34.2 and has a median price target of 39.11 (+14%).

DBS stock rallies ahead of its earnings report

The stock has been performing well ahead of its earnings reports, thanks to the news that DBS will be the bank to utilise MaxxDigital – a digital asset platform that provides risk and FX solutions for institutions. Whilst Singapore’s regulators continue to clamp down on crypto trading for retailers, Singapore wants to become a digital-asset hub within the financial sector – and this could be the first step of many which help them do just that.

DBS rose 3.6% on Friday following the announcement and has extended those gains to around 6% at the time of writing from Friday’s low.

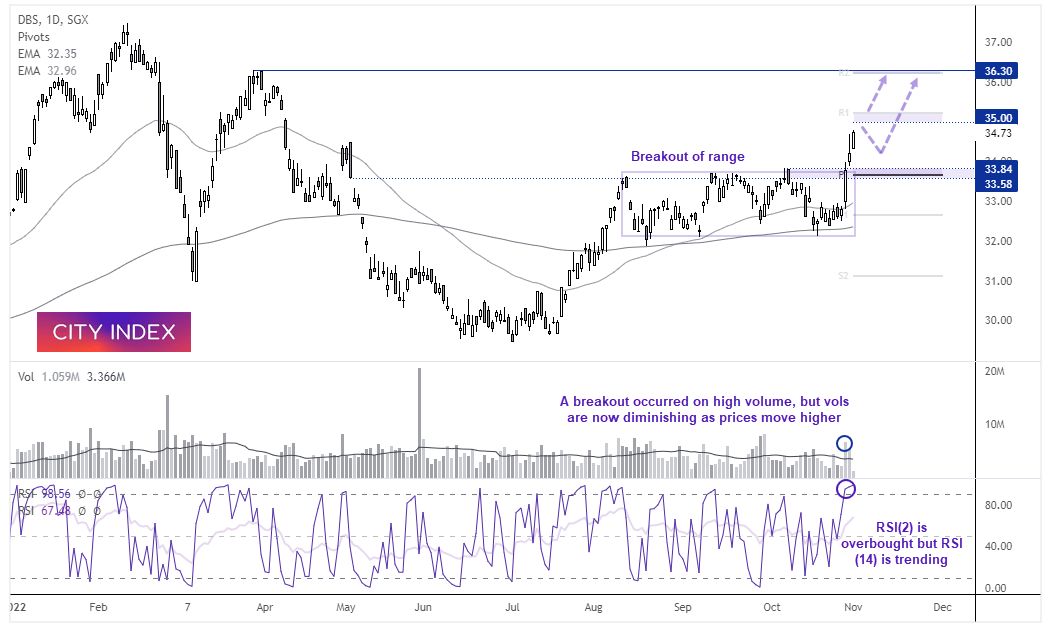

DBS Daily Chart:

The daily chart shows that DBS performed a strong breakout (with high volume) from its sideways range after prices found support at the 200-day and 50-day EMA’s. And that suggests it could be part of the bullish trend from the July low. However, there are a couple of warning signs that it may need to retrace a little before continuing higher.

A bearish pinbar formed yesterday with low volume, and today’s price action is struggling to take out the hammer high at the time of writing. Resistance is also nearby at 35 and the monthly R1 pivot point, and RSI (2) is overbought - which can indicate a near-term turning point. With that said, the RSI(14) is over 50 and trending higher with prices, which is another reason we suspect any move lower is part of a retracement before prices head for the high around 36.30.

Of course, earnings can be full of surprises and we may need to see DBS beat estimates for it to trade directly higher. Otherwise – assuming earnings is not too disappointing – it could help with a desired pullback, where we would seek bullish setups around the monthly pivot / prior breakout range.

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade